Dear Sophie,

I was laid off and I’m on an H-1B. I have enough savings to survive for a while. What should I do if I have been let go from my job?

I am on an H-1B, have an approved I-140 and an I-797 that expires in March 2024.

If I have to leave the U.S., can my current I-797 be transferred to my next employer? Are there any issues I should be aware of?

— Upended & Unemployed

The seasons won’t change for another 43 days, but in San Francisco, it already feels like winter.

As an offshore weather system brings gusts and downpours, local employers like Twitter, Lyft, Stripe, Brex, Opendoor and Chime are laying off thousands of employees. This week, Meta will reportedly announce the first large-scale staff cuts in its history.

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

For tech workers who are immigrants, this is an especially fraught time, as their ability to remain in the U.S. is conditional on their employment.

Most visa holders have a 60-day grace period after an unexpected layoff, but with thousands of skilled workers hitting the market at once, the clock is ticking.

We usually run Silicon Valley-based immigration attorney Sophie Alcorn’s column on Wednesday, but in light of current events, we ran it yesterday (without a paywall).

First order of business: if you’ve been impacted, don’t delay. Start looking now for a new position, and tell everyone in your network that you’re open to work.

“At a job interview, be direct about your need to transfer your H-1B to a new employer. If the company is not willing to sponsor you, move on,” advises Sophie.

“Ideally, you should accept a job offer no more than 45 days into your 60-day grace period unless you have applied for another fallback status because it can take several weeks to prepare and file the H-1B transfer.”

Brace yourself: more layoffs are coming. Update your resume, save as much money as you can, and most importantly — don’t panic.

Thanks for reading,

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

2023 will be the year of cyber risk quantification

Image Credits: Olemedia (opens in a new window) / Getty Images

Myriad factors determine a company’s valuation, and cybersecurity is one of them.

Public companies that experience a breach tend to see a -3.5% drop in stock value after the news goes public.

That’s why cyber-risk quantification (CRQ) “has slowly grown from a nice-to-have to become the foundation for addressing the most critical concerns about a business’ cybersecurity posture,” writes John Chambers, founder and CEO of JC2 Ventures.

How ButcherBox bootstrapped to $600M in revenue

Mike Salguero at ButcherBox’s dry ice factory

Grocery delivery service ButcherBox ran a Kickstarter campaign in 2015 to identify customers who wanted to receive 100% grass-fed beef.

Since then, the company “has seen $600 million worth of revenue without taking a penny of external investment,” reports Haje Jan Kamps, who spoke to CEO and co-founder Mike Salguero about how the founding team bootstrapped their D2C startup.

“I was meeting meat farmers in parking lots, buying a couple of trash bags full of meat — I’m sure that didn’t seem sketchy at all,” he said.

“But it was too much meat for my freezer, so I ended up selling the excess meat to friends or people I was working for.”

New data show how SaaS founders have been dealing with whiplash from public markets

Image Credits: puruan / Getty Images

According to OpenView Venture Partners’ 2022 SaaS benchmarks report, “an overwhelming majority of respondents are slashing spending regardless of cash runway.”

In this year’s survey, which covered 660 companies, OpenView operating partner Kyle Poyar and senior director of growth Curt Townshend found that “the rule of 40 is back,” as the need to generate profits has overtaken investors’ obsession with growth.

“Achieving 40 each quarter is not required,” they concluded. “But it is required to have a grasp on what caused a drop or spike, and what can be done to get to 40 long term.”

