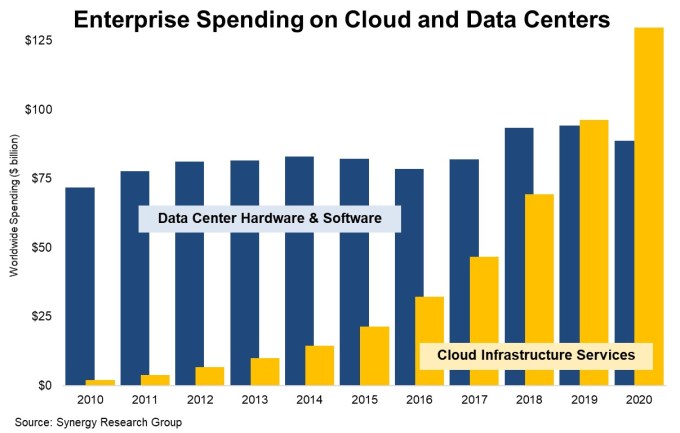

There is a prevailing notion that while the cloud infrastructure market is growing fast, the vast majority of workloads remain on premises. While that could be true, new research from Synergy Research Group found that cloud infrastructure spending surpassed on-prem spending for the first time in 2020 — and did so by a wide margin.

“New data from Synergy Research Group shows that enterprise spending on cloud infrastructure services continued to ramp up aggressively in 2020, growing by 35% to reach almost $130 billion. Meanwhile enterprise spending on data center hardware and software dropped by 6% to under $90 billion,” the firm said in a statement.

While the numbers have been trending toward the cloud for a decade, the spending favored on-prem software until last year when the two numbers pulled even, according to Synergy data. John Dinsdale, chief analyst and research director at Synergy says that this new data shows that CIOs have shifted their spending to the cloud in 2020.

“Where the rubber meets the road is what are companies spending their money on, and that is what we are covering here. Quite clearly CIOs are choosing to spend a lot more money on cloud services and are severely crimping their spend on on-prem (or collocated) data center assets,” Dinsdale told me.

Image Credits: Synergy Research Group

The total for on-prem spending includes servers, storage, networking, security and related software required to run the hardware. “The software pieces included in this data is mainly server OS and virtualization software. Comparing SaaS with on-prem business apps software is a whole other story,” Dinsdale said.

As we see on-prem/cloud numbers diverging in this way, it’s worth asking how these numbers compare to research from Gartner and others that the cloud remains a relatively small percentage of global IT spend. As workloads move back and forth in today’s hybrid world, Dinsdale says that makes it difficult to quantify where it lives at any given moment.

“I’ve seen plenty of comments about only a small percentage of workloads running on public clouds. That may or may not be true (and I tend more toward the latter), but the problem I have with this is that the concept of ‘workloads’ is such a fungible issue, especially when you try to quantify it,” he said.

It’s worth noting that the pandemic has led to companies moving to the cloud much faster than they might have without a forcing event, but Dinsdale says that the trend has been moving this way over years, even if COVID might have accelerated it.

Whatever numbers you choose to look at, it’s clear that the cloud infrastructure market is growing much faster now than its on-premises counterpart, and this new data from Synergy shows that CIOs are beginning to place their bets on the cloud.