In the wake of a seminal wave of new artificial intelligence startups such as OpenAI, a new U.K. company claims it can track and rank banks on their ability to develop and deploy AI platforms.

Evident, a benchmarking and intelligence company, says its inaugural Index can rank the 23 largest banks in North America and Europe on their competence in AI.

“As the real-world application of AI accelerates at astonishing speed, we believe that this transformation is too important — for managers, for investors, for society at large — to be happening in a darkened room. Our Index measures the race to banking AI maturity in a way that brings transparency to the top of the agenda,” said Alexandra Mousavizadeh, Evident co-founder and CEO in a statement.

Over a call she added: “Setting our methodology onto the banks felt like the right place to start because this is a sector that has been really focused on this for a number of years. After this we plan to go into insurance and the health sector as well as the energy sector, manufacturing and so on.”

The Evident AI Index is based on “millions of public data points” says the company, “without resting on proprietary surveys that suffer from self-reported biases.”

The results make for interesting reading.

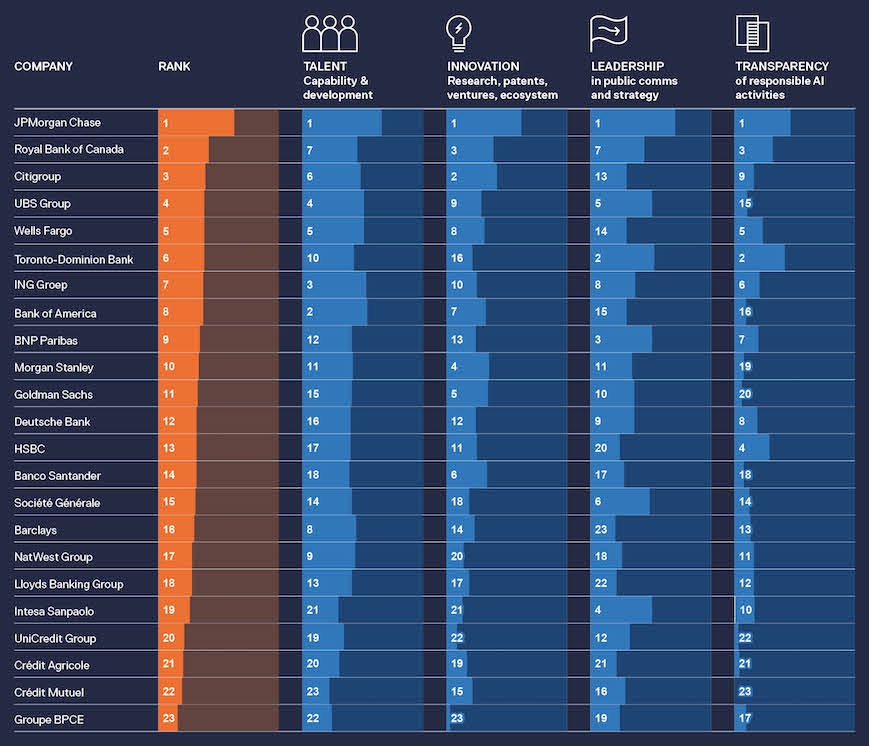

Evident AI Index rankings. Image Credits: Evident

JPMorgan Chase comes out top, leading on all pillars, and scoring 63% of the available points. The bank is joined in the top five by Royal Bank of Canada, Citi, UBS and Wells Fargo.

North American banks listed in the index tend to appear ahead of European counterparts in building AI capability, said the company, making up some 7 out of the top 10 rankings in the Index.

It would appear European banks are at risk of being left behind in the AI race, according to this inaugural index.

Only three European banks make it into the top 10: UBS, ING and BNP Paribas.

Evident is being backed by $3 million in funding from VCs and angel investors, including Venrex Investment Management (an early backer of Revolut); Scott Galloway, NYU Professor and co-host of Pivot podcast; Robin Saunders, CEO, Clearbrook Capital; David Brierwood, former COO of MSCI; Dimitri Goulandris, CEO, Cycladic; and Gary Ginsberg, former senior vice president Softbank Corp. and executive vice president of Time Warner.

“This is the year of AI, and we are seeing a rapid rise in AI use in almost every single sector. As the market begins to discern winners from losers based on their capability in AI, robust metrics and insight become key to stakeholder value. Evident is uniquely placed to provide that clarity,” Galloway added in a statement.