Meet Airbank, a startup that is taking advantage of open banking regulation and related APIs to aggregate all your bank accounts. Focused on startups and small and medium companies, the company wants to build an all-in-one banking interface to access financial data, initiate payments, manage cash flow and more.

Airbank just raised a $3 million (€2.5 million) seed round led by Pia d’Iribarne and Jean de la Rochebrochard at New Wave, with Speedinvest and Tiny VC also participating. A handful of business angels are also joining the round, such as Cris Conde (Executive in Residence at Accel), Luca Ascani (Accel scout) and Marc McCabe (Sequoia scout).

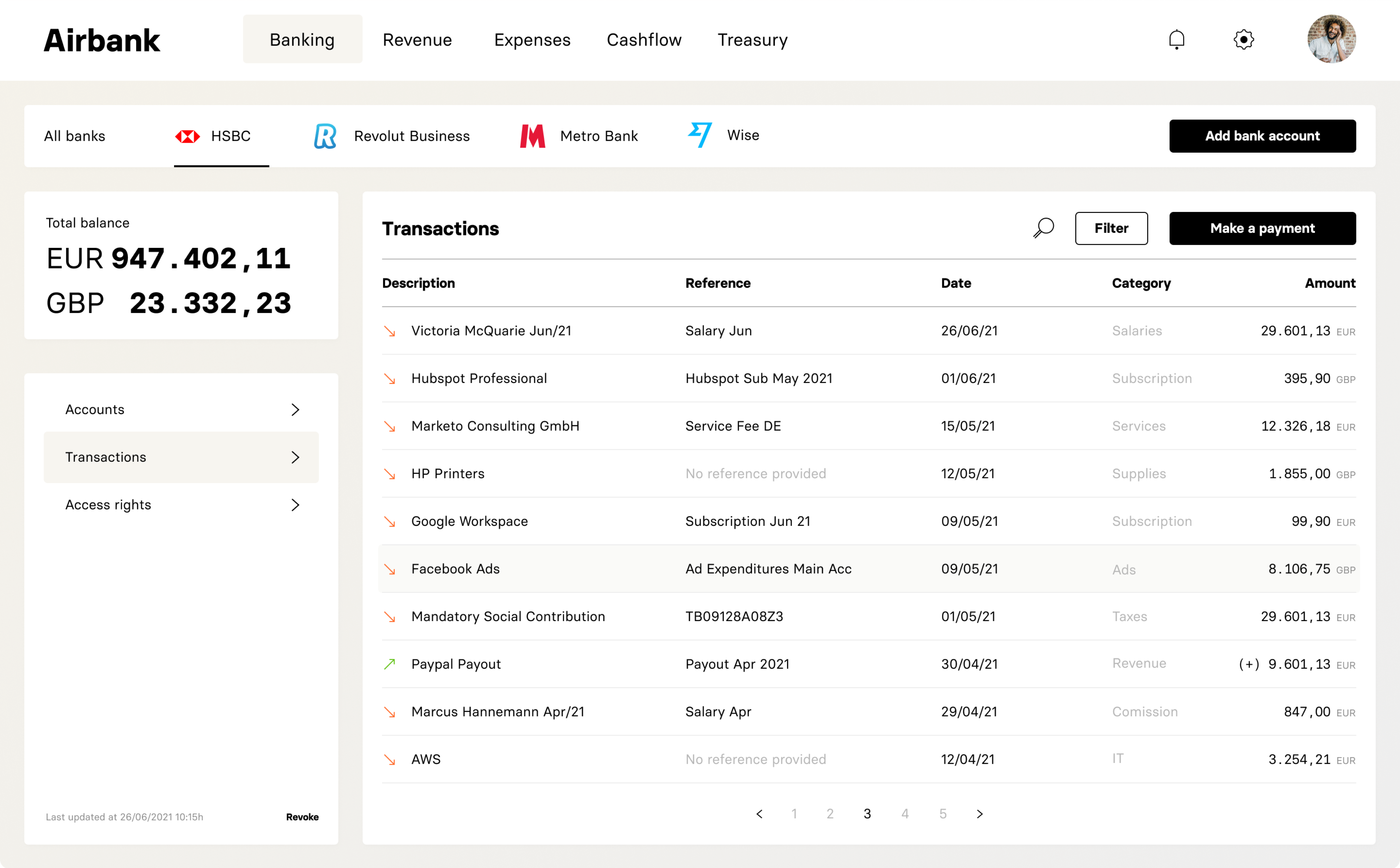

The startup’s value proposition is quite simple and can be easily explained in one screenshot. With Airbank, you can enter your login information for all the bank accounts and related accounts that you use. After that, you can view everything from your Airbank account:

Image Credits: Airbank

Many companies have to deal with multiple bank accounts for several reasons — you may have opened one bank account when you incorporated your company, another bank account to request a loan, a Wise Business account for low foreign transaction fees, a Revolut Business account to get debit cards for everyone, etc.

In addition to bank accounts, chances are you’re also generating revenue with Stripe, PayPal or Shopify. Many executives lose a ton of time connecting to web portals, exporting data as CSV files, importing those files in Microsoft Excel and consolidating all that information.

Airbank automatically refreshes your balances across several accounts. You can see your total balance in multiple currencies. It can also help you reconcile transactions with outstanding invoices as you can search across multiple accounts at once.

This is just a starting point as Airbank wants to become the only interface for all your banking needs. You can categorize transactions, see how much you’re spending with each supplier, track recurring payments and export everything to Google Sheets or Microsoft Excel. Soon, you’ll be able to use Airbank for cash flow forecasting and automatic reconciliation with your Xero or Quickbooks data.

Open banking isn’t limited to account aggregation. With proper APIs, you should be able to initiate payments from a third-party product. And Airbank plans to take advantage of that as the company is working on payments. As you can manage access rights, Airbank could act as the payment portal for the finance team.

“Open banking has enabled smooth integrations with banks, which we can utilize to offer richer banking and payments experiences for our users. Our vision is to build an all-in-one finance hub that connects all your financial accounts in one place. Our integrations will bring bill payments, expense management, and FX all in a single product that is easy to use,” co-founder and CEO Christopher Zemina said in a statement.

Other startups have been working on cash flow management, such as Agicap, and B2B payments, such as Libeo and Upflow. Airbank is starting with account aggregation and wants to tackle B2B finance in a holistic manner.

Vertical SaaS products have been booming lately. And there’s a reason why the space is quite competitive. There’s still a ton of stuff to do around B2B fintech and specialized software-as-a-service products.