Kaia Health, a digital therapeutics startup which uses computer vision technology for real-time posture tracking via the smartphone camera to deliver human-hands-free physiotherapy, has closed a $26 million Series B funding round.

The funding was led by Optum Ventures, Idinvest and capital300 with participation from existing investors Balderton Capital and Heartcore Capital, in addition to Symphony Ventures — the latter in an “investment partnership” with world famous golfer, Rory McIlroy, who knows a thing or two about chronic pain.

Back in January 2019, when Kaia announced a $10M Series A, its business ratio was split 80:20 Europe to US. Now, says co-founder and CEO Konstantin Mehl — speaking to TechCrunch by Zoom chat from New York where he’s recently relocated — it’s flipped the other way.

Part of the new funding will thus go on building out its commercial team in the US — now its main market. He says they’ll also be spending to fund more clinical studies, and to conduct more R&D, including looking at how to supplement their 2D posture modelling with 3D data they can pull from modern, depth-sensing smartphone cameras.

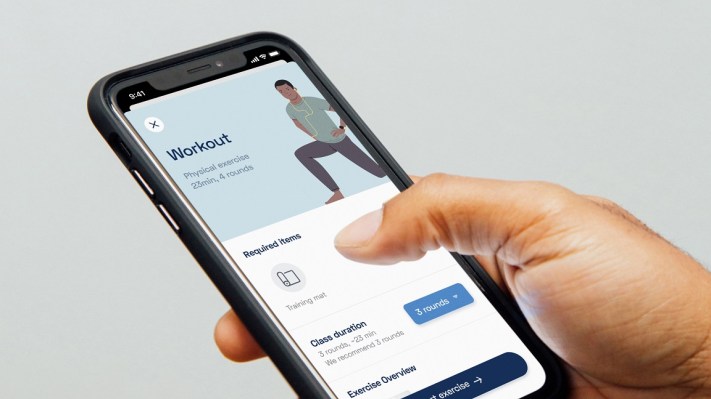

“We use the smartphone camera to give you real-time feedback on your physical exercises. We are already pretty good at that but there are a lot more sensors in the iPhone so we’ll build out the computer vision team to start with 3D tracking,” he tells TechCrunch. “Including the depth cameras of the latest Samsung and Apple devices — mixing that with the 2D data we basically get from all the devices to see what we can do with these two data sets.”

On the research front, Kaia published a randomized control trial in the journal Nature last year — comparing its app-based therapy with multidisciplinary pain treatment programs for lower back pain which combine physiotherapy and online learning. “We have another large scale trial which is currently in the peer review process,” says Mehl, adding: “There will be a couple of interesting clinical trials getting published in the next six to nine months.

“We already have clinical studies that look specifically at how accurate the motion tracking technology is at the moment and how fast patients can learn exercises with the technology and how correct it is compared to when they learn it with real physical therapists — I think that’s an exciting study.”

He also flags another published app study which examined the treatment link between sleep and chronic back pain.

“We right now have nine clinical studies ongoing — part of the studies have the goal to compare our therapy apps against a lot of care treatments,” he goes on, fleshing out the reason for having such a strong focus on research. “The other part of the studies specifically look at AI features that we have and how they increase the quality of care for patients.

“Because a lot of startups say they have AI for healthcare or for patients but you never know what it exactly means, or if it really helps the patient or if it’s just material for the pitch, for investors. So that’s why we’d really like to do a lot more effort here, even if we already have nine studies ongoing — because it’s just a very powerful way to show how the products work. And it also helps to get more credibility as an industry.”

Kaia retired an earlier direct consumer subscription strand of its business to focus fully on b2b — chasing the “holy grail” of having its digital therapies fully reimbursed via users’ medical insurance.

Though it does still offer a number of free apps for consumers, with a physical trainer type function, as a way to gather movement data to feed its posture tracking models.

Overall it claims some 400,000 users across all its apps at this point.

