A big problem for companies these days is finding ways to connect to various data sources to their data repositories, and Fivetran is a startup with a solution to solve that very problem. No surprise then that even during a pandemic, the company announced today that it has raised $100 million Series C on a $1.2 billion valuation.

The company didn’t mess around with top flight firms Andreessen Horowitz and General Catalyst leading the investment with participation from existing investors CEAS Investments and Matrix Partners. Today’s money brings the total raised so far to $163 million, according to the company.

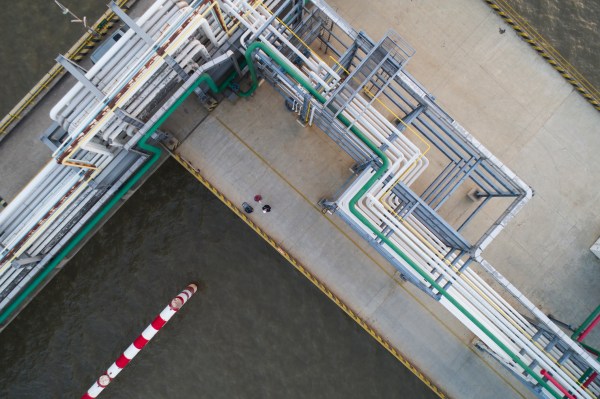

Martin Cassado from a16z described the company succinctly in a blog post he wrote after its $44 million Series B in September 2019, which his firm also participated in. “Fivetran is a SaaS service that connects to the critical data sources in an organization, pulls and processes all the data, and then dumps it into a warehouse (e.g., Snowflake, BigQuery or RedShift) for SQL access and further transformations, if needed. If data is the new oil, then Fivetran is the pipes that get it from the source to the refinery,” he wrote.

Writing in a blog post today announcing the new funding, CEO George Fraser added that in spite of current conditions, the company has continued to add customers. “Despite recent economic uncertainty, Fivetran has continued to grow rapidly as customers see the opportunity to reduce their total cost of ownership by adopting our product in place of highly customized, in-house ETL pipelines that require constant maintenance,” he wrote.

In fact, the company reports 75% customer growth over the prior 12 months. It now has over 1100 customers, which is a pretty good benchmark for a Series C company. Customers include Databricks, DocuSign, Forever 21, Square, Udacity and Urban Outfitters, crossing a variety of verticals.

Fivetran hopes to continue to build new data connectors as it expands the reach of its product and to push into new markets, even in the midst of today’s economic climate. With $100 million in the bank, it should have enough runway to ride this out, while expanding where it makes sense.