TikTok this week presented its new plan to ramp up advertiser investment in its video platform with the expansion of e-commerce, a new promise of “brand safety,” and the launch of several new and interactive ad formats, ranging from clickable stickers to choose-your-own-adventure ads to “super likes” and more. The additions, the company says, will make TikTok’s advertising more interactive and creative, much like the TikTok experience itself.

The company demonstrated its new additions at an online conference aimed at the advertising and marketing community on Tuesday.

Here, TikTok also announced several new e-commerce partnerships beyond its pilot partner Shopify to make online shopping a more native experience, with the ability for users to go from product discovery to checkout without leaving the app. It noted it’s making live shopping available to brands and offered several ad products made just for e-commerce brands. And, in some markets, TikTok is offering to take on the responsibilities of shipping and fulfillment, as well.

Meanwhile, TikTok’s broader ads business is getting a jolt with the launch of several new products designed with the goal of making TikTok better differentiated from other social media rivals.

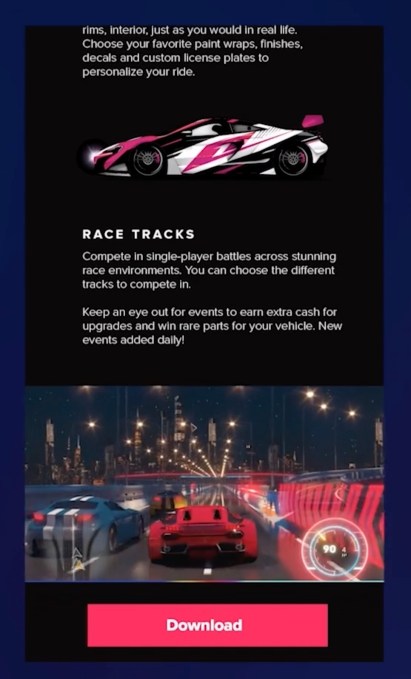

On this front, TikTok introduced a new product called “instant page,” which is a quick-loading landing page that the company claims will load 11 times faster than a typical mobile website. This allows a user who clicks through on an ad to be immediately taken to a page where they’ll be able to see more information from the brand, watch more videos, and swipe through other content — all without leaving the TikTok app. This could compete with Instagram’s Link Sticker which recently stepped in to replace the swipe-up gesture in its app.

Image Credits: TikTok (instant page)

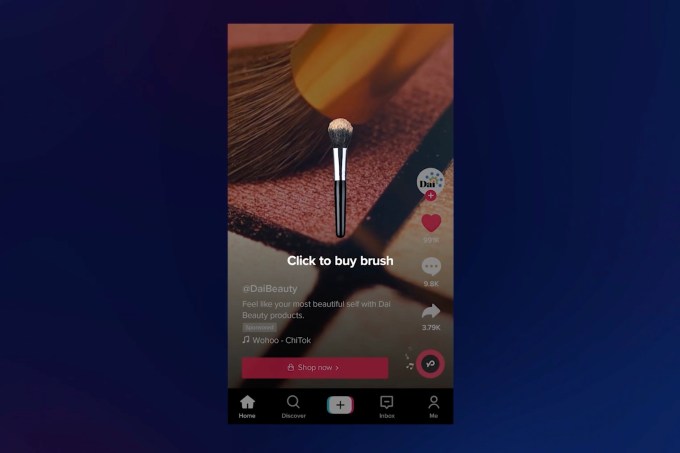

Another new product, “pop out showcase,” aims to make engaging with ads a more interactive experience.

With “pop out showcase,” advertisers can access a library of stickers and images that can be superimposed on top of their TikTok videos to illustrate the products they’re demonstrating or other key story elements. For instance, a beauty brand may add a sticker of a makeup brush to its content that, when tapped, takes the viewer to a page where they can buy a makeup brush from the brand.

Image Credits: TikTok (pop out showcase)

Other new formats encourage TikTok users to tap on the ads themselves.

