SoLo Funds has acquired over 1 million registered users and over 1.3 million downloads to make it “the largest and first Black-owned personal finance platform” to do so, Rodney Williams, co-founder and president of SoLo, told TechCrunch.

The community finance company defines the claim “as a business-to-consumer personal finance banking solution, U.S.-based and Black-owned with registered users or downloads above 1 million. Black-owned is defined as Black majority ownership.”

“It’s a huge testament to the product we’ve built, that it is actually addressing a real problem,” Williams told TechCrunch. “The system is somewhat discriminatory or selective, in that it’s extremely expensive to start a financial services company. That cost is a significant barrier of entry for the average American who are the ones that need these financial services. It’s challenging across the board.”

SoLo has been on a mission to right-bank some 254 million underserved Americans since launching its platform in 2018, Williams said. The company enables its members to set their own borrowing terms and lend to other members to make returns or a social impact. After borrowing, some 30% of members have even turned around and lended money, he added.

The 1 million registered user milestone hasn’t come without some blood, sweat and tears, though. Before we profiled the company in 2021 when it raised $10 million in Series A funding, SoLo basically ran out of money, causing the founders to shut down the platform toward the end of 2019, Williams said.

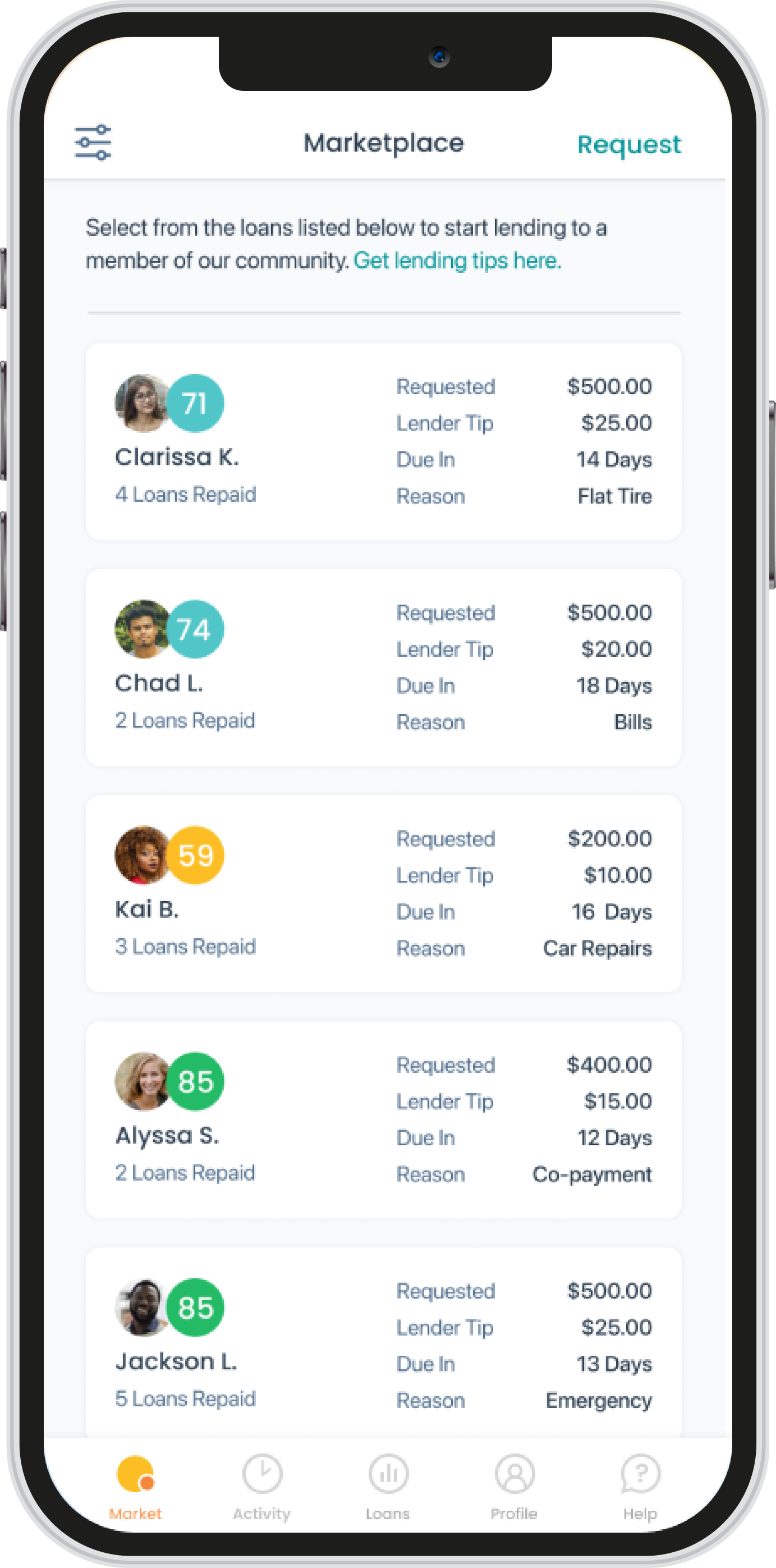

SoLo Funds’ lending marketplace Image Credits: SoLo Funds

SoLo was relaunched in April 2020 with what Williams said was a better product and new features, including protection for lenders. That paid off: In less than a year, the company had aggressive growth — like 2,000% — and a Series A.

Williams also credits the registered user milestone to that perseverance. Not to mention, it is why the company recently landed a seven-figure investment from Serena Ventures and other investors and funds.

Speaking about the investment, Serena Williams, managing partner at Serena Ventures, said in a written statement: “SoLo is transforming the lives of everyday Americans with democratized access to capital and returns that’s truly rooted in community. Community finance is working and SoLo is proof of that.”

Meanwhile, the Los Angeles–based company continues on its growth streak. Since its relaunch in 2020, SoLo has amassed nearly 100 employees and processed over 600,000 loans, some 45,000 of those in the last month. Over 80% of those loans were taken out by members from underserved zip codes. The number of loans per month has steadily grown over six months when the company processed around 30,000 loans, Williams said.

In addition, those 600,000 loans accounted for $300 million in transaction volume. Williams said the company is on pace to more than triple that transaction volume to over $1 billion by the first quarter of 2024.

“We have a strong network effect: for every loan funded, we attract five or six users,” Williams added. “We always wanted to be an alternative to payday loans, and the best part is we are finally making the impact we envisioned.”

SoLo members get a consumer deposit account, but coming down the pipeline the company will be releasing some new features, including access to debit cards, credit lines, credit cards, high-yield savings accounts and an auto lending account that will be launched later this year. It will enable members to upload capital into an account and set risk tolerance and the account will lend automatically.