How to compete without losing your mind — and your runway

Competing in an increasingly crowded space can be nerve-wracking. Competing in an increasingly crowded space amid a challenging fundraising environment is even more nerve-wracking.

We all know that cash is not nearly as readily available in 2022 as it was in 2021. This puts startups in the position of having to compete without losing their minds — or runway.

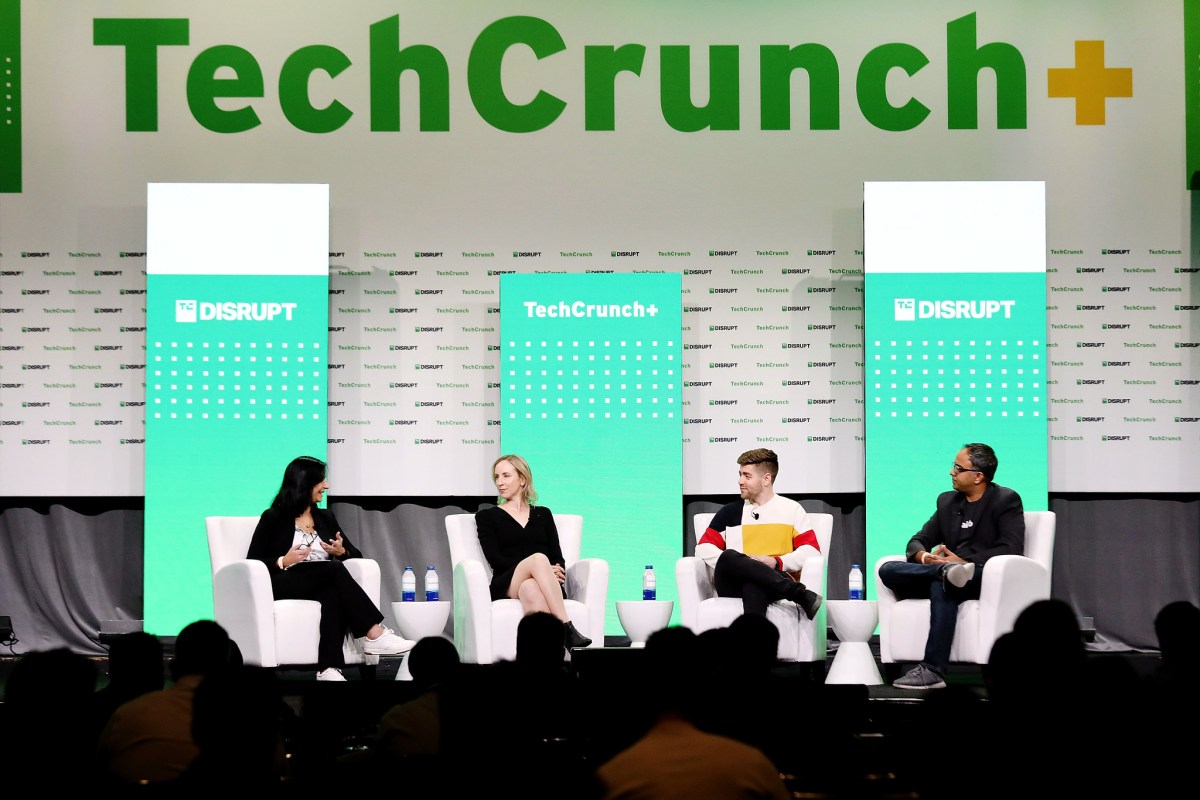

At TechCrunch Disrupt 2022, I interviewed Ramp CEO Eric Glyman, Airbase CEO Thejo Kote and Anthemis partner Ruth Foxe Blader on the topic. Glyman and Kote shared how they’re working to preserve capital, while Blader offered up some of the advice she’s giving to her portfolio companies. And she didn’t hold back.

For the unacquainted, Glyman and Kote both run startups in the spend management space. As friendly competitors, they acknowledged that while the category is not a winner-takes-all one, it’s still important to differentiate and continuously innovate.

Said Glyman: “One of the things that we’ve done in our business has been to look at the cost of acquisition — to fully earn back the cost deployed — and we’ve reduced that threshold,” he said. “And so our view is that we want to grow as fast as possible, but at a much faster tolerance — in that same way where you can earn higher yield elsewhere, applying that rigorous framework to where you choose to deploy capital. We think this is the right approach for this environment.”

For Kote, it’s mostly about focus. Airbase, he noted, has historically targeted the midmarket and early enterprise space. He referenced “the crazy 2021 period where there was all the insanity around investment in this space,” with investors “willing to pay 100x, 200x multiples.” Rather than frantically try to change Airbase’s model to meet expectations, Kote said the startup kept operating the way it always had.

“So a silver lining from a focus perspective coming into this year for us has been, ‘You know what? None of that matters,’” Kote said. “We were very focused on subscription revenue and high-margin subscription revenue and net ARR — not gross ARR. So we have really stuck to what we have always done, which is focused on the midmarket. And that meant that we freed up resources in a bunch of ways, giving us additional runway.”

Meanwhile, Blader — whose firm invests at all stages of the life cycle — shared her belief that “this is a sentiment-driven industry, and when the music’s playing, everybody dances.”

“The people who danced in 2021 and raised a bunch of capital — enough capital to hit breakeven with maybe a little bit of burn cutting, are probably feeling pretty good,” she said. “And the folks who really either under-raised or didn’t raise or raised capital at a valuation where they’re really not going to be able to close the gap between where multiples were and where they are now, are slightly panicked.”