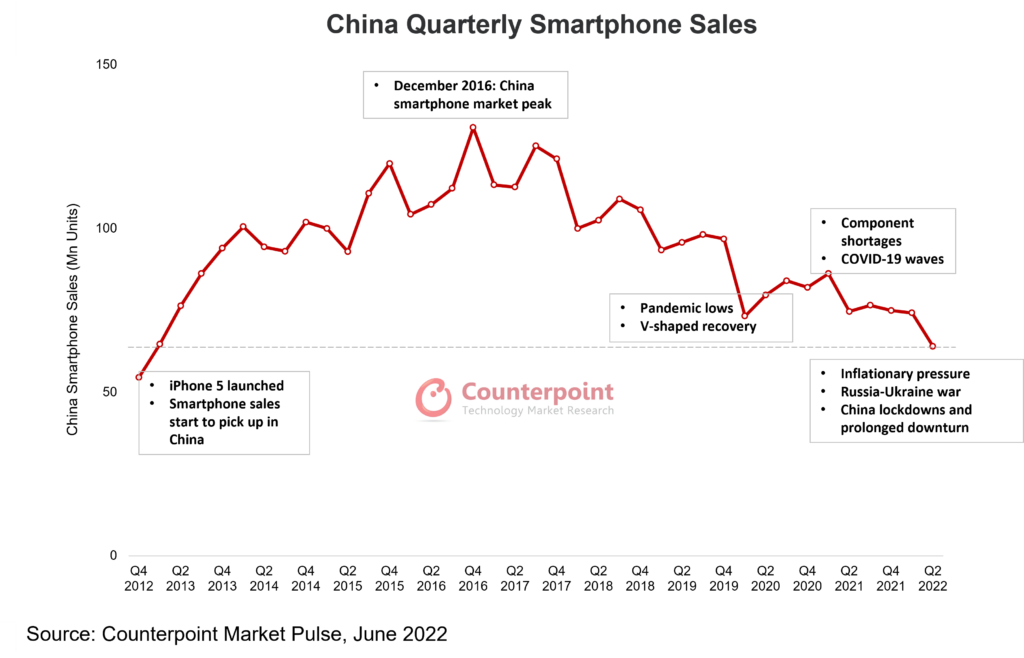

New numbers from Counterpoint Research paint a rough picture for China’s smartphone market. Things show a steady climb, dating back to the iPhone 5’s 2012 launch, before peaking in December 2016 and beginning their descent back down to Earth.

Sales in China dropped sharply in Q2 at 14.2%, year over year. The numbers are now at their lowest since the iPhone 5 arrived, less than half since their peak and nearly 13% below Q1 2020, when the pandemic accelerated the already slowing market.

The causes are myriad, as is generally the case with these things, including continued COVID-19 lockdowns in the country, broader economic forces and a resulting drop in consumer confidence.

“During this period, major cities across China, including financial and manufacturing hub Pan-Shanghai, went through full or partial lockdown,” Counterpoint analyst, Ivan Lam, says in a release. “The hardest hit was the services sector, which fell into contraction territory, from 4% YoY growth in the first quarter to 0.4% in the second quarter. The deepest decline occurred in April’s consumption data, with total retail sales of consumer goods falling 11.1% YoY. Weak consumer sentiment combined with the high smartphone penetration rate in China resulted in poor Q2 performance of smartphone sales.”

Image Credits: Counterpoint Research

Virtually all of the major players took a big hit from this time last year. Vivo, Oppo, Xiaomi and Huawei all saw double digit drops from Q2 2021. Apple got off relatively unscathed thanks to the iPhone, with only a 5.8% drop, but Honor had a banner year. The Shenzhen-based Huawei spinoff effectively doubled its sales figures and moved from a 7.7% to 18.3% market share, while securing the number two spot between Vivo and Oppo.

“Honor continues its great comeback by expanding its offline presence,” says analyst Mengmeng Zhang. “With the lockdowns hitting major cities, Honor’s coverage in lower-tier cities, which saw fewer lockdowns, helped the brand steer through the turbulence in Q2 2022. It may be noted that Honor managed to take share from all the leading Chinese brands, including Huawei, during the quarter. It is time for Oppo and Vivo, known as the ‘offline channel kings,’ to take Honor seriously.”