How to land investors who fund game-changing companies

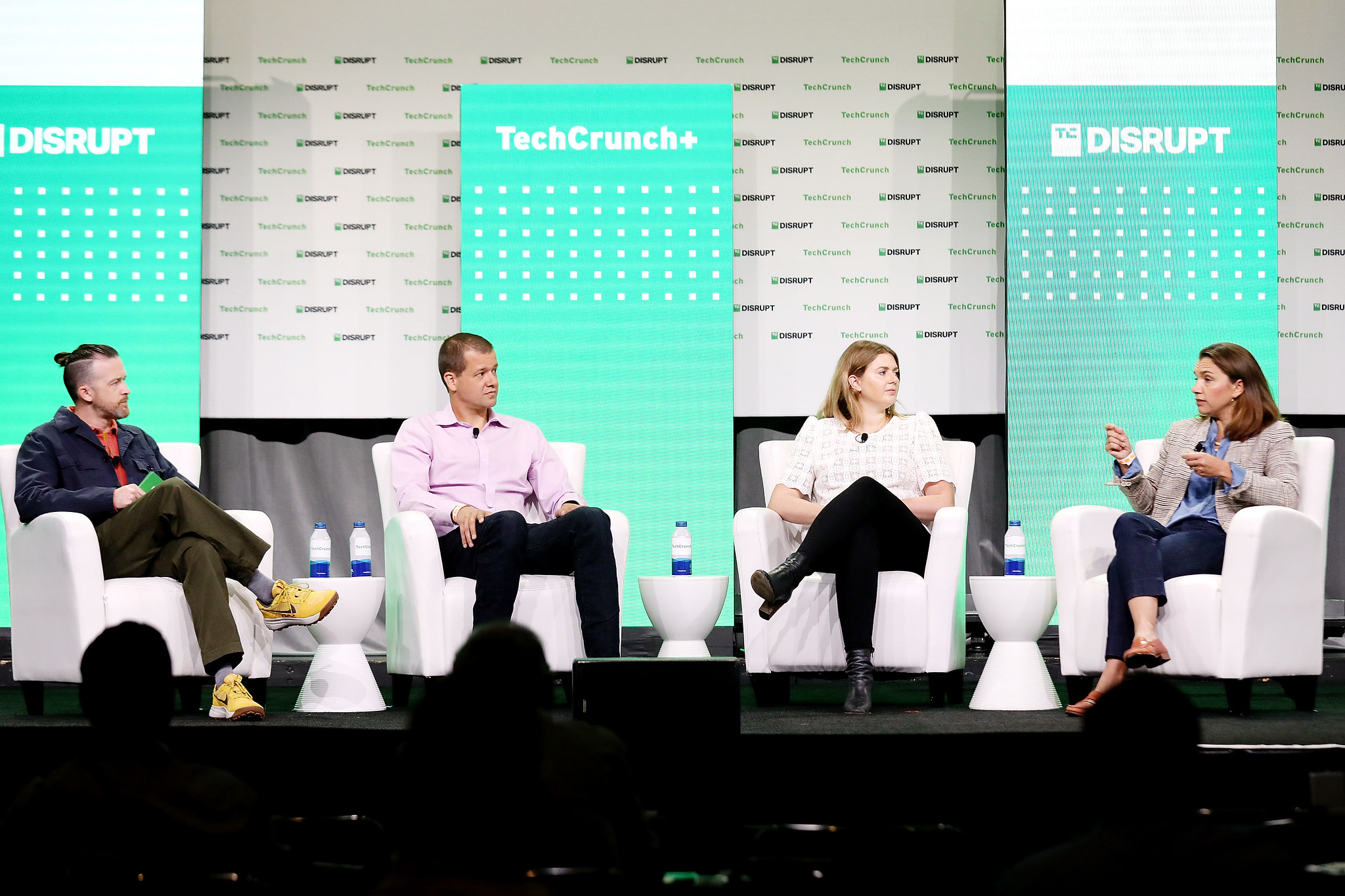

Image Credits: Kelly Sullivan / Getty Images

A SaaS startup can conceivably find product-market fit within a few months of launching, but companies that work with hardware and robotics may wander in the pre-revenue wilderness for years.

To learn more about how investors approach risk when it comes to emerging technology, Tim De Chant moderated a panel at TechCrunch Disrupt with Milo Werner (general partner, The Engine), Gene Berdichevsky (co-founder and CEO, Sila) and Erin Price-Wright (partner, Index Ventures).

“Hire people to do the technical stuff,” said Berdichevsky. “Keep an eye on it, but then go learn the other pieces.”