If you were hoping for Q3 SaaS IPOs, here’s some good news

The domestic stock market is advancing today on the back of some better-than-anticipated economic recovery data in the United States. While retail spending is still lower compared to the year-ago period, gains in May from April were better than anticipated.

The American stock market, ready to trade higher on any scrap of good news — even news predicated on economic weakness and the need for continued intervention — shot north, with the tech-heavy Nasdaq Composite index rising 2.3% to 9,947.5 and the SaaS-focused BVP Nasdaq Emerging Cloud Index (EMCLOUD) rising 1.6% to 1,719.2.

From Bessemer, a venture capital firm that invests in cloud startups, here’s some data on today’s SaaS market:

- Median enterprise value/annualized revenue multiple for public SaaS/cloud companies: 12.6x

- Median forward enterprise value/annualized revenue multiple for public SaaS/cloud companies: 10.5x

- Median “efficiency” (revenue growth plus FCF Margin): 37.8%

- Median revenue growth: 31%

- Media gross margin: 73.6%

We’re marking this moment in time, just days after the Nasdaq Composite index crossed the 10,000 point mark, as it’s a useful yardstick for us to use in the future. Today, the above median results were enough to push EMCLOUD back to within a fraction of a point of its all-time highs.

What surprised me in this data is that the resulting revenue multiples haven’t gone completely bonkers; I expected more extreme figures going into preparing this post.

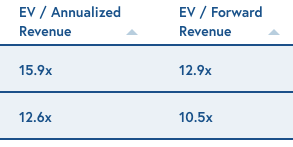

In fairness, by looking at median results instead of average results, we’re skewing the multiples a bit. Here’s the same data, with average results on top and the previously mentioned medians down below:

Image Credits: BVP