Mobile banking app Current, which began as a teen debit card controlled by parents, expanded to offer personal checking accounts earlier this year. Now the company says it has grown to host over 500,000 accounts on its service and has closed on $20 million in Series B funding to further its growth.

The round included new investors Wellington Management Company, Galaxy Digital EOS VC Fund, and CMFG Ventures — the venture capital arm of the CUNA Mutual Group, a mutual insurance company serving credit unions and their 120 million members. Returning investors included QED Investors, Expa, and Elizabeth Street Ventures.

The first version of Current, which debuted in 2017, was focused on giving parents a more modern way to dole out allowances and reward their kids for chores. But over time, the product became more like a real bank account for teens, culminating with the addition of routing and account numbers late last year. This allowed working teens to direct their paycheck to Current, as they could with a traditional bank.

The first version of Current, which debuted in 2017, was focused on giving parents a more modern way to dole out allowances and reward their kids for chores. But over time, the product became more like a real bank account for teens, culminating with the addition of routing and account numbers late last year. This allowed working teens to direct their paycheck to Current, as they could with a traditional bank.

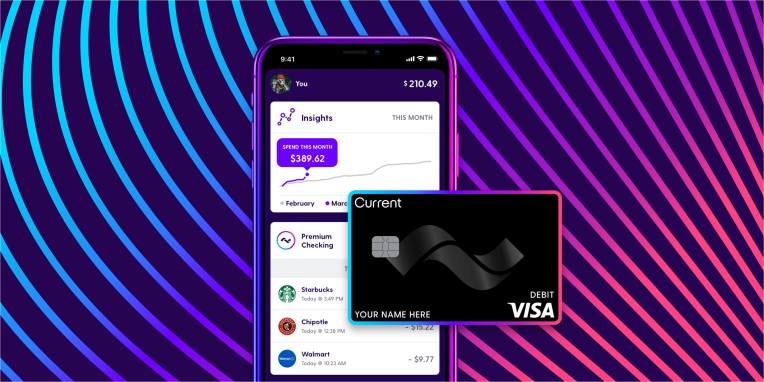

This year, Current launched personal checking using the same core technology powering its teen banking product. The product includes features like faster direct deposits, gas hold crediting, and merchant blocking without charging overdraft fees, hidden fees, or requiring minimum balances.

While the teen checking account users have an average of 15, the average age for the new personal checking account users is 27.

This puts Current in a more competitive market, where a number of banking apps are now targeting a younger, more mobile generation who begun to favor modern, feature-rich apps over brick-and-mortar banks. Among its rivals are apps like Step, Cleo, N26, Chime, Simple, Stash, and others.

Like many in this space, Current isn’t actually a bank — its banking services are provided by Choice Financial Group and Metropolitan Commercial Bank, which allows it to offer FDIC insurance up to $250,000. Instead, many of the banking apps focus instead on the feature set and user experience they can offer.

Both of Current’s products include a Visa co-branded debit card tied to the Current account. Along with the funding, Current and Visa are also announcing an expanded joint marketing partnership, which will help Current reach new customers.

“We believe everyone should have access to affordable financial services that improve the chances for a better life,” said Stuart Sopp, Current Founder and CEO. “We have made this a reality through rebuilding financial infrastructure with the Current Core. It allows us to build more products that offer new ways to interact with money. Our rapid growth to half a million accounts serves as a testament to the ways our products and cost savings are bringing better financial outcomes and we anticipate bringing those benefits to over 1,000,000 customers by mid-2020.”

To date, Current has raised $54 million in funding.