The global Covid-19 pandemic had a chilling effect on a number of industries and their workforces, resulting in mass furloughs and layoffs. But now, with countries now taking steps back to “normal”, that has been leading, in many cases, back to a hiring surge. Today, SmartRecruiters, one of the companies that has built software to handle that process more smoothly, is announcing $110 million in funding to seize the moment.

The funding, a Series E, is coming in at a $1.5 billion valuation, the company confirmed. Silver Lake Waterman is leading this round, with previous backers Insight Partners, and Mayfield Fund also participating.

The investment will be used in two areas. First, SmartRecruiters plans to continue expanding business — its primary customers are large enterprises with Visa, Square, McDonald’s, Ubisoft, FireEye, Biogen, Equinox and Public Storage among them, and the plan will be to bring on more of these globally. Jerome Ternynck, SmartRecruiters’ CEO and founder, pointed out that one of its clients made a move recently in which it had to swiftly ramp up by 10,000 people in 90 days.

“That is the scale of the great rehire that we are aiming to serve,” he said.

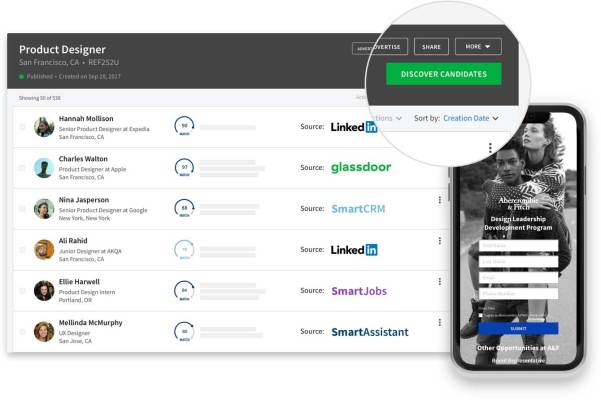

And second, it plans to hire and invest more in product. Specifically, Ternynck said the company is looking to build more intelligence into its platform, so that it can help customers find ideal matches for roles and provide them with tools to automate and reduce the busy work of managing a recruitment process.

This is a notable area for growth, and one that smaller startups have also identified and are building to fix: just yesterday, one of them, Dover, announced a Series A.

Ternynck likes to describe SmartRecruiters as “the Salesforce of recruiting”, by which he means that it provides a system of record for large enterprises who can manage 100% of the process of recruitment, from sourcing candidates to hire.

“In recruiting tech, we are the mothership,” he said, with some 600 vendors integrated into its platform — a mark of how fragmented the wider industry really is.

(Salesforce, incidentally, is an investor in SmartRecruiters, and while right now it’s not directly working with its portfolio company to build recruitment into what it operates as essentially a massive CRM behemoth, it’s an interesting prospect and seems like a no-brainer that it might try to some day. Ternynck would not comment…)

There are already a lot of application tracking systems in the market that can handle the basics of logging candidates and managing their progress through the screening, interview, references, and hiring/rejection cycle — Ternynck, in fact founded and sold one of the pioneers in that space, But the problem with these is that they are limited and often work within their own silos. He refers to these ATS systems as “the first generation” of recruitment software, a generation that is now getting replaced.

There are some big changes driving that evolution, and specifically SmartRecruiters’ growth. One key area is the bigger shift in “digital transformation”, precipitated by the pandemic but also a bigger shift to cloud-based computing and evolutions in big data management. Fragmentation is rife in recruiting, but we now are equipped in the world of IT with many, many ways of navigating that and using the wide amount of information out there to our advantage.

But there is another, more epistemological shift, too. Recruitment, and talent in general, has become a critical part of how a company conceives of its future success. Get the right people on board and you will grow. Fail to hire correctly and you will not, and you might even fail.

“This round and our progression signals the fact that CEOs have been forced to care more about recruiting,” he said. They want want to hire the best, he added, but that is fundamentally different from how recruiting has traditionally been approached, which is focused on cost per hire.

“This means recruiting is coming out of the administration function and into value add and sales and marketing,” he added. (That’s another interesting parallel with Dover which has gone so far as to conceive of its recruitment approach as “orchestration”, a word more commonly associated with sales software.)

The pandemic has had an impact here, too: employees and “hires” today are not what they used to be. It has become more acceptable to work remotely, and what people have come to expect out of jobs, and what roles they are coming from when applying, are all so different, and that also demands a different kind of platform to engage with them.

Indeed, that bigger area — sometimes referred to as “the future of work” — is part of what attracted this investment.

“Hiring talent and building human capital is more complex and important than ever, and SmartRecruiters is well positioned to help companies attract and land top talent,” said Shawn O’Neill, Managing Director and Group Head, Silver Lake Waterman, in a statement. “Their scale and customer growth are testament to their strong leadership and industry leading platform. We are excited to help fuel SmartRecruiters’ next growth chapter.”

Interestingly, Ternynck noted that even despite the mass layoffs and furloughs experienced in some industries in the last year and a half, SmartRecruiters has seen business grow, even through some of the worst moments of Covid-19. Over the last 12 months, bookings have grown by 70%, he said. That’s a mark of how recruiting priorities are indeed changing, regardless of whether it’s a SmartRecruiters, or another kind of company entirely — and there are many, from Taleo and Cornerstone, through to smaller hopefuls like Dover, and even Salesforce — who might reap the spoils longer term.