French startup Roundtable has raised a $3.2 million (€3 million) funding round from a hundred business angels. That’s quite a large group of individual investors — but that’s because Roundtable runs an angel investment platform for European startups. Backed by eFounders, the company takes care of the administrative, legal and financial processes involved with startup investments.

Roundtable isn’t the first investment platform focused on startup investments. In particular, AngelList popularized the concept of group investments with AngelList Syndicates. Essentially, an angel investor brings an investment opportunity to the platform and other angels can follow the lead angel on a deal-by-deal basis.

AngelList isn’t the only company facilitating startup investment. For instance, in the U.K., Seedrs and Odin also manage fundraising deals for startups.

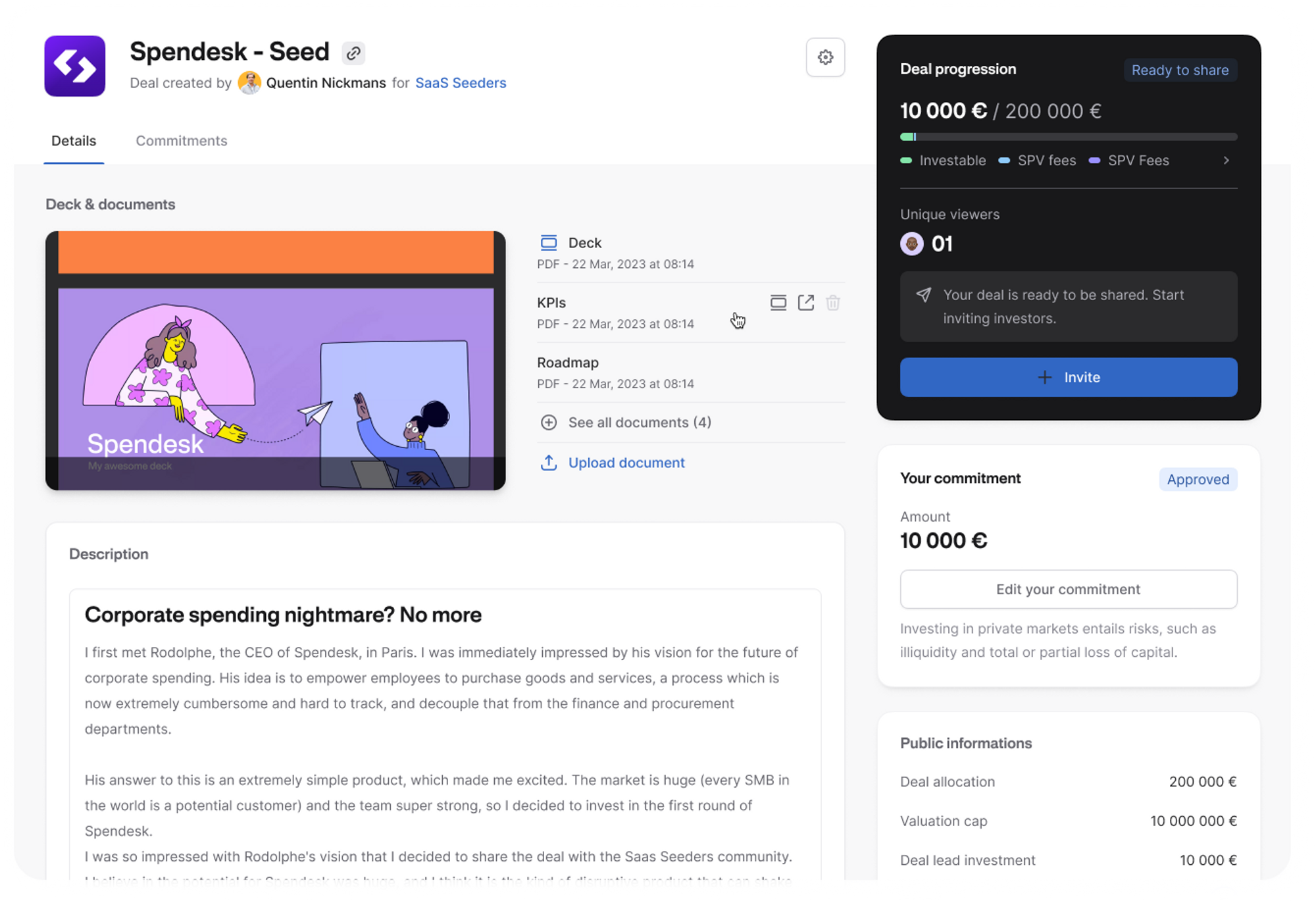

Roundtable specifically focuses on European startups and works particularly well for startups based in France, Belgium, the Netherlands and Luxembourg. When investors want to buy shares in a startup, Roundtable sets up a special purpose vehicle (SPV) based in France or Luxembourg. The angel who is in charge of the SPV can decide to allocate some carried interest from other investors in the vehicle.

The platform currently charges 1% of the amount raised by the vehicle with a minimum of €5,000 and a maximum of €15,000. There are also some fees involved with secondary sales. So far, the company’s first few months have pretty good as Roundtable has already handled more than 100 deals. It represents €50 million in assets under administration.

Because of the social features of the platform, influential angels bring deals and leverage their networks to increase the amounts raised. Some of the most active angels on the platform include Roxanne Varza who created a community of female business angels, Pieter-Jan Bouten in the Belgian tech ecosystem, Christopher Zemina in the Germany/Austria region, Aircall co-founder Olivier Pailhes in Spain, Paul Lê, etc.

Many of these angels invested in Roundtable itself. And there has already been one exit for a Roundtable investment — Space tug startup Launcher was acquired by Vast (see TechCrunch’s coverage of the deal).

Overall, this isn’t the biggest funding round of the year. But I’m sure Roundtable will come up more and more in investment conversations going forward.

Image Credits: Roundtable