We’ve all looked at our credit card statements and seen the reference numbers that are just a string of letters, numbers and symbols that don’t mean much to the average consumer.

Most times the statement shows where something was purchased and the company, but what happens when a company’s name on the statement doesn’t match up to the receipt? For companies reconciling dozens or even hundreds of statements for its employees, that can translate into hours of playing detective.

The U.S. processed more than $124 billion credit and debit card transactions in 2020, so what if there was a way to more easily decipher that string of data? That’s exactly what Spade is working on.

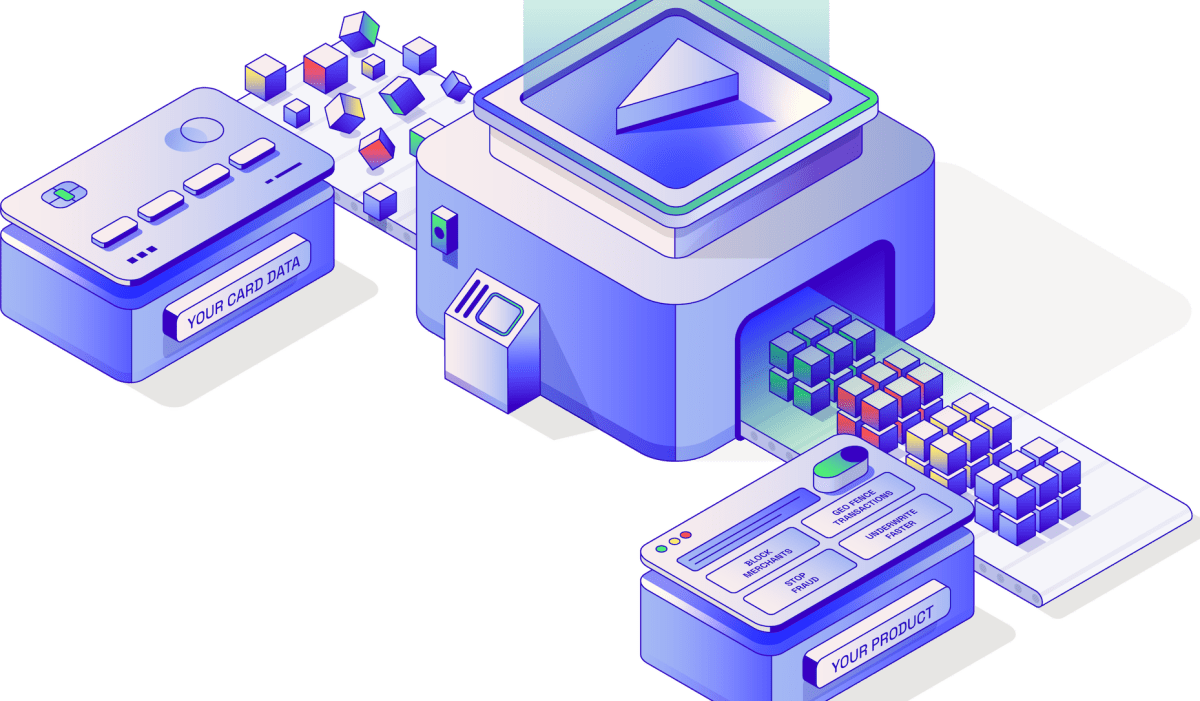

The company, founded in 2021 by Oban MacTavish and Cooper Hart, is developing a data-backed transaction enrichment API that turns that bad data into merchant, category and geolocation details in real time.

“It started basically as doing a logo for transactions,” MacTavish told TechCrunch. “It very quickly snowballed, so we discussed building a simple integration of layers on top of bank data that makes it better.”

Spade’s technology “cleans” the data and enriches it with a proprietary first-party dataset that matches transactions with actual merchant identities, logos, business hours and spending history so companies can get a full picture of purchases, MacTavish said.

Spade founders Oban MacTavish and Cooper Hart. Image Credits: Spade

With that more enhanced data, Spade customers, which include card issuers, anti-fraud platforms and neobanks, can do things like implement spending controls and improve fraud prevention models.

“Now computers can properly build systems on top of the data because it’s not just a clean merchant name, but a consistent ID number across every version of a merchant,” MacTavish added. “We can also know if a merchant is a fraudulent merchant for some reason, which is actually not possible today without better data. That’s where we come in.”

Spade is now buoyed by $5 million in seed funding, led by Andreessen Horowitz. Joining in on the round were Y Combinator, Gradient Ventures, Dash Fund and a group of angel investors from Square, Alloy, Coinbase, MANTL and Venmo. In total, the company raised $6.1 million.

MacTavish intends to deploy much of the funds into hiring — until recently it was just him and Hart, but now there are 10 people on the team. The company also has a lot of runway now to purchase and negotiate data acquisition deals, he said.

MacTavish said Spade is bringing in revenue, but declined to comment further than to say the company “had our biggest quarter ever in the first quarter” of this year after launching its card issuer products last October. He also offered that the company is now more focused on growing revenue now that it has gotten to a good place with its product.

“We’re at a really strong place in terms of product and we’re very confident we have the team to scale,” MacTavish added. “Historically, we’ve worked with mid-market and startups, but we’re really pushing off towards the mid-market and then on the enterprise side as well. Once we land a few more marquee customers we can sort of get that next stage of growth.”