Aiming to compete with Bilt in the nascent property renter rewards market, Stake, a startup that provides cash back and banking services to renters, today announced that it raised $12 million in a Series A round led by RET Ventures’ new RET Ventures ESG Fund. Enterprise Community Partners, Hometeam Ventures, Operator Stack, Shadow Ventures, Olive Tree Ventures and Second Century Ventures, the investment arm of the National Association of Realtors, also participated, bringing Stake’s total raised to $17.9 million.

Co-founder and CEO Rowland Hobbs says the new capital will be put toward expanding the platform and increasing Stake’s workforce from 17 employees to 23 by the end of the year.

“During the pandemic lockdown, we saw renters really struggle, and owners couldn’t collect rent. The pandemic has changed real estate forever,” Hobbs told TechCrunch in an email interview. “Today, affordability for rentals is front-and-center in every aspect of our current economic environment. Inflation and rising rents are crushing renters — and rising mortgage rates are turning even more people into renters. On the other side of the coin, rising labor costs and delinquencies are hurting rentals.”

Prior to starting Stake, Hobbs co-founded a communications and integrated marketing firm, Post + Beam, and co-launched Linea, a mobile photo-sharing app organized around a scrolling filmstrip of pictures. Through Post + Beam, Hobbs consulted with banks and brands to create customer loyalty programs, and it’s through this work that he says he had the inspiration for Stake.

Image Credits: Stake

“Despite the large audience, brands wouldn’t target renters. Banks certainly didn’t cater to renters. Yet, housing is the largest expense for consumers. It’s painful. Huge spend, with no return,” Hobbs said. “In 2018, we began showing hundreds of apartments to learn what really matters to renters. On a hot August day, in a small sixth-floor walkup, one renter’s phrase hit home: ‘It’s the money, stupid.’ This insight led to the [Stake’s] cash back rewards for renters.”

Stake uses a “behavioral science” algorithm to suggest to property owners how much in cash back they should reward renters who pay rent on time or sign a lease renewal early. Integrating with property management software such as Yardi and Entrata, landlords can use Stake to activate “personalized incentives” and targeted offers, Hobbs said, with the goal of reducing delinquencies.

Renters earn an average of 4% of cash back on their rent with Stake. At a time when nearly three-quarters of renters who’ve seen their rent rise are considering a move, it could make the difference between having to find a new occupant and retaining a longtime tenant, Hobbs said.

“Stake uses machine learning to help determine the right amount of cash back to offer residents. For example, if the data shows a decrease in the number of submitted lease applications at a certain property, Stake often suggests an increase in the cash back being offered at that property,” Hobbs said. “Stake stores anonymized user data for the duration of their relationship with Stake and as long as required to meet our legal and client obligations.”

The fact that Stake stores personal data, albeit anonymized, might make a few renters uncomfortable. Data retention aside, it’s unclear the extent to which Stake has probed its cash-back-calculating algorithm for bias. As reporting has revealed, many of the algorithms financial institutions use to make lending decisions are biased against minority applicants, in part because they reward traditional credit and don’t consider on-time payments for things like utilities and cell phone bills.

Hobbs asserts that Stake advocates for renters, in truth, by offering loyalty solutions that promote savings. Unlike financial products that sell debt to renters, Stake doesn’t burden renters with loans and fees. That’s key, he claims, at a time when property costs are rising at a record rate — even at rent-stabilized units that have historically been slow to change year-to-year.

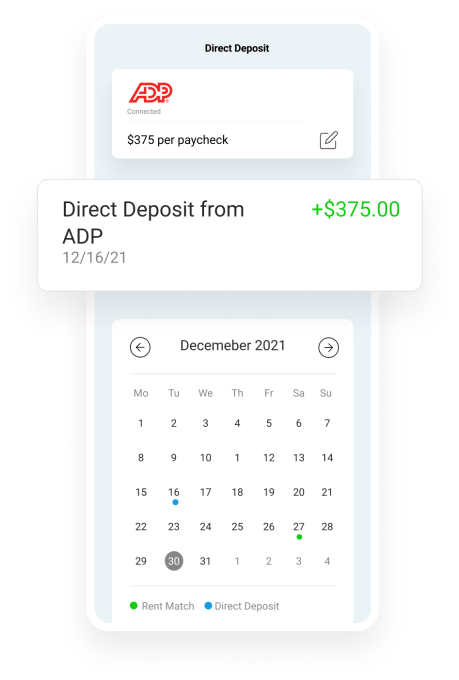

Image Credits: Stake

“Stake finds savings for owners and then returns that money to renters so they can spend on the stuff they want today and save for the life they want tomorrow,” Hobbs said. “Every major industry, from hospitality and travel to credit cards and finance, has used loyalty to reduce the cost of marketing and to increase the lifetime value of customers. Stake is bringing the same transformation to real estate. But transformation takes time, and real estate decisions tend to be long-term. Our challenge is to continue to provide better data to help owners and operators make the transformation to a loyalty mindset.”

In line with this mission, Stake recently began offering an array of banking services to renters, including checking accounts with payroll and direct deposit planning features and a debit card with cash-back rewards. Hobbs says that, for many renters, Stake’s is their first checking account.

While Stake competes against the aforementioned Bilt, which last year raised $60 million for its loyalty program for property renters, Hobbs claims that Stake is growing at a robust pace. He estimates that Stake now reaches around 20,000 homes across multifamily, single family and student housing units in the U.S.

“We’ve made savings easy and intuitive for renters, and we reward it. Stake has grown 10x in the last year and experienced 30% growth every month since it closed a seed round in September 2021, and booked annual recurring revenue is over $2 million,” Hobbs said. “With this new funding — combined with booked sales, strategic real estate investors, and low cost of acquisition — we have significant growth and runway ahead to empower renters, lower costs for owners, and build the next generation of financial infrastructure for rentals.”