Samsung, which once led the smartphone market in India, slid to the third position in the quarter that ended in December even as the South Korean giant continues to make major bets on the rare handset market that is still growing.

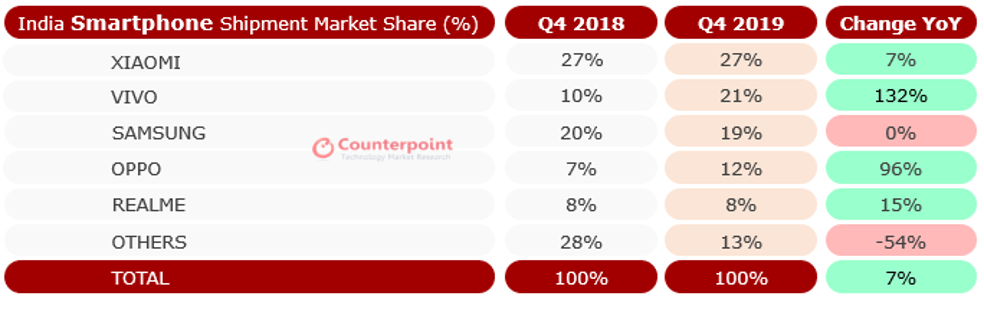

According to research firm Counterpoint, Chinese firm Vivo surpassed Samsung to become the second biggest smartphone vendor in India in Q4 2019. Xiaomi, with command over 27% of the market, maintained its top spot in the nation for the 10th consecutive quarter.

Vivo’s annual smartphone shipment grew 76% in 2019. The Chinese firm’s aggressive positioning of budget S series of smartphones — priced between $100 to $150 (the sweet spot in India) — in the brick and mortar market and acceptance of e-commerce sales helped it beat Samsung, said Counterpoint analysts. Vivo’s market share jumped 132% between Q4 of 2018 and Q4 of 2019, according to the research firm.

Realme, which spun out of Chinese smartphone maker Oppo, claimed the fifth spot. Oppo assumed the fourth position.

Realme has taken the Indian market by a storm. The two-year-old firm has replicated Xiaomi’s playbook in the country and so far focused on selling aggressively low-cost Android smartphones online.

The report, released late Friday (local time), also states that India, with 158 million smartphone shipments in 2019, took over the U.S. in annual smartphone shipment for the first time.

India, which was already the world’s second largest smartphone market for total handset install base, is now also the second largest market for annual shipment of smartphones.

Tarun Pathak, a senior analyst at Counterpoint, told TechCrunch that about 150 million to 155 million smartphone units were shipped in the U.S. in 2019.

More to follow…