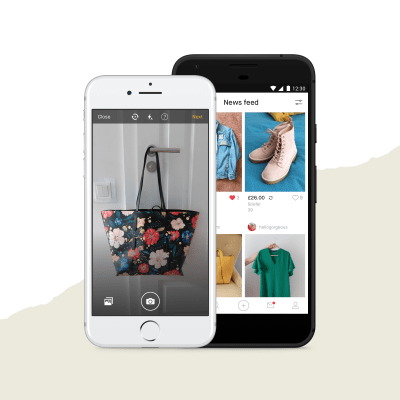

The market for second-hand clothes — the “circular economy” as it’s sometimes called — has been on the rise in the last several years, fuelled by economic crunches, a desire to make more responsible and less wasteful fashion choices, and a wave of digital platforms that are bringing the selling and buying of used clothes outside the charity shop. Today, one of the bigger companies in Europe working in the third of these areas is announcing a huge round of funding to double down on the trend.

Vinted, a site where consumers can sell and buy second-hand fashion, has raised €128 million (around $140.9 million) in a round that is being led by Lightspeed Venture Partners, with previous backers Sprints Capital, Insight Venture Partners, Accel and Burda Principal Investments also participating.

With this investment, the startup — founded and headquartered out of Vilnius, Lithuania — has passed a valuation of $1 billion (it is not specifying an exact amount), making it one of the biggest startups to come out of the country (but not the Baltics’ first unicorn… Estonian Uber competitor Bolt, formerly known as Taxify, is also valued at over $1 billion.)

The company is going to use the money to continue expanding in Europe, and building out more features on its platform to improve the buying and selling process, while sticking to its goal of providing a platform for consumers to list and buy used fashion.

“We want to make sure we don’t have new products,” CEO Thomas Plantenga said in an interview earlier. “All our sellers are regular people.” Some 75% of Vinted’s customers have never bought or sold second hand clothes in their lives before coming to the platform, he added. “The stigma is no longer there.”

Vinted’s growth comes on the heels of a remarkable turnaround for the startup. Founded in 2008 by Milda Mitkute and Justas Janauskas as a way to help Mitkute clear out here wardrobe before a house move, the company expanded fast, but at a price: by 2016, it was close to running out of money and business had slowed down to a crawl. Investors brought in Plantenga to turn it around.

“We changed the business model in 2016 to make the costs as low as possible for users to list clothes,” Pantenga said today. “That produced a dramatic change in our growth trajectory.”

The company, more specifically, went through some drastic changes. First, it clawed back a lot of its pricey international expansion strategy (and along with that a lot of the costs associated with it); and second, it removed all listing fees to encourage more people to list. Now, Vinted charges a 5% commission only if you conduct transactions on Vinted itself, bundling in buyer protection and shipping to sweeten the deal. (You can still post, sell and buy for free if you pay offline but you don’t get those perks.)

The turnaround worked, and the company bounced back, and two years later, in 2018, it went on to raise €50 million. Today, Vinted has some 180 million products live on its platform, 25 million registered users in 12 markets in Europe (but not the US) and 300 employees. It expects to sell €1.3 billion in clothes in 2019, has seen sales grow 4x in the last 17 months.

From fast fashion to fashion that lasts

Vinted’s rise has matched a wider trend in the region.

Europe is the home to some of the world’s biggest “fast fashion” businesses: companies like H&M, Zara and Primark have built huge brands around making quick copies of the hottest styles off the fashion presses, and selling them for prices that will not break the bank (or at least, no more than you might have previously paid to buy a pair of average jeans on the discount rack of a Gap).

But it turns out that it’s also home to a very thriving market in second-hand clothes. One estimate has it that two out of every three Europeans has bought a second-hand good, and 6 out of 10 have sold their belongings using platforms dedicated to second-hand trade.

Even as the company continues to hold back on expanding into the US — perhaps burned a little too much by its previous efforts there; or simply aware of the wide competition from the likes of Ebay, OfferUp, Letgo, Poshmark, and many more — Vinted’s growth in Europe has caught the eye of investors in the that market.

“At Lightspeed, we look for outlier management teams building generational companies. We’ve been impressed by the team’s ability to build an incredible product and value proposition for their community, and adapt and expand their business along the way,” said Brad Twohig, a partner at Lightspeed. “Vinted is defining its market and has built a global brand in C2C commerce and communities. We’re proud to partner with Vinted and leverage our global platform and resources to help them continue to build on their success and achieve their goals.”

While charity shops have traditionally dominated this market, sites like eBay, followed by a secondary wave of platforms like Vinted and another competitor in this space, Depop, have made selling and buying items into an established, low-barrier business.

All the same, given that extending the life of one’s goods feeds into a do-good ethos, it’s noticeable to me that Vinted hasn’t quite replaced the Salvation Army: there is virtually no way to sell on Vinted and give the proceeds to charity, if you so choose.

It appears that this might be something Vinted will try to address in the future.

“We are looking at making fashion circular for our users so that clothing that they bought doesn’t go to waste,” Plantenga said. “[Giving proceeds to charity] is super interesting and we should explore it as part of our growth story. To be honest, those things have been in the background and not developed because we’ve just been trying to keep up with everything, but the idea fits into our culture.”

E-commerce — in particular startups nipping at the heels of bigger players like Amazon and eBay by focusing on specific areas of the market that aren’t as well served by them — has had a bumper day in Europe, after brick-and-mortar marketplace Trouva earlier today also raised a sizeable round.