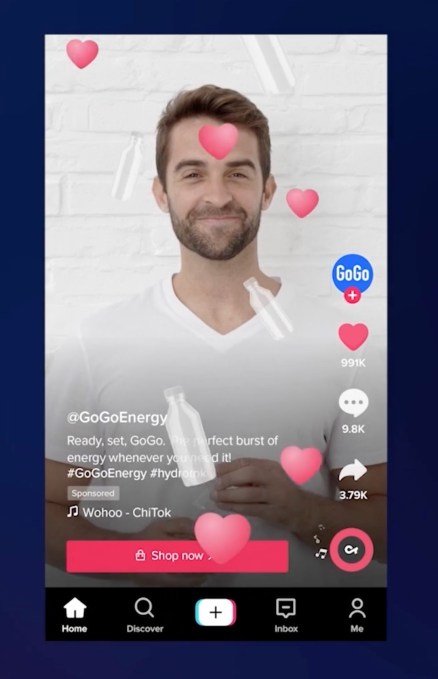

One of these is TikTok’s “super like.” This offers a way to make “liking” a video a more engaging experience. When users tap the like (heart) button on a TikTok video, the Super Like can display different types of icons that appear on viewers’ screens. Users are also invited to visit a landing page where they can learn more about the brand’s product or service being featured.

Image Credits: TikTok (super like)

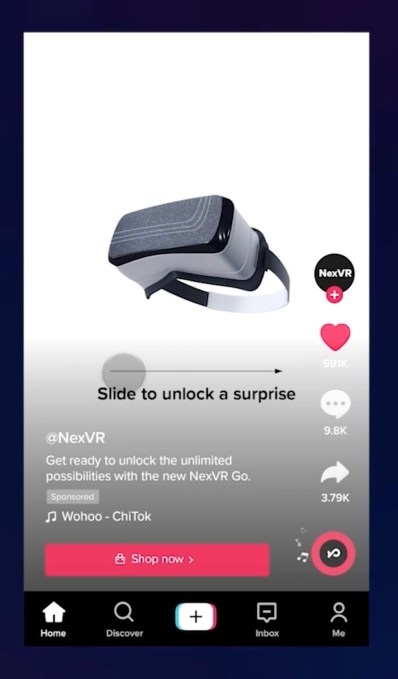

There are also gesture ads that will reveal rewards or other information to users who either slide or tap on videos. Like the “pop out showcase: and “super like,” these ads play to the familiarity that TikTok users — particularly its young Gen Z and millennial demographic — have with how to navigate their smartphones. It’s second nature for younger people to know to tap, swipe, and drag, and these ads offer some form of immediate gratification for doing so, whether that’s an explosion of icons or even a real-life reward.

Image Credits: TikTok (gesture ads)

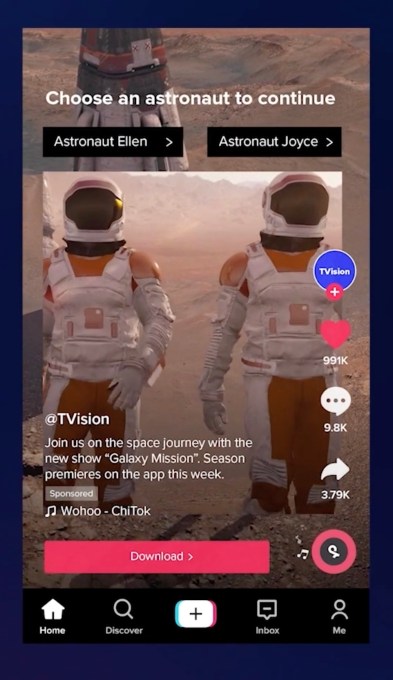

The final new product is TikTok’s “storytime tool,” which encourages users to become a part of the brand’s storytelling experience. Some streaming services, like Hulu, have experimented with ads that ask the users to play along — but not quite to the extent of controlling the story. Instead of just watching a TikTok ad, this choose-your-own-adventure style format lets users tap to direct the action in the video to shape the narrative and personalize the outcome.

