Back when most commerce took place on the local high street, shoppers who exchanged personally identifiable information with merchants received something in return.

Shops kept track of customers’ hat, shoe and dress sizes, along with their birthdays, anniversaries and personal preferences. In return, buyers got a first look at new products and service that anticipated their wants — personalized shopping.

For most of the internet era, that work was performed with tools like browser cookies and tracking pixels, but consumer desire for greater privacy (and increased regulation) is forcing online marketers to rethink basic practices.

What if instead of surreptitiously tracking our behavior, they just asked us for relevant details?

Full TechCrunch+ articles are only available to members.

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription.

“Think of the kind of things you’d tell a store associate helping you find the right gifts to purchase for your family,” says Ben Parr, president and co-founder of Octane AI. “That’s zero-party data.”

In a highly detailed post with multiple examples, he shares methods for collecting zero-party data that will engage customers and drive higher conversions.

It’s not just e-commerce: New restrictions on data sharing and collection will raise customer acquisition costs for everything from auto sales to real estate. If your startup is formulating a zero-party data strategy, please read.

On Wednesday, November 17 at 3 p.m. PST/6 p.m. EST, I’ll interview Ben Parr on Twitter Spaces about zero-party marketing best practices. To get a reminder, please follow @techcrunch on Twitter.

Have a great weekend,

Walter Thompson

Senior Editor, TechCrunch+

@yourprotagonist

Demand Curve: How Zapier acquires customers via its homepage

Image Credits: zoff photo (opens in a new window) / Getty Images

Your homepage is your most valuable asset when it comes to explaining what you do and the value you provide.

At its root, it’s an advanced exercise in storytelling, but many startups completely overthink it, which is why studying how the competition presents itself will help you save time and money on testing and optimization.

As an example, Demand Curve’s Joey Noble tears down automation service Zapier’s homepage, delving into the copywriting and conversion tactics that have helped the platform gain millions of users worldwide.

Airbnb CEO Brian Chesky discusses the future of work and the one thing he’d do over

Image Credits: Waldo Swiegers/Bloomberg / Getty Images

In an expansive interview, Airbnb CEO Brian Chesky and TechCrunch Managing Editor Jordan Crook looked back at how the travel company has adapted since the beginning of the pandemic.

Their chat covered topics as far afield as Airbnb’s “work anywhere” policy, how it’s addressing liability issues for hosts and his biggest regret from the COVID-19 era:

I overrode the host cancellation policy and refunded more than a billion dollars of guest bookings. I think it was the right thing to do. But I did it unilaterally, without consulting the hosts. They got really pissed off and it broke some trust with some of our host community.

Debt-as-a-service provider Sivo wants to power the next generation of lending startups

Image Credits: zakokor (opens in a new window) / Getty Images

Raising debt is never easy for startups, and for fintechs with a business model that revolves around lending, raising a line of credit from banks or lending institutions can take several months.

Offering “debt as a service,” Sivo aims to rectify this problem through its platform, which requires few agreements and fees, and makes raising debt “as easy as plugging into an API,” reported Ryan Lawler.

“Early returns have been positive: In just about three months since launch, Sivo has received about $4 billion in demand and actually signed $1.5 billion in term sheets from originators who wish to leverage its debt-as-a-service offering,” he writes.

“And, according to founder and CEO Kate Hiscox, the company is in the process of onboarding 600 originators who are hoping to tap into its programmatic debt lines.”

As valuations soar and IPOs accelerate, the public is taking on more startup risk

Image Credits: Nigel Sussman (opens in a new window)

Investing in companies that have astronomical valuations based on expected growth can work out really well. But when the gulf between expectation and reality becomes too great, markets can crash.

According to Alex Wilhelm, today’s IPO market and valuations are based on real growth, but investors should still remain wary.

“The public is increasingly able to invest in higher-risk tech companies, and as multiples rise, the amount of air that tech valuations sit upon is expanding,” he writes.

“The public is now at risk.”

Sweetgreen’s IPO pricing guidance illuminates valuation range for tech-enabled companies

Image Credits: Scott Olson (opens in a new window) / Getty Images

This week, salad chain Sweetgreen set an IPO range of $23 to $25 per share, giving it a multiple of about 8.2x and a valuation between between $2.5 billion and $2.7 billion.

That’s a lot of lettuce, but the pricing shows how much tech-enabled DTC firms can flex, writes Alex Wilhelm, who compared Sweetgreen’s range to IPO pricing for Allbirds and Rent the Runway.

“Modern software multiples these are not, but nor are they poor,” says Alex. “In fact, they are better than I would have guessed, more evidence that I am a mixture of Scrooge and the Grinch.”

