In the wake of the pandemic, more and more companies are relying on independent contractors to sustain and grow their businesses — and more people are turning to freelancing. According to a Fiverr poll, 45% of businesses are using more freelancers than before the pandemic. And Fiverr rival Upwork found that 39% of the U.S. workforce, or 60 million Americans, performed freelance work in the past year — a three-percentage-point increase from the year prior.

One of the major challenges for companies drawing on the gig economy is managing payroll and benefits. In fact, one survey found that three out of every five gig workers lose earnings because of technical difficulties clocking in or out. Inspired to solve it, Anthony Mironov and Greg Franczyk founded Wingspan, a payroll platform aimed at firms employing mainly freelancers.

Mironov came from the finance world, having spent several years as a private equity analyst, associate and consultant. Franczyk is an engineer by trade, previously leading the Washington Post’s software engineering division and managing an engineering team at Google.

“Behind each independent contractor is an individual vendor, W9, 1099, e-signature, background check and a reconciliation process — a situation that ultimately blocks companies from working with contractors more,” Mironov told TechCrunch in an email interview. “Greg and I founded Wingspan in 2019 to create the system of record and payroll platform for independent contractors. The future of work is happening now, but actually supporting it requires a paradigm shift in how companies efficiently engage with independent contractors at scale.”

Plenty of contractor-focused payroll platforms exist, like Gusto, Deel and Payable. And of course incumbent payroll providers like Square offer their own solutions. So what does Wingspan bring to the table?

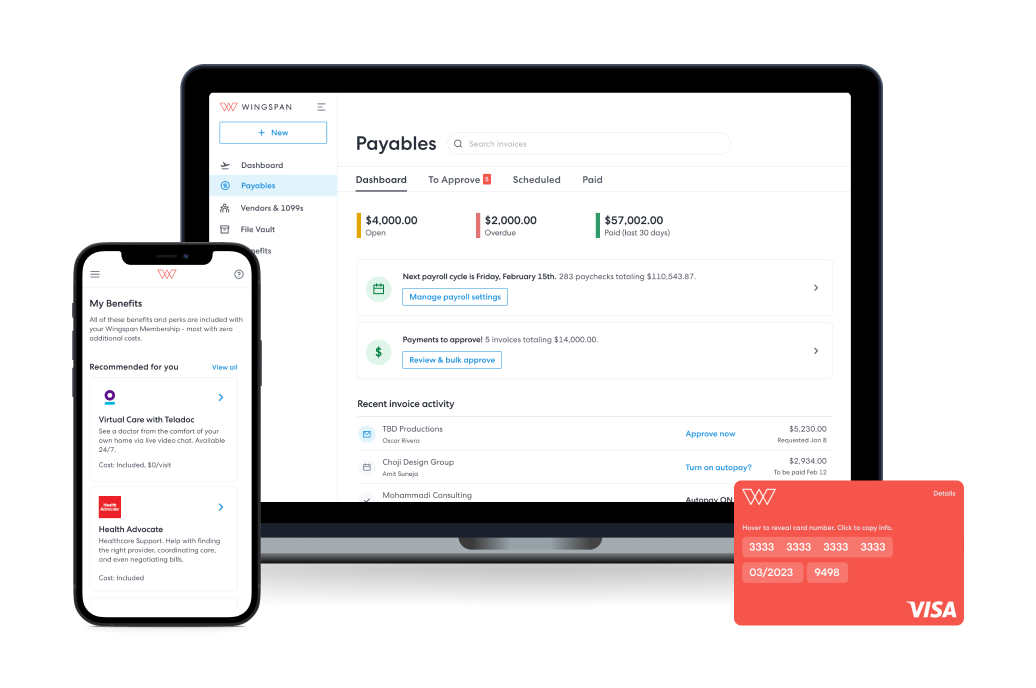

Mainly consolidation, according to Mironov. “Hundreds of companies do bits and pieces of what Wingspan does: for example, there are many ways to send payments,” he added. “We are [an] all-in-one platform linking payroll, benefits and onboarding for freelancers, so Wingspan replaces multiple categories of tools typically used by mid-market businesses.”

Image Credits: Wingspan

To this end, Wingspan provides onboarding and management tools that allow companies to invite contractors with just an email, perform background checks and make same-day payments. Contractors can add a bank account, W-9 and any necessary e-signed documents themselves.

On the backend, employers get automated workflows for generating and filing contractor 1099 tax forms that attempt to identify write-offs and estimate withholdings. They also have the option of offering contractors access to discounted health, vision, dental and life insurance through the platform, Mironov says.

Beyond basic automation, Wingspan uses AI and machine learning to streamline certain tasks. For example, on the end-user side, users can import their off-platform expenses and Wingspan will try automatically categorizing them, taking a best guess as to whether they’re business-related or not and compiling multiple transactions into one report.

“Contractor data is spread across multiple business systems across orgs and needs to be maintained and updated manually when a contractor’s status changes (e.g. when they leave, change their address, change their bank account) — creating significant administrative overhead. Wingspan solves this by acting as a system of record for contractor identities,” Mironov said. “Our company-contractor graph allows companies to pay contractors who already have a profile on the system much quicker while giving contractors a single home for their administrative and financial needs across all clients.”

Whether because of those differentiating features or because global HR tech VC investment continues to outperform the market (the first half of 2022 saw funding reach $9.4 billion), Wingspan is growing at a healthy clip — at least according to Mironov. The company claims to have more than 20,000 members on the platform and “hundreds” of enterprise clients, and it’s on track to surpass a billion in contractor payments by the end of the year.

Just this week, Wingspan closed a funding round — a $14 million Series A — led by Andreessen Horowitz (a16z) with participation from existing investors including Distributed Ventures, Long Journey Ventures, Ludlow Ventures and 186 Ventures. It brings the company’s total raised to $23.5 million, which Mironov says is being put toward expanding the Wingspan platform and team.

Wingspan plans to double its 20-person team by the end of the year.

“Our customer base is broad and diverse, and while venture-backed startups may be reducing their contractor spend, freelancers are a critical part of the overall workforce,” Mironov said, touting the robustness of his business. “With all the recent news [about bank failures], it’s also worth noting that Wingspan partners with many different financial institutions to provide its service. By partnering low in the fintech stack and selecting providers that are optimized for specific use cases, we can provide the fastest payments and best end-user experience while also having a natural set of built-in redundant solutions.”