Argent is launching the first public version of its Ethereum wallet for iOS and Android. The company has been available as a limited beta for a few months with a few thousand users. But it has already raised a seed and a Series A round with notable investors, such as Paradigm, Index Ventures, Creandum and Firstminute Capital. Overall, the company has raised $16 million.

I managed to get an invitation to the beta a few months ago and have been playing around with it. It’s a well-designed Ethereum wallet with some innovative security features. It also integrates really well with DeFi projects.

Many people leave their crypto assets on a cryptocurrency exchange, such as Coinbase or Binance. But it’s a centralized model — you don’t own the keys, which means that an exchange could get hacked and you’d lose all your crypto assets. Similarly, if there’s a vulnerability in the exchange API or login system, somebody could transfer all your crypto assets to their own wallets.

At heart, Argent is a non-custodial Ethereum wallet, like Coinbase Wallet or Trust Wallet. You’re in control of the keys. Argent can’t initiate a transaction without your authorization for instance.

But that level of control brings a lot of complexities. Hardware wallets, such as Ledger wallets, ask you to write down a seed phrase so that you can recover your wallet if you lose your device. It requires some discipline and it’s hard to understand if you’re not familiar with the concept of seed phrases.

Even Coinbase Wallet tells you to back up your seed phrase when you first create a wallet. “We see them as advanced tools for developers,” Argent co-founder and CEO Itamar Lesuisse told me.

That’s why a new generation of wallets tries to hide the complexity from the end user, such as ZenGo and Argent. Creating a wallet on Argent is one of the best experiences in the cryptocurrency space. Your wallet is secured by something called ‘guardians’.

Trust your friends

A guardian can be someone you know and trust, a hardware wallet (or another phone) or a MetaMask account. Argent also provides a guardian service, which requires you to confirm your identity with a text message and an email. If you lose your phone and you want to recover your wallet on another phone, you need to speak to your guardians and get a majority of confirmations. If they can all confirm that, yes, indeed, your phone doesn’t work anymore and you want to recover your crypto assets, the recovery process starts.

Let’s take an example. Here’s your list of guardians:

- Argent’s own guardian service

- Two friends who are also using Argent

- A Ledger Nano S hardware wallet

In total, there are five different factors involved, you including. If you lose your phone, you can recover your wallet by downloading Argent on another phone (factor #1), asking Argent’s guardian service to send you a text and an email to confirm your identity (factor #2) and confirming your identity with the Ledger Nano S (factor #3).

You have reached a majority and the recovery process starts. You’ll get your funds in 36 hours so that you have enough time to cancel it it’s a hijacking attempt.

But you could also have downloaded the Argent app on another phone (factor #1) and pinged your two friends (factor #2 and #3) directly. If they can confirm the same sequence of characters (emojis in that case), the recovery process would start as well.

“I’m interested in social recovery, multi-key schemes,” Ethereum creator Vitalik Buterin said in a TechCrunch interview in July 2018. It’s not a new concept as social media apps already use social recovery systems. On WeChat, if you lose your password, WeChat asks you to select people in your contact list within a big list of names.

In Argent’s case, social recovery adds an element of virality as well. The experience gets better as more people around you start using Argent.

In addition to wallet recovery, Argent uses guardians to put some limits. Just like you have some limits on your bank account, you can set a daily transaction limit to prevent attackers from grabbing all your crypto assets. You can ask your guardians to waive transactions above your daily limits.

Similarly, you can ask your guardians to lock your account for 5 days in case your phone gets stolen.

Betting on Ethereum

Argent is focused on the Ethereum blockchain and plans to support everything that Ethereum offers. Of course, you can send and receive ETH. And the startup wants to hide the complexity on this front as well as it covers transaction fees (gas) for you and gives you usernames. This way, you don’t have to set the transaction fees to make sure that it’ll go through.

