Most M&A deals involve a lot of activity from the buyer to the financiers and a myriad interested parties. The typical way of describing this is to write dense text in a contract explaining the relationships, an approach that quickly becomes difficult to follow, even for the most experienced legal minds.

StructureFlow’s founder and CEO, Tim Follett, who was trained as a lawyer prior to founding the company in 2017, thought that moving that information to a visual workflow-style approach would transform the process.

Today, the company announced a $3.6 million investment.

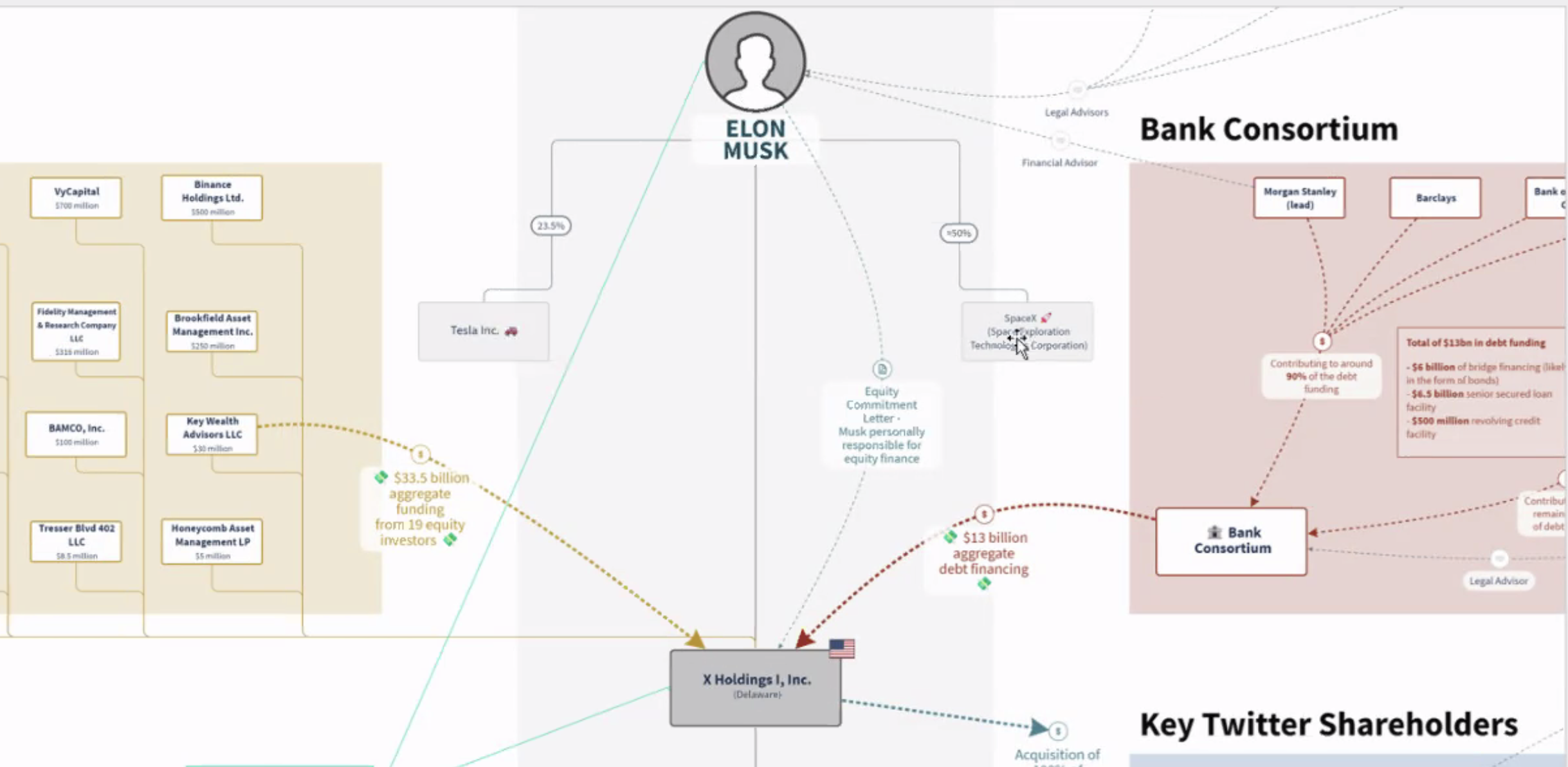

StructureFlow identifies all of the parts of the textual description as different components: people, assets, funding flows and contractual relationships. “What our software does is it visually models those things and those relationships so instead of having to engage with that information through mountains and mountains of written text, which is the way the legal industry has operated for decades, centuries; what we do is we provide a visual interface into that information,” Follett told TechCrunch.

“And by doing that, we help people understand what’s going on far faster than if they were reading 200 pages. Contracts are long, long documents, and we allow people to communicate that information far faster than they would be able to do if they were writing it out, or just speaking to it.”

The software works like a lot of the no-code workflow tools we see on the market. You can drag and drop the different components onto the canvas and show the relationships between the different items and how the money flows from one group to another. Sometimes it’s simple and sometimes it’s complex, but being able to visualize it all makes it far simpler to understand than reading.

This could be at the start of a deal, or after a deal is completed to get the big picture (useful for tech journalists or others looking at big deals like the $44 billion Twitter acquisition) or it could be how to untangle a company as is happening now as lawyers are working to shut down FTX.

Twitter deal flow visualized in StructureFlow Image Credits: StructureFlow

As a non-technical founder, Follett has had to hire technical people to implement his product vision. He produced his first version of the product in late 2019, and then COVID hit, but he has been able to build up a business with 45 firms using his product today across several continents.

Today he has around 30 employees as he prepares to build out the product with the goal of getting to a Series A investment next year when he plans to start scaling and accelerating. As he builds his company, he says diversity is particularly important.

“So these things at the moment they’re obviously big topics. And I think for good reason. Because what you get through diversity and inclusion is different perspectives, different ways of thinking,” he said.

He says one area that is near to his heart is neuro-diversity “because what we’re doing fundamentally is we’re creating a new paradigm for engaging with complicated information.” He believes that will help people who have trouble reading this information as text.

Today’s investment was led by Venrex with participation of several industry angels. This investment brings the total raised, pre-Series A, to around $8 million, according to the company.