Meet Point, a new challenger bank in the U.S. that has been available as a private beta for the past year. Today, the company is launching a major new version of its service and opening its doors to everyone. But you’ll have to get an invite to get in at first.

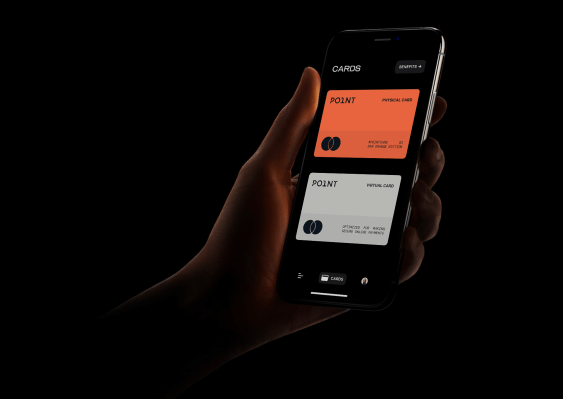

Point is a consumer banking app combined with a debit card. The company wants to reproduce the experience of credit cards but with debit cards thanks to rewards and a point-based system. There’s no credit check when you sign up.

The startup raised a $10.5 million Series A funding round led by Valar Ventures with Y Combinator, Kindred Ventures, Finventure Studio and business angels also participating. Valar Ventures has backed several high-profile fintech startups, such as N26, TransferWise and Stash.

As a user, you get many features you’d expect from a challenger bank. The debit card is tightly integrated with the app, which means that you can receive notifications every time you make a transaction and manage your card from the app. You don’t pay any foreign transaction fees for international transactions — the company uses Mastercard’s exchange rate for those transactions.

In addition to your physical Point card, you can access a virtual card from the app. Point has partnered with Evolve Bank & Trust for the banking infrastructure, an FDIC-insured bank.

When it comes to points, every transaction lets you earn points. For each $0.01 spent, you get one point. You get 2X points on groceries and dining and 5X points on subscriptions, such as Spotify and Netflix. It then works like a cashback system. You can redeem points for dollars and they’ll appear on your checking account.

The company uses Plaid to link your Point account with a third-party bank account. You can then move money from your existing account to your Point account. You can also top up your account with payment apps, such as Venmo, Cash App and PayPal.

Points’ biggest competitor is probably Chime, the challenger bank that has attracted 8 million customers. Chime doesn’t currently offer rewards. Let’s see if Point can convince customers who have yet to try out a challenger bank that Point is a better option.

Image Credits: Point