The last 20 months of living in the midst of Covid-19, with all its unexpected developments, have been a challenge for many organizations when it comes to planning for the future. But that has also presented an opportunity for tech: build tools to make planning and forecasting, even in the midst of a pandemic, easier and more effective. To that end, Pigment — a Paris startup that has built a platform to help organizations better visualize data and use it to power better business planning and forecasting — has been seeing a surge of business, and today it is announcing a Series B of $73 million to fuel its growth, both in the U.S. and Europe.

Its mission, CEO and co-founder Eléonore Crespo said in an interview, is not just to make it easier to use big datasets in more strategic ways, but to use its intuitive approach to take on the behemoth of Excel — estimated at over 1 billion users — and other generic spreadsheet programs, to become the go-to planning and forecasting platform.

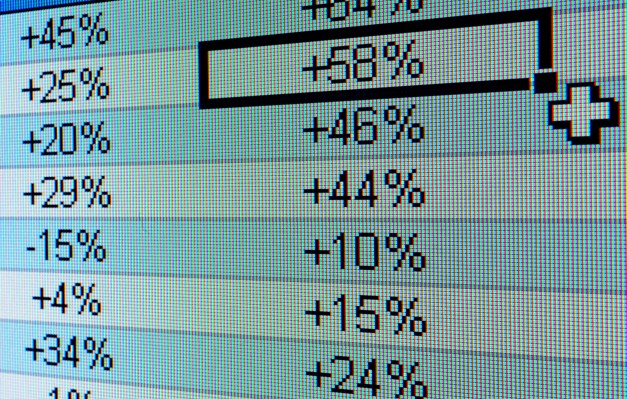

“Eighty percent of use cases are still done in Excel,” Crespo said. “We have built the most powerful engine in market, providing simplicity in what is a complex process.” The approach is about replacing the ubiquitous spreadsheet interface with drag and drop elements to manipulate business data so that anyone, including non-technical people, could use it, she added, “a little like Lego.” Starting first in finance and revenue, the plan will be to build modeling and forecasting templates that can be used in a variety of business departments, including HR, sales and marketing.

The round is being led by Greenoaks, with previous backers FirstMark Capital and Blossom Capital also participating. Blossom led Pigment’s $26 million Series A in December 2020.

Pigment is not disclosing its valuation with this round, but for some context, it was valued at $112 million in its Series A, per PitchBook data.

With customer traction, Pigment’s sweet spot up to now has been working with fast-scaling businesses with a strong play specifically in the world of tech, where its customers include Algolia, Gong, Melio, Deliveroo, Spendesk, Blablacar, and Cheerz — precisely the kind of organizations that are both amassing large amounts of data about how the business is running, and in strong need of tools to help make better sense of that data, to use it to have a better idea of what the future might hold.

Indeed, one of the reasons Pigment plays so squarely into that use case is because that was some of the impetus behind why it was founded in the first place. Crespo previously was an investor at Index Ventures (and before that a data analyst at Google) and her co-founder Romain Niccoli was previously the CTO and co-founder of adtech giant Criteo.

At Criteo, she said, Niccoli’s “biggest nightmare” was that technical, sales and other departments were tapping into very powerful tools to handle data modeling and forecasting, but in areas like revenue and finance, “They were still using Excel for super strategic data.” That posed a huge problem since Excel was never originally designed to be used in that way, and it hadn’t evolved to meet that demand and heavy use.

Crespo found the same, she said, both at Index when trying to evaluate information, and at Index’s portfolio companies.

“All these companies that were fast-growing, preparing for IPOs, and we’d see them running strategic cases on spreadsheets,” she recalled. “It just didn’t work. Excel would just break. It wasn’t secure. I thought there should be a better way.”

Pigment does this by first of all providing a wide range of connectors to integrate data from a variety of other platforms, including Snowflake, Netsuite, Looker, Workday, Salesforce, Google Sheets and “dozens” of others, Crespo said. It then provides a set of tools so that teams and partners can view, collaborate and provide feedback on data. For those that already use Excel, they can work on data in Pigment using “Excel syntax” to show trends in the data. It also provides a range of big data analytics tools behind the scenes so that users can then run multiple “what-if” scenarios on the data to compare different financial outcomes when and if conditions change.

There are, of course, a number of different companies, both old and new, that have been tackling the world of business planning with software to make it easier to do this. They include the likes of Anaplan, DataRails, Workday (related to the specific area of HR), Oracle, IBM, Looker, and even newer players in the more general spreadsheet landscape like Airtable. Interestingly, two of Pigment’s angel investors, Paul Melchiorre and David Clarke, respectively come from two of those competitors, Anaplan and Workday. (Melchiorre had been the CEO of Anaplan, and Clarke is the former CTO of Workday.)

“I’ve been in the enterprise planning business since my time at SAP in the early 1990s. I recently led the largest player in the space, and I can honestly say that Pigment’s platform is the most flexible and comprehensive,” Melchiorre said in a statement. “Pigment will be transformative for the start-up ecosystem because it will be at the core of successful and sustainable growth strategies, tailor made for the next generation of leaders. It will allow them to deliver on high expectations set by increasing levels of funding, and plan for uncertain scenarios while being socially and environmentally mindful.”

That endorsement, and the startup’s growth, are behind this latest round.

“Financial planning & analysis is a critical business function. But today, most companies rely on software that hasn’t evolved in years — either outdated spreadsheets that are inflexible and don’t scale, or expensive and overly-complex FP&A suites that require an industry of consultants to support them. Today’s businesses demand agile and intelligent tools that will help them make better decisions more quickly,” said Neil Shah, at Greenoaks Capital, in a statement. “We believe that the company will rapidly become the market’s clear leader in planning software, building faster and for broader use cases than any competitor, and delighting their customers along the way.”