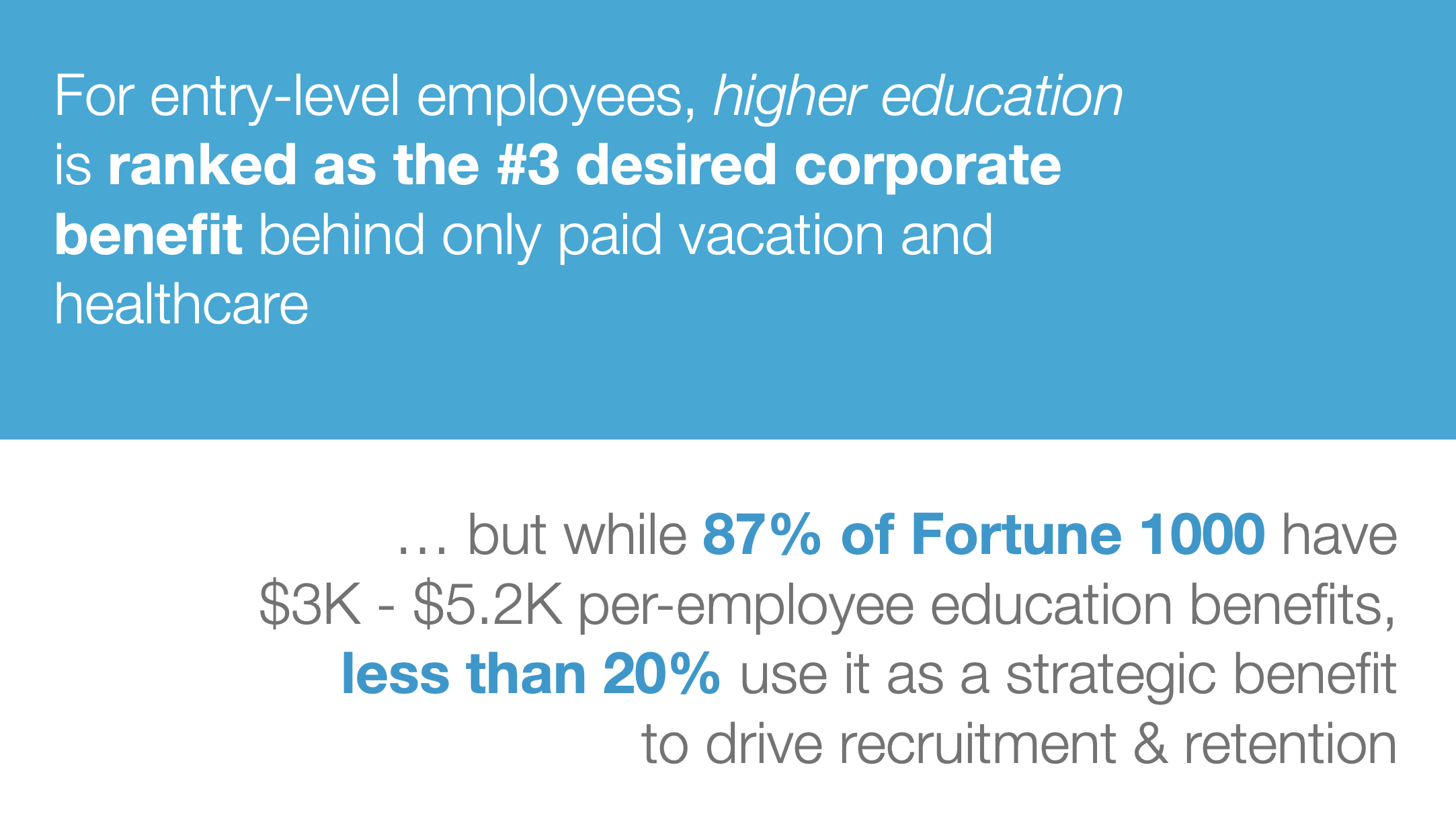

Aileen Lee and Rachel Carlson walk through Guild Education’s early pitch deck

Image Credits: Guild Education

For a recent episode of TechCrunch Live, Managing Editor Jordan Crook spoke to Guild Education CEO Rachel Carlson, co-founder Brittany Stich, and Aileen Lee, founder and managing partner of Cowboy Ventures, about the education upskilling platform’s origins and growth arc.

Cowboy Ventures led a $2 million seed round in 2015 while the founders were just starting their entrepreneurial journey.

“[We felt like we had to] show up and be a founding team,” said Carlson.

“We tried to fake it a little bit. We had this great intellectual first meeting, and at the next one, I felt like I had to show up and show her that I made a business. I was a little less authentic.”

How to take advantage of distributed work

Image Credits: Feodora Chiosea / Getty Images

For several years, I’ve earned a living sitting at a desk in my living room. Each day, I get up, brew some coffee, and go to work.

“‘Remote’ is fundamentally disadvantaged,” said Phil Libin, founder and CEO of startup studio All Turtles and mmhmm at TechCrunch Disrupt. “We’re not remote, we’re distributed. We’re distributed intentionally in the same way that the internet is a distributed