“Back in Germany we have the majority of the population that can get the chronic pain app reimbursed already so there we do b2c marketing but the insurances reimburse it,” says Mehl. “In the US we mostly sell it to self-insured employers — the big employers.”

“Our goal in the end is always to get reimbursed as a medical claim because if you think back to our strong clinical focus, it just adds credibility — if you do the full homework,” he adds. “In medicine the holy grail is always to get reimbursed as a medical claim, that’s why we focus on that.”

So far Kaia offers app-based therapy for chronic back pain; a digital treatment for pulmonary rehabilitation treatment targeting at COPD (Chronic obstructive pulmonary disease); and is set to launch a new app, in about a month, tackling knee and hip osteoarthritis.

It calls its approach ‘multimodal’ — offering what it describes as “mind body therapy” for musculoskeletal (MSK) disorders which consists of guided physical exercises, psychological techniques and medical education.

Unlike some rivals in the same digital therapeutics for MSK space — notably Hinge Health, which recently raised a $90M Series C — Kaia’s approach is purely software based, with no additional sensor hardware required to be used by patients.

Mehl says it has steered clear of wearables to ensure the widest possible accessibility for its app-based treatments — a point it seeks to hammer home on its website via a table comparing what it dubs a “typical sensor-based system” and its “health motion coach”.

Competition in the digital health space has clearly heated up in the almost half decade since Kaia got started but Mehal argues that major b2b buyers now want to work with therapy platform providers, rather than buying “point solutions” for one disease, giving this relative veteran an edge over some of the more recent entrants.

“We now have three therapies against three very big diseases so I think that helps us,” he says. “We we started 4.5 years ago it was pretty unsexy to start something in digital therapies and now there are so many startups getting started for digital therapies or digital health. And what we’re seeing is that the big b2b customers now move away from wanting to buy point solutions, against one disease, more towards buying a couple of diseases — in the end they want to work more with platforms.”

“The important thing here is we never invent any therapy — we just digitize the best in class therapy and that’s important because if not you have very different requirements of what you have to prove,” he adds. “Now we always just prove that the digital delivery of the best in class therapy works as good or better than the offline role model.”

A key focus for Kaia’s business in the US is working directly with health insurance claims payers — such as Optum — who manage budgets for the employers providing cover to staff, with the aim of getting its digital therapy reimbursed as a medical claim, rather than having to convince employers to fund the software as a workplace benefit.

“We focus on working directly with these payers to be reimbursed by them so that we help them reduce the costs and stay on budget,” he explains. “We already have some really interesting partnerships there — obviously Optum Ventures invested in us, and Optum is the biggest player with [its parent company] UnitedHealth… So we have a very big partner there.

“Once you get reimbursed as a medical claim, the employer doesn’t really have to pay you anymore out of the separate benefits budget — which includes all kinds of other benefits, and which is relatively small compared to the medical claims budget. So if you’re reimbursed it’s a no brainer for an employer to basically buy your therapy. So it’s a fast-track through the US healthcare system.”

The team is also positioning the business to work with the growing number of telemedicine providers — and its app-based therapy something those services could offer as a bolt on for their own patients.

Mehl argues that the coronavirus crisis has transformed interest in digital care provision, and, again, contends that Kaia is well positioned to plug into a future of healthcare service provision that’s increasingly digital.

“Our goal is to not only have a therapy app that works in parallel to the healthcare system but to integrate in a full treatment pathway that a patient goes through. The obvious first thing is that we integrate more with doctors — we are currently talking with a lot of different players in the market how we can do that because if you use one of the many apps where you can talk to a doctor, what do you do afterwards?

“If they prescribe you in person physical therapy or even surgery you can’t really do that at the moment. So to have this full treatment pathway in the digital world just became mass market now. Before the crisis it was more like an early adopter market and now people have no other choice or don’t really want to go out even if the restrictions are lifted because they just don’t feel safe.”