Nauta Capital, the pan-European venture capital firm that invests in B2B technology startups at seed and Series A, is launching its fifth fund.

The new vehicle has an initial close of €120 million and is expected to surpass the VC’s 2016 fund, which topped out at €155 million.

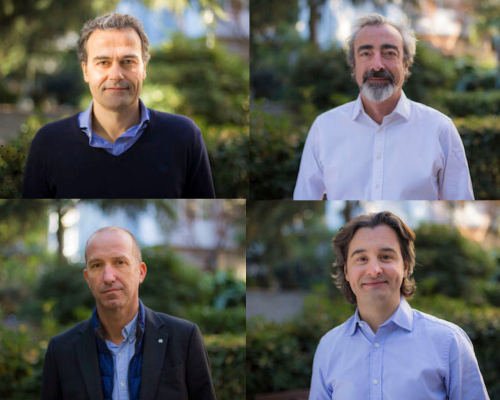

With offices in London, Barcelona and Munich, Nauta Capital has over half a billion under management and is supported by a team of 24 people, making it one of Europe’s largest B2B focused VCs. The firm invest in companies mainly based in the U.K., Spain, and Germany, as well as those based in other continental European countries with plans to significantly increase their presence in one of its key geographical hubs.

Describing itself as “sector-agnostic,” Nauta Capital’s main areas of interest include B2B SaaS solutions with “strong network effects”, vertically focused enterprise tech that is attempting to transform large industries, and deep tech applications that solve an array of challenges faced by large enterprises. More broadly, it says it targets “capital-efficient” B2B software companies.

In total, Nauta has led investments in more than 50 companies. They include Brandwatch, a U.K. digital consumer intelligence company with $100 million ARR; Onna, a knowledge integration platform that unifies workplace knowledge platforms for the likes of Facebook and Dropbox; PromoteIQ which was acquired by Microsoft in 2019; zenloop, a Berlin-based experience management platform; and MishiPay, a mobile self-checkout technology.

LPs in this fifth fund’s first close include both existing and new investors from continental Europe and America. They span fund of funds, financial institutions, insurance companies, and large family offices that lead large corporates with “strong synergies” with Nauta’s portfolio.

“We have doubled the first close compared to our 2016 fund in record time against a backdrop of a global pandemic,” says Carles Ferrer, Nauta’s London-based General Partner, in a statement. “With more than 80% of the contributions received from existing LPs, we are humbled to see that our thesis has resonated with so many of our current LPs who have joined us again”.

That thesis has seen Nauta have the discipline to back companies that take a leaner approach, including during fundraising or leveraging cash efficiently to achieve growth, according to Carles. “At a time when we are navigating a global pandemic, where the global economy has taken a severe hit, it’s more apparent than ever that our conviction in capital-efficiency maximises sustainability and leads to greater long-term outcomes for entrepreneurs, regardless of their stage,” he says.

Meanwhile, Nauta is disclosing that the first company to be backed from its new fund is NumberEight, which has raised a $2.3 million seed round led by the VC. Based in the U.K., NumberEight offers a “contextual intelligence” platform for mobile devices that predicts consumer context to “enable the delivery of the right content at the right time,” while claiming to preserve user privacy by not sending or storing sensor data beyond the user’s device.

“The startup leverages advanced context recognition and on-device AI techniques to predict over 100 contextual signals such as ‘travelling to work on a bicycle’, thus providing mobile apps with real-time behavioural and situational consumer insights,” explains Nauta.