Meniga, the London fintech that provides digital banking technology to leading banks, has closed €10 million in additional funding.

The round is led by Velocity Capital and Frumtak Ventures. Also participating are Industrifonden, the U.K. Government’s Future Fund and existing customers UniCredit, Swedbank, Groupe BPCE and Íslandsbanki.

Meniga says the funding will be used for continued investment in R&D, and in particular further development of green banking products — building on its carbon spending insights product. In addition, the fintech will bolster its sales and service teams.

Headquartered in London but with additional offices in Reykjavik, Stockholm, Warsaw, Singapore and Barcelona, Meniga’s digital banking solutions help banks (and other fintechs) use personal finance data to innovate in their online and mobile offerings.

Its various products include a software layer that bridges the gap between a bank’s legacy tech infrastructure and a modern API, making it easier to build consumer-friendly digital banking experiences. The product suite spans data aggregation technologies, personal and business finance management solutions, cash-back rewards and transaction-based carbon insights.

Meniga tells TechCrunch it has experienced a significant increase in the demand for its digital banking products and services over the past year. This has seen the fintech launch a total of 18 digital banking solutions across 17 countries.

Image Credits: Meniga

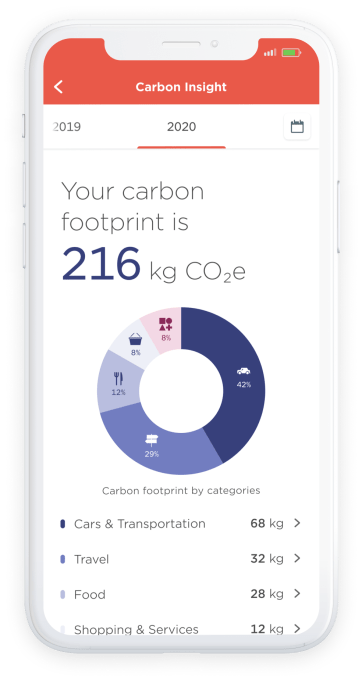

Helping fuel that demand is the need for banks to attract and retain a generation of customers that increasingly care about sustainability and the need to tackle climate change. Enter Meniga’s green banking solution: Dubbed “Carbon Insight,” it leverages personal finance data so that mobile banking customers can track and, in theory, reduce their carbon footprint.

Specifically, it lets users track their estimated carbon footprint for a given time period (which can be broken down into specific spending categories); track the estimated carbon footprint of individual transactions; and compare their overall carbon footprint and the carbon footprint of spending categories with that of other users.

Last month, Íslandsbanki became the first Nordic bank to implement Meniga’s Carbon Insight solution into its own digital banking offering.