Two decades after businesses first started deploying AI solutions, one can argue that they’ve made little progress in achieving significant gains in efficiency and profitability relative to the hype that drove initial expectations.

On the surface, recent data supports AI skeptics. Almost 90% of data science projects never make it to production; only 20% of analytics insights through 2022 will achieve business outcomes; and even companies that have developed an enterprisewide AI strategy are seeing failure rates of up to 50%.

But the past 25 years have only been the first phase in the evolution of enterprise AI — or what we might call Enterprise AI 1.0. That’s where many businesses remain today. However, companies on the leading edge of AI innovation have advanced to the next generation, which will define the coming decade of big data, analytics and automation — Enterprise AI 2.0.

The difference between these two generations of enterprise AI is not academic. For executives across the business spectrum — from healthcare and retail to media and finance — the evolution from 1.0 to 2.0 is a chance to learn and adapt from past failures, create concrete expectations for future uses and justify the rising investment in AI that we see across industries.

Two decades from now, when business leaders look back to the 2020s, the companies who achieved Enterprise AI 2.0 first will have come to be big winners in the economy, having differentiated their services, scooped up market share and positioned themselves for ongoing innovation.

Framing the digital transformations of the future as an evolution from Enterprise AI 1.0 to 2.0 provides a conceptual model for business leaders developing strategies to compete in the age of automation and advanced analytics.

Enterprise AI 1.0 (the status quo)

Starting in the mid-1990s, AI was a sector marked by speculative testing, experimental interest and exploration. These activities occurred almost exclusively in the domain of data scientists. As Gartner wrote in a recent report, these efforts were “alchemy … run by wizards whose talents will not scale in the organization.”

But the data science bottleneck — the need for everything to funnel through a small team of experts — was not the only hurdle to scaling. AI is only as powerful as the data systems it’s plugged into. Many companies experimenting with AI at the time had data spread across silos with inadequate data infrastructure and processes to optimize the technology.

Two decades from now, when business leaders look back to the 2020s, the companies who achieved Enterprise AI 2.0 first will have come to be big winners in the economy.

Moreover, early iterations of B2B AI involved complex horizontal “machine learning” platforms focused on model development. Operationalizing these hand-curated models required crossing a deep chasm related to customization and integration with enterprise applications and workflows. These Enterprise 1.0 solutions were cumbersome and clunky to operate yet still required large investments to deploy.

Most initiatives started from the bottom up. Data scientists developed them as exploratory projects focused on speculative use cases largely decoupled from business objectives. Many turned out to be science projects and the failure rates were extraordinarily high.

In 2017, Gartner analyst Nick Heudecker estimated the AI project failure rate at 85%. “Organizations … need a plan to get to production,” Heudecker said, explaining the high failure rate. “Most don’t plan and treat big data as technology retail therapy.”

Even for the projects that promised to demonstrate an impact, getting to production was riddled with additional challenges arising from a lack of transparency, trust, bias, ethical and other governance-related considerations.

Given the tactical scope of the few projects that did make it to production, the impact has been underwhelming when compared to strategic expectations around accelerated innovation, greater competitiveness, happier customers, higher margins, more productivity and other goals. That’s about to change, however.

Enterprise AI 2.0 (2021 to ~2030)

The COVID-19 pandemic was an inflection point that accelerated digital transformation within enterprises. From banking to retail and entertainment, employees and customers moved to online platforms and relied completely on digital tools for continued operations.

These changes also laid the foundations for Enterprise AI 2.0, a term that describes a new generation of automation, analytics and practices that will drive operational efficiency and long-term profitability. Whereas shallow learning approaches that required expensive model training defined Enterprise AI 1.0, the next generation of AI has the capacity for more sophisticated analysis incorporating advanced unsupervised learning and models pre-seeded with semantic intelligence that require little or no training.

For the first time at many enterprises, AI projects are receiving sponsorship from C-level executives who are now fully aware of the imperative for digital transformation. Rather than being data science passion projects, Enterprise AI 2.0 is now a key enabler for business model transformation that can be systematically applied across many operations in many sectors.

This executive buy-in cannot be overrated. In a recent survey on analytics adoption, McKinsey found that strong commitment from all levels of management was a driving factor for the top 8% of companies in terms of AI performance.

Although most AI projects over the past two decades were underwhelming, these initial forays into big data were crucial to creating the current environment for successful AI implementation where most companies have invested in data lakes or warehouses, feature stores and other systems to process, harmonize and analyze incoming data streams.

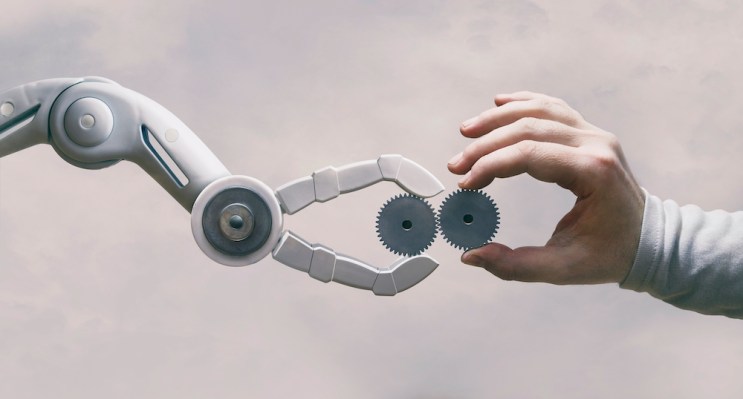

Today, Enterprise AI 2.0 builds on that work to overcome the hurdles that prevented Enterprise AI 1.0 businesses from operationalizing models. Enterprise AI 2.0 solutions come with pre-packaged, industry-specific knowledge and capabilities that allow for efficient, streamlined and widespread deployment to unleash the power of AI for rank-and-file employees. These solutions deliver the best outcomes based on hybrid intelligence — blending human knowledge, wisdom and experience with state-of-the-art machine learning algorithms.

These solutions will only become more powerful as machines learn from humans and mimic our cognitive processes. In Enterprise 2.0, technology evolves from “machine learning” to “machine reasoning,” in which AI can semantically understand user activities contexts and events, interpret results and explain findings, and identify root causes, recommend decisions or take optimal actions.

Whereas Enterprise AI 1.0 projects were narrowly targeted on tactical tasks, 2.0 solutions will evolve in their scope to cover end-to-end processes with interleaved systems of intelligence that deliver end-user insights and discovery, augmented decision-making or autonomous operations across business functions.

What emerges from this level of innovation is a “self-driving enterprise.” The shift requires a new level of trust in these systems. To that end, however, we will see mature governance guardrails to supervise AI systems — think AI police patrolling your data highways or scores of AI supervisors monitoring thousands of AI workers.

We are in the early days of realizing that vision. Most companies are still held back by challenges arising out of their strategy, culture, people, technology or processes. But the self-driving enterprise is clearly where we’re headed. Enterprise AI 2.0 is the next step for future leaders who want to get there.