Last month, when transportation startup Via raised $110 million at a $3.5 billion valuation, CEO Daniel Ramot said it planned to make acquisitions to grow its transportation technology stack. Now, a piece of that strategy is falling into place: today the company is announcing its acquisition of Citymapper, the London startup that produces a popular urban mapping app. Originally making a name for itself as an alternative to apps like Google Maps for consumers planning journeys in metropolitan areas using public transportation, Citymapper has around 50 million users globally.

Financial terms are not being disclosed. Via has confirmed it’s a mixture of cash and stock, while sources close to the deal tell TechCrunch that Citymapper investors are mostly not making their money back in the transaction and that it’s effectively a washout. (One publication has reported $100 million; we were told that it was “well below” this amount.)

It has been rumored for years that Citymapper was trying to find a buyer, with names like Google and Apple — which once name-checked the app as a must-have to use on its own hardware — once floated as possible acquirers. Things then went very quiet, until last month, when reports suddenly began to surface of the acquisition being announced today by Via.

Backers of the startup included Balderton, Index Ventures, Benchmark, DST and a number of high-profile individuals, who collectively put around $52 million into the startup, alongside a more recent U.K. crowdfunding raise of around $8 million (£6 million in local currency).

Citymapper currently covers 108 cities, mostly in the U.K. and Europe, but also in North America, Asia and elsewhere. The plan is to integrate Citymapper’s product (and data) into the Via platform, but also to keep it going as a standalone service for now, too. Citymapper employees, minus CEO/founder Azmat Yusuf, will be joining Via. Yusuf will be a transition advisor.

The sale of Citymapper underscores the challenges in the current market for startups that are running out of money, but also the challenges for Citymapper in particular, as well as those endemic to the transportation sector overall.

Citymapper made big waves when it first launched its urban movement planning app, which today includes not just public transit routes but also walking, cycling, scooters and taxis to help users get from A to B. That may sound like table stakes for a mapping app now, but it was fairy revolutionary when Citymapper first built and introduced this to the world in 2011. (Google, Apple, the likes of Uber and others were far behind where they are today as mapping apps.)

That led to the startup picking up a loyal following and catching the attention of some big-name investors. Its valuation in its $40 million Series B round back in 2016 (a millennium in tech!) was over $365 million, an even bigger-sounding sum back in those days.

But arguably Citymapper never really managed to capitalize on that momentum and early promise.

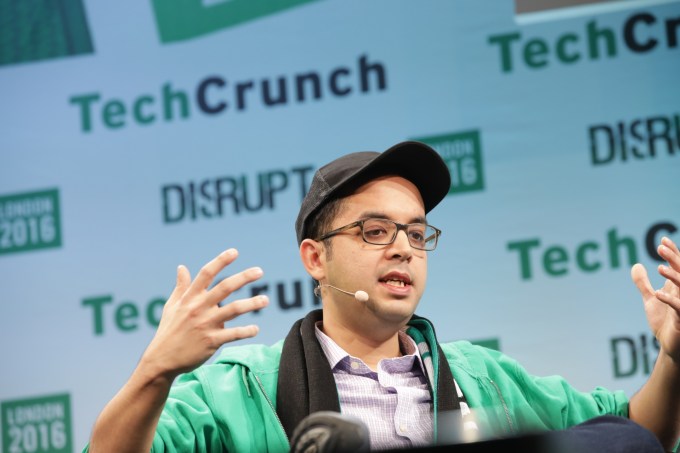

Founder Azmat Yusuf (pictured below, when we had him at Disrupt in London) had a strong focus on keeping a consistent, “excellent” user experience, as he told us at the time of the Series B. That was something he strictly vowed to adhere to over the concept of growth at any cost.

“The thing we like to do is really focus on quality and so we look at a city and say ‘can we do an excellent job?’” he said at the time, “If we manage to figure out how to do a great job then we’ll expand faster. And if we struggle with expanding we’ll slow down and make sure we do it well. So the number of cities is not the target. The target is basically how do we do a great job?”

That doggedness might have sounded refreshing at the time to some — it was playing out simultaneously as companies like Uber were in high-gear, growth-over-everything mode — but ultimately it also meant a very slow pace of change.

Eventually companies like Google caught up and overtook Citymapper on its key USPs.

The company did try things to generate more income over the years. It started but then ultimately mothballed its own hybrid transportation service. After years of a very advertising- and marketing-free experience, it introduced ads not so long ago. It also offers a paid “Club” tier these days to remove those ads, as well as Pass that includes the Club features plus a travel card.

But it’s unclear what kind of take-up these various products have had. And it also appeared to have struggled to hold on to talent amid all of this, with very mixed reviews on sites like Glassdoor, and some high profile executive exits, too. The downturn of people moving around cities and using public transport during Covid-19 also could not have helped, either.

According to its most recent accounts filed with Companies House, Citymapper posted a widening operating loss in the year that ended December 2021 of £8.1 million, compared to £7.3 million the year before on stagnant revenues. Meanwhile, that 50 million user number hasn’t been updated since 2021.

But Citymapper is not the only one that has had to reroute its future.

Via itself started as a transportation app (shuttles and small buses), but in more recent years, after buying Remix in 2021, it moved away from the high costs of running services and pivoted to focusing just on the technology that others are using.

It’s based out of New York and the agencies it works with include Jersey City, NJ; Arlington, VA; and Sarasota County, FL; as well as campus services for Harvard, Northwestern, and BASF. The idea is that Citymapper data can help feed that.

“Citymapper has a large usership around the world, so at that point, you have access to the data so you can understand where people are traveling, how they’re using the system, how they’re trying to use the system, what’s working, all of it in real time,” Ramot told TechCrunch. “And in retrospect, if they took a trip, how did that trip actually go? Was it on time? How many connections were made?” Ramot added that the Citymapper product could in turn also get a boost from Via, which might be able to help cities better communicate with public transit riders through Citymapper by sending updates, disruptions or changes to the system.

“If we have the data from Citymapper about where people are trying to go, we can better position all the vehicles in real time to make them more likely to capture that demand,” he added.

Additional reporting Romain Dillet