In 2016, the Gulf Cooperation Council (GCC) member states signed the Value Added Tax (VAT) agreement paving way for the introduction of the general levy on consumption across the region. The United Arabs Emirates (UAE) and Saudi Arabia became the first member states to adopt the treaty in 2018, and its implementation meant that for the first time businesses in these territories were required to file VAT returns periodically.

Nadim Alameddine, a UAE resident, says he immediately saw an opportunity in the accounting space as businesses sought to file returns as required by the new law. This inspired him to launch Wafeq in 2019, a startup that initially offered accounting services and later, in 2021, launched a scalable accounting and e-invoicing SaaS solution focused on clients in UAE and Saudi Arabia.

Wafeq is now exploring new growth opportunities in Egypt while doubling down on its existing markets as businesses comply with evolving accounting and financial requirements. The growth plans follow a $3 million seed funding it has secured in a round led by Raed Ventures and participated by Wamda Capital.

“There are regulatory changes happening in Saudi Arabia and Egypt, and that is what we are trying to capitalize on at the moment… we are also doubling down on our existing markets, where we already have good traction,” Alameddine told TechCrunch.

Egypt and Saudi Arabia currently require businesses to be e-invoicing compliant, which he says has led to a surge in demand for accounting software, which Wafeq is tapping through its enterprise (API) product.

Wafeq is a ratified provider in Saudi Arabia, and the UAE (e-invoicing is not mandatory there yet). The startup is in the process of seeking approval from the Egyptian Tax Authority too. Alameddine said the North African country offers massive opportunities for the startup as it is home to millions of small medium businesses.

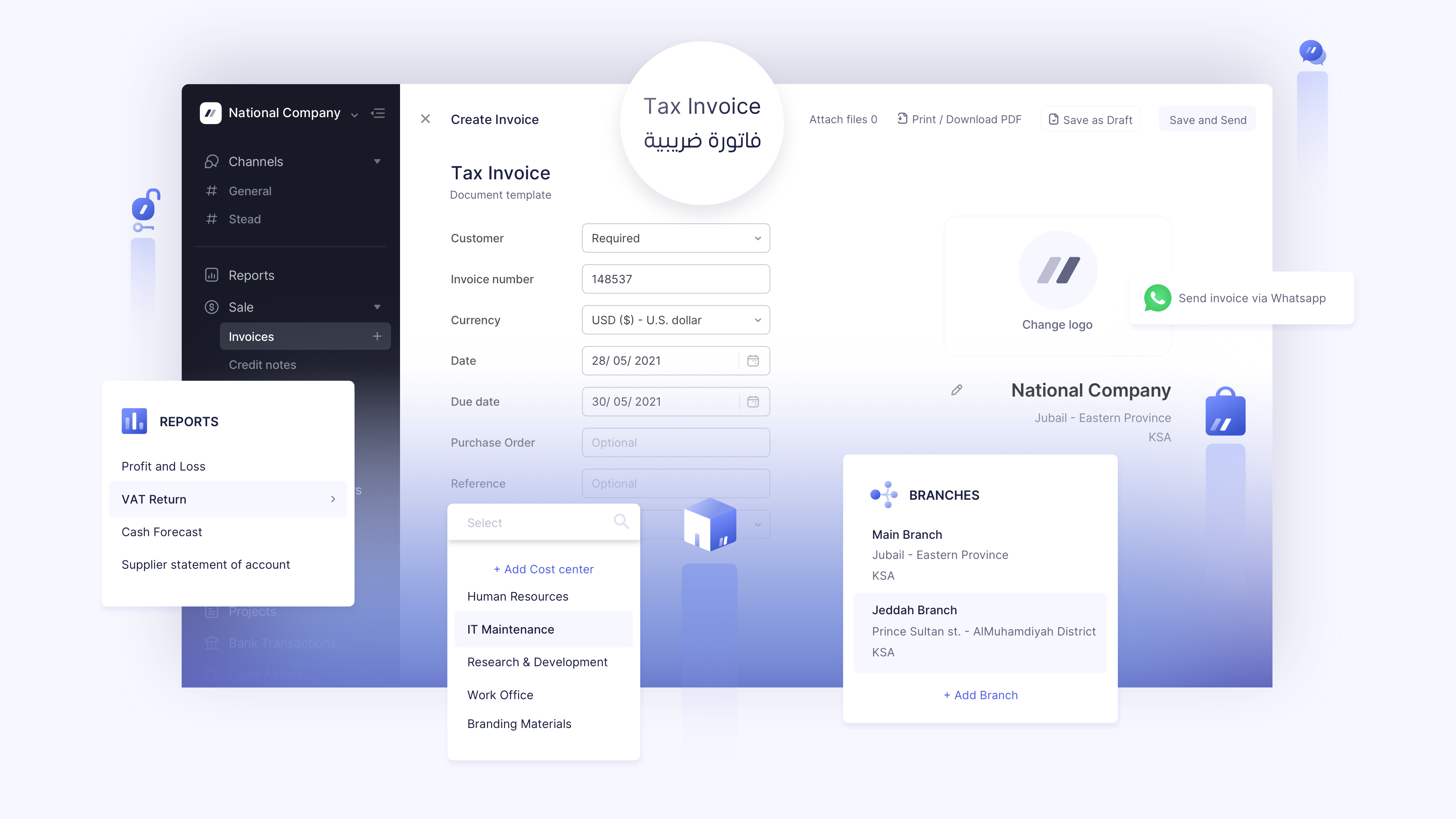

Wafeq says its powering accounting and financial compliance for SMEs. Image courtesy: Wafeq

Its accounting platform, on the other hand, makes it easy for clients to generate their VAT returns, manage inventory, payrolls, bills and track expenses. It also generates actionable financial reports and insights for businesses.

“We position ourselves as a full accounting software for SMEs, and we offer three different plans serving businesses looking to send compliant invoices, manage their accounts payable, or those seeking a full accounting solution that includes inventory management and payroll services,” said Alameddine.

Currently, over 630,000 invoices are created every month through its platform, with the total monthly invoiced amounts exceeding $117 million. They anticipate this to grow enormously in the wake of its growth plans.

Commenting on the deal, Talal Alasmari, the founding partner of Raed Ventures said; “We are thrilled to back Wafeq as they solve a problem that impacts thousands of businesses in the region. The digitalization of accounting practices will truly transform how SMEs here operate, increasing operational transparency, creating efficiencies and contributing to economic growth.”