I think it’s important that we explicitly discuss something that every VC instinctively knows: The hype around a given business or category has become a form of bias for investors and founders when vetting ideas to pursue. At any point in time, you can find FOMO-flavored bad business decisions based on false market signals somewhere in tech. It’s human nature for excitement to be contagious, but treating it as a leading factor when considering a new opportunity is not a good idea.

It’s human nature for excitement to be contagious, but treating it as a leading factor when considering a new opportunity is not a good idea.

Take the 17th century tulip-mania, when, at one point, Dutch speculators drove tulip futures so high that one bulb of a particularly rare species was valued at more than a fully furnished luxury house1. We can look at this and collectively lampoon anyone who could possibly have bought into that absurd trend.

But that’s the rule with mega-hyped markets. The dot-com apocalypse was inevitable in hindsight. So was the consumer lending bubble that set off the global financial crisis. But major market catastrophes aside, newly hyped sectors in tech seem to pop up, like Moore’s Law clockwork, every year or so.

In the last 15 years, giant bonfires of cash have turned to ash financing companies in hyped up sectors like SoLoMo (I bet many people reading this have never even heard of this trend), clean tech, VR gaming, daily deals, crypto (which spawned flashy undercard entries like PotCoin, BurgerKing’s WhopperCoin, and yes, TrumpCoin), the sharing economy, scooters (in which Bird, Lime, Lyft and Uber competed around little more than the color scheme of the otherwise identical Segway Ninebots), and SPACs (through which the aforementioned white-colored scooter company is going public).

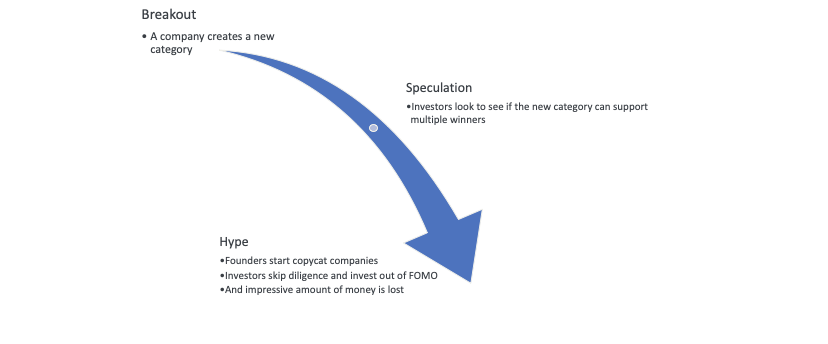

Usually, these bubbles start when a breakout company creates a discontinuity in the market — a technology that changes how we live (Apple’s iPhone), or delivers an exceptional solution to a ubiquitous pain point better and more cost effectively than before (Uber’s ride-sharing). Rational speculators look to apply lessons from these breakouts to identify other massive winners. If a few seem to take off, irrational FOMO takes over.

The hype-driven race to the bottom. Image Credits: Victor Echevarria

What does that look like? Here’s an actual example, per data sourced from PitchBook:

- Yelp creates a new way for local businesses to engage their customers.