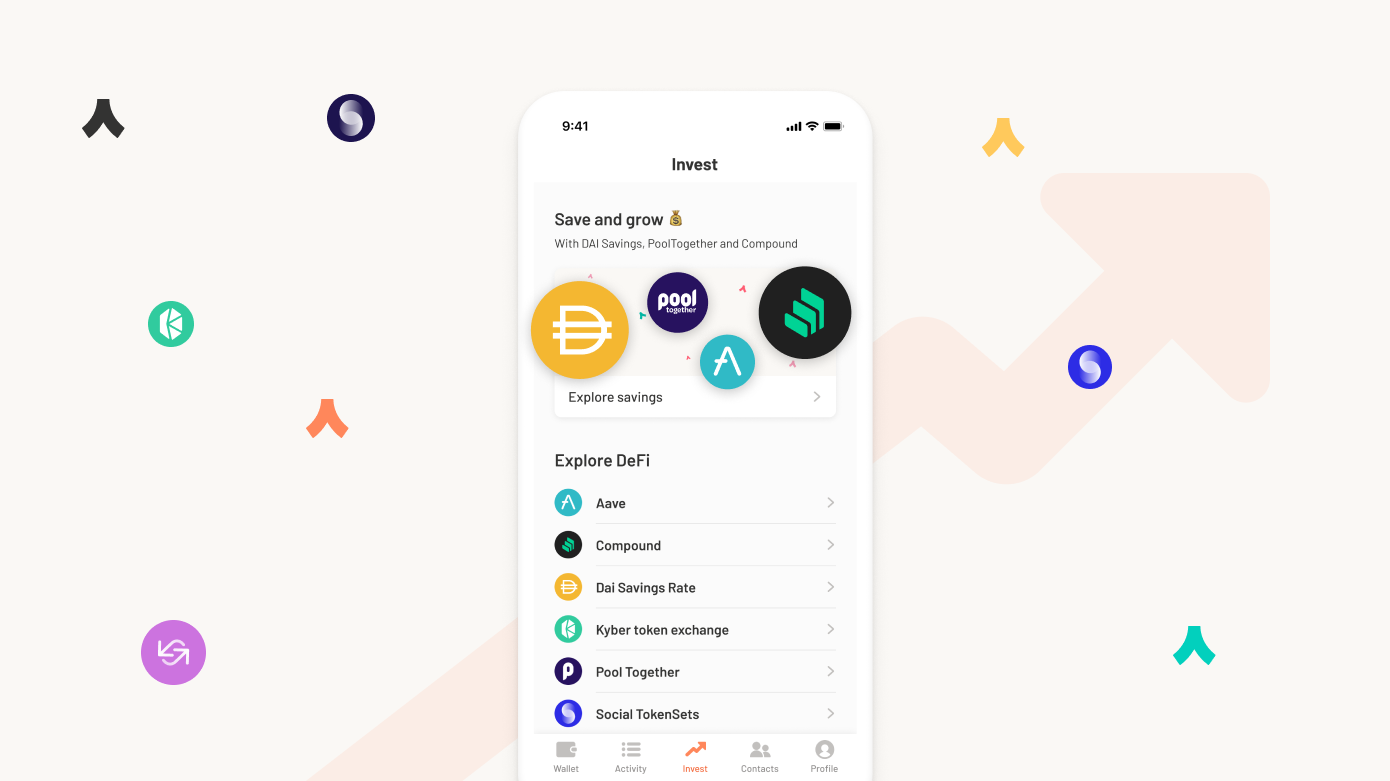

The startup plans to integrate DeFi projects directly in the app. DeFi stands for decentralized finance. As the name suggests, DeFi aims to bridge the gap between decentralized blockchains and financial services. It looks like traditional financial services, but everything is coded in smart contracts.

There are dozens of DeFi projects. Some of them let you lend and borrow money — you can earn interest by locking some crypto assets in a lending pool for instance. Some of them let you exchange crypto assets in a decentralized way, with other users directly.

Argent lets you access TokenSets, Compound, Maker DSR, Aave, Uniswap V2 Liquidity, Kyber and Pool Together. And the company already has plans to roll out more DeFi features soon.

Overall, Argent is a polished app that manages to find the right balance between security and simplicity. Many cryptocurrency startups want to build the ‘Revolut of crypto’. And it feels like Argent has a real shot at doing just that with such a promising start.