Image Credits: TikTok (storytime tool)

“All these solutions are a part of our goal to enable advertisers to create the most engaging ads in ways that taps into their creativity and fun that exists on the platform,” said Jaclyn Fitzpatrick, TikTok Product Strategist, Global Business Marketing, when introducing the new lineup.

Of course, performance and measurement capabilities are just as important to marketers as the ad creatives themselves. To address these concerns, the company touted its TikTok Ad Manager, editing suite, trends and insights, and other new tools for buying, scaling, and analyzing their campaigns. It launched a new buying type called Reach & Frequency, which allows advertisers to target a higher volume of users through extended reach, or get more impressions with the same number of users by opting into a higher frequency for their ad placements.

TikTok also made a commitment to brand safety — an issue that’s plagued YouTube in the past — with the launch of a proprietary brand safety inventory filter.

The solution leverages machine learning technology to classify a video’s risk based on the video’s content, text, audio, and more, so advertisers can make decisions about which kind of inventory they want to run adjacent to, the company explained. TikTok says the new filter is aligned with the Global Alliance for Responsible Media (GARM)’s industry framework and it partnered with Integrate Ad Science (IAS), Zefr, and OpenSlate to help it to ensure ads run next to brand-safe content.

The message to advertisers, clearly, is that TikTok should be considered not only because of its sizable audience — now 1 billion monthly actives, it says — but also because of its advertising toolset.

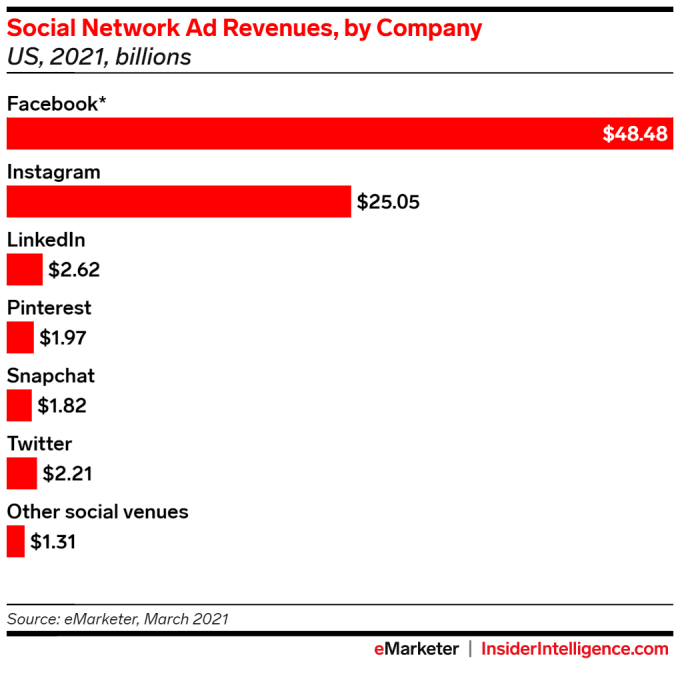

To date, marketers haven’t carved out as much of their spending for TikTok compared with other major platforms, like Facebook and Instagram. But TikTok parent company, ByteDance, has been making inroads in the global ad market, with annual revenue across its apps more than doubling in 2020 to reach $34.3 billion. In the U.S., TikTok was expected to bring in $500 million in 2020, up from $200-$300 million in the year prior, according to a report by The Information. (Some of that is from in-app purchases, of course.)

As TikTok has scaled its ad business, its ad prices have been steadily increasing, too. Bloomberg noted this summer it was jacking up home page takeover ads, its most valuable real estate, to more than $2 million on top days — like holidays. Reuters also noted that TikTok saw a 500% increase in the number of advertisers that were running campaigns in the U.S. from the start of 2020 to the end, though ad sales were still small compared with other major platforms.

Image Credits: eMarketer

That continues to be the case in 2021, as TikTok’s U.S. ad revenues are dwarfed by other social brands. In fact, TikTok was not even broken out in eMarketer’s recent tabulation of U.S. ad revenues, where it’s instead lumped into an “Other” category with other, smaller social networks which, combined, are expected to reach $1.3 billion in 2021.