What happens to hot fintech startups that have benefited from a rise in consumer trading activity if regular folks lose interest in financial wagers?

That’s the question facing Robinhood, Coinbase and other trading platforms that have ridden an upward cycle. Each has performed well in recent quarters: Robinhood by securing huge payment-for-order-flow revenues, while Coinbase’s trading fees have proven incredibly lucrative, something we learned when it filed to go public.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

According to recent reporting, the consumer trading frenzy could be slowing: Bloomberg recently noted that options trading volume is slipping, Robinhood’s app store ranking is falling, and some alternative assets are also losing steam. Other reporting from the publication notes that many SPAC shares are underwater while Google trends data indicates falling consumer trading interest, perhaps limiting the inflow of new users for equities-focused apps.

There are other indications that the red-hot speculative consumer market is cooling. Bitcoin is off around 10% in the last week after a blistering rise in recent quarters. Hot stocks like Peloton, once a darling of traders, fell more than 10% yesterday alone.

But looking past price declines and other signals of market chop, volume itself at some well-known exchanges could be falling.

But looking past price declines and other signals of market chop, volume itself at some well-known exchanges could be falling.

There’s a historical precedent for such declines. Coinbase’s historical revenues, to pick an example, have proved variable based on consumer interest in cryptocurrencies, with the company benefiting from rising demand and trading activity and seeing its top line decline in periods of restrained enthusiasm.

Robinhood and its fellow free-trading apps have yet to undergo a similar rise-and-fall in trading volume, I’d reckon. At least of the sort of extreme up-and-down that Coinbase endured after the 2017-2018 bitcoin boom. Our question is, what would happen to Robinhood and its cohorts if the apparent cooling in consumer trading demand continues? Let’s talk about it.

Coinbase’s historical revenue declines, and the Robinhood example

Coinbase was a famously lucrative organization during the 2017/-2018 bitcoin boom.

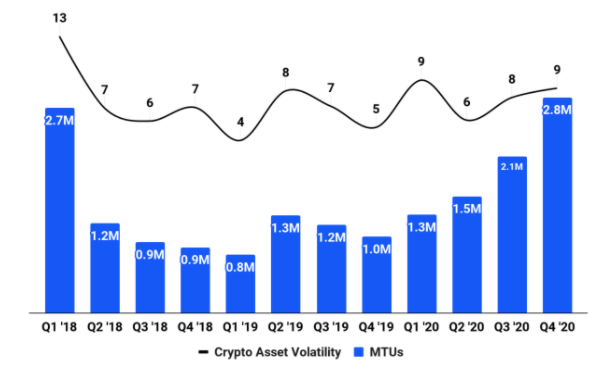

Indeed, we can see from the following chart from its S-1 filing that the company’s Monthly Transacting Users (MTUs) dropped sharply into 2018. The percentage decline from 2.7 million to 800,000 is just over 70%.

And in case you think we’re being rude, we have a related chart from the same SEC filing that shows trading volume falling over the same period, not merely MTUs. We’re not picking a loose proxy to merely infer that trading revenue dipped at Coinbase. We can show it: