When news broke that former U.S. President Donald Trump had conceived of a media and technology company and intended to take it public via a blank-check company, you would have been forgiven if you immediately began to wonder how quickly you could short the stock.

Pick a reason: Right-leaning social networks have largely flopped; the company appeared to be severely underfunded given the scope of its goals and the wealth of its rivals; the fact that there was no product available to use, let alone historical revenue to model forward. There are other reasons for skepticism, but those are my favorite.

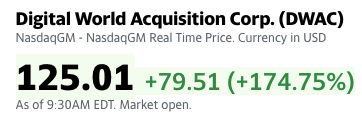

And yet! Shares of the SPAC in question, Digital World Acquisition Corp, shot higher on the news. And it is repeating the feat this morning:

Recall that DWAC is the Class A share ticker symbol of Digital World Acquisition Corp, while DWACU is the same equity, but with half a warrant attached. The latter shares are up less, which is a bit odd.

Regardless, DWAC now sports a market cap of around $4.7 billion, per Yahoo Finance. That means that Digital World — aka Trump Media and Technology Group (TMTG) — is something akin to the newest unicorn to come out of the land of media and tech. Sure, it’s a public price, but because the company that will merge with Digital World is so nascent as to be risible: Fuck it, let’s call it a startup.

None of this makes sense. Even by the standards of 2021 and the SPAC era, this is all very stupid.

The only thing that TMTG has that makes it anything other than hot air attached to tissue-thin market statistics — we’d like to thank the company’s presentation for reminding us that podcasts are rising in popularity, a truly mind-bending insight — is Trump’s name. Recall that TMTG intends on using SPAC money to fund its operations, not Trump cash; it doesn’t even really have the financial backing of the man whose name is atop its business. You know, the supposed billionaire.

Perhaps the fact that the company is so silly should have tipped us off to it becoming a memestock, or stonk. Why? Because only the wackiest companies seem to make the cut. Physical retail is falling amid rising digital delivery of gaming goods? Let’s send GameStop to the moon. No one is renting cars? Let’s pile into Hertz stock. That sort of thing.

So, almost, of course DWAC is going vertical. Why not?! This stock shooting higher is at once utterly hilarious and a grim indictment of efficient market theory. Nothing makes a stonk better as a meme than it making little to no sense as a business. Thus, TMTG is up a kajillion percent, which makes sense precisely in how little sense it makes.

Normally I’d just go to bed at this point, but it turns out I have a lot of work to do so, we’ll leave this here for now. Good luck to everyone trading today.