For many non-technical sales teams at product-led growth companies, it’s difficult to sift through reams of data to find out the best way to engage with potential paying customers. That’s a problem that HeadsUp, a conversion engine for product-led sales, wants to solve. The San Francisco-based startup announced today it has raised $8.5 million in seed funding, led by 645 Ventures (also an investor in SaaS companies like Iterable, FiscalNote and Panther), with participation from Wing Venture Capital, Firstminute Capital and Character. Other investors include the founders of Drift, Algolia and Crossbeam, plus senior go-to-market leads at companies like Asana, Amplitude and Miro.

Founded by Earl Lee and Momo Ong in 2020, HeadsUp’s customers include unicorn SaaS companies. Lee and Ong were early employees of Fiscalnote, a data-tracking SaaS company that recently went public.

During their time at Fiscalnote, the two built an internal tool to give sales teams visibility into how customers were using the software. But even with the new tool at their disposal, salespeople had to spend hours going through accounts to figure out the best times to engage with potential customers.

Lee said HeadsUp is starting with PLG companies because they often get a lot of usage signals before the buying process, but all SaaS sales teams need help understanding when users are ready to convert to paid plans or upgrade their current subscriptions.

“Imagine you’re a seller at a developer tooling company. Engineers hate being sold to when they’re still tinkering with the product and testing it,” said Lee. “So sellers worry about annoying developers by pitching them before they are ready to buy. At the same time, you don’t want to ignore them during the small time window when they’re ready to engage with you to buy the tool for their company.”

HeadsUp identifies that window by analyzing the wide array of data collected by SaaS companies and helping non-technical salespeople figure out the best users to engage, and when to engage them. For go-to-market teams, this includes finding users who are stuck in activation and identifying upsell opportunities or churn risks.

The types of data that HeadsUp analyzes to increase conversion rates include usage data, billing and CRM data and third-party data like job titles and how much users’ companies have raised in funding.

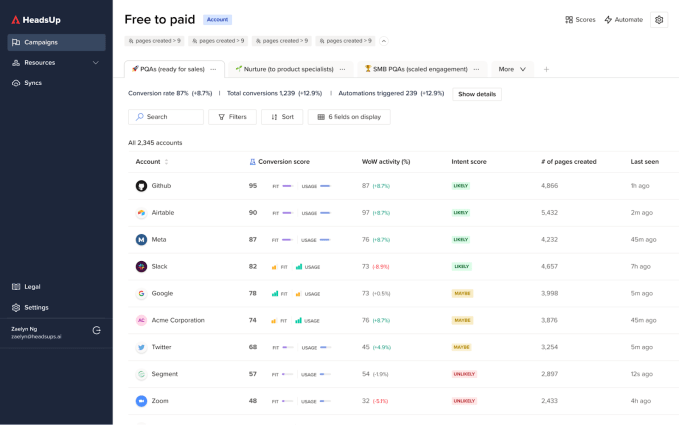

All this goes into HeadsUp’s machine learning model, which is trained on data from SaaS companies. The ML model lets its clients pick an objective, like conversion or churn prevention, and then delivers a score based on their accounts’ historical data.

Instead of showing salespeople all usage data and customer data, which can be confusing, HeadsUp picks four to five data points that most strongly predict conversion, expansion and churn. For example, that might include the amount of time users spend in an app, or growth in seats over the last month. It also delivers contextual information, including potential champions and seniors executives, and recent in-product interactions, to help sales representatives figure out how to approach prospects.

HeadsUp is especially suited to SaaS companies with small sales teams and marketing budgets that need to quickly find ways to monetize their user base. Ong notes that SaaS companies can have hundreds of thousands, or even million of users, but still convert only 1% to 2% into paid users. An even smaller subset pay for upsells or cross-sells, and the process of monetization can take months, if not years.

Ong gave an example of the user-to-enterprise sales pipeline at a company. If an engineer is stuck on a certain feature, the sales team can send a marketing email referring them to docs about how to use it. If they are still stuck a week or two after the email, then the sales team can call them and walk them through the process of using the feature. Then after they have used it for months with good results and have invited their manager to use it, their organization might be ready to buy.

HeadsUp’s conversion page

But getting to that point requires understanding of how the customer is using the product and coordination across multiple GTM teams. This means they need to be able to access data and discuss when to handoff the customer to another team (i.e. from marketing, to sales assist and product support, to enterprise sales).

“PLG companies can have up to tens of millions of users. Imagine having to understand when to engage for tens of millions of users, and then coordinating the engagement between scaled and unscaled means,” Ong said. “This coordination and handoff become impossible without tooling and analytics.”

HeadsUp helps by giving insights on exactly when and how to engage with users, while also coordinating customer touchpoints across sales, product, marketing and customer success teams.

The startup will use its new funding to build its team. “Specifically, we are looking for strong scala back end engineers to work on our data process infrastructure, as well as data scientists and machine learning engineers for our analysis and insights,” said Ong.