Whether it’s the coffee shop down the street, a mobile app on your phone, or software used at work, any long-term minded and customer-centric company is typically focused on:

- Acquisition: Attracting new customers

- Retention: Maintaining existing customer relationships and preventing churn

- Expansion: Deepening and broadening existing customer relationships through cross- and up-sell

Companies aspire to have direct, long-term, and recurring customer relationships with high retention and expansion because these characteristics lead to more predictable revenues and profits. Predictable businesses are more durable, easier to manage, and typically rewarded with higher valuations than unpredictable ones.

Predictable businesses are more durable, easier to manage, and typically rewarded with higher valuations than unpredictable ones.

Software companies tend to have relatively high customer retention and expansion compared to other business models. For software, two metrics are commonly used to measure retention and expansion:

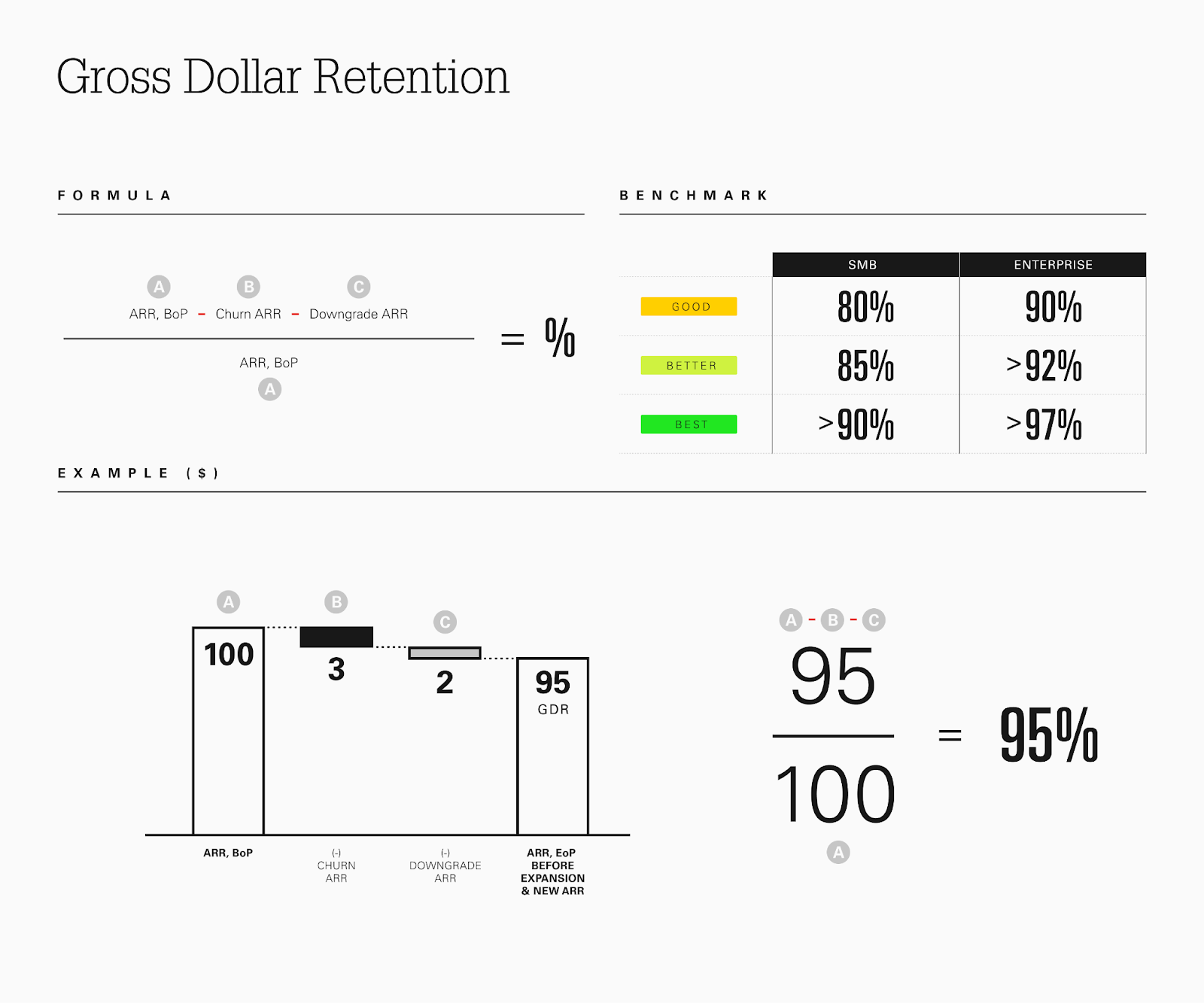

- Gross Dollar Retention (GDR)

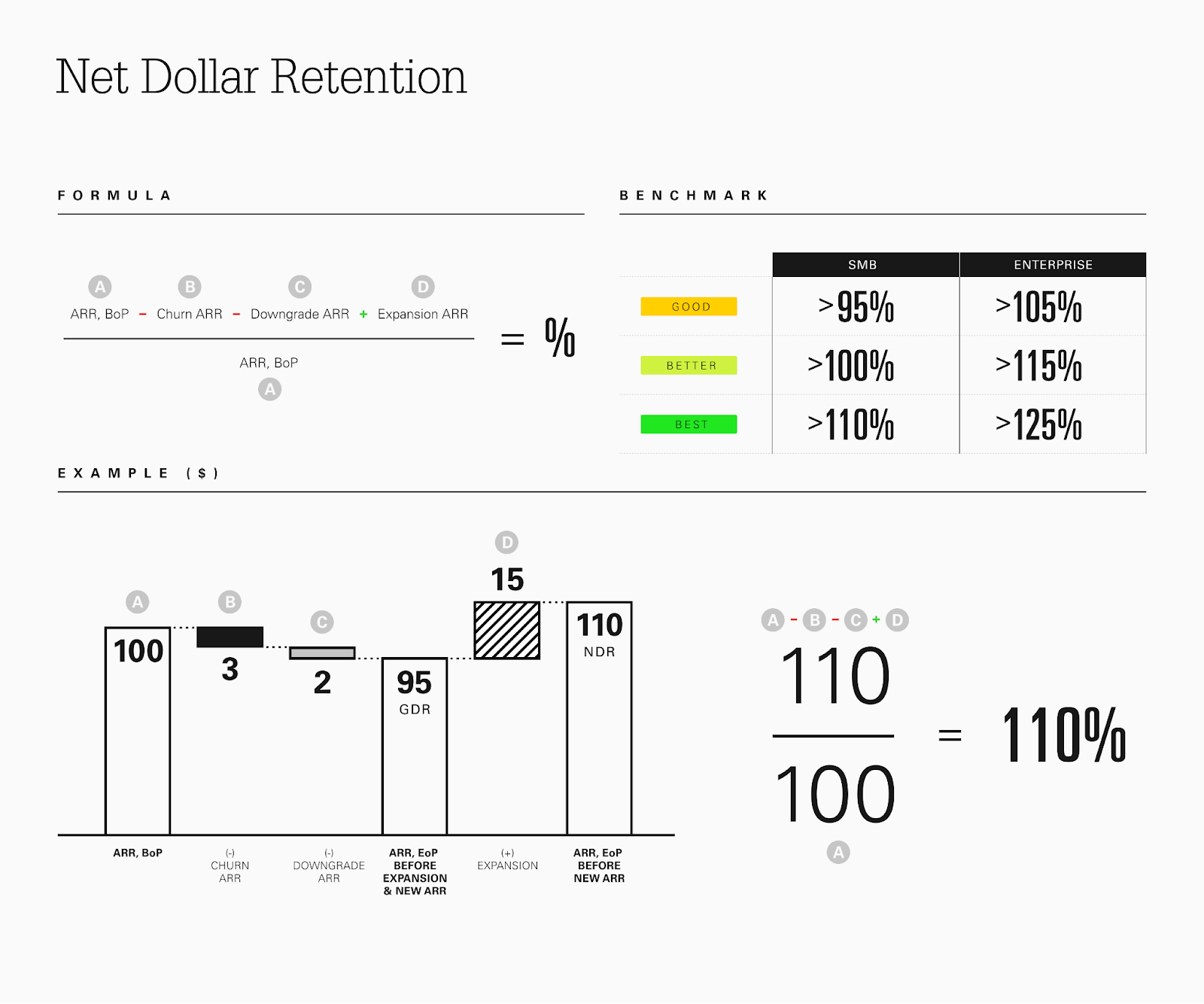

- Net Dollar Retention (NDR), sometimes referred to as Net Revenue Retention, or Dollar Based Net Revenue Retention.

GDR measures retention of an existing book of revenue before expansion, whereas NDR incorporates expansion:

Image Credits: Index Ventures

Image Credits: Index Ventures

GDR and NDR are well-known and widely used metrics, often discussed in the context of growth. Software companies with NDR over 100% grow revenues organically each year just by expanding their existing book of business before adding any new customers.

While NDR is not a required disclosure, as it is a non-GAAP metric, public software companies often provide visibility to investors through a combination of shareholder presentations, public filings, and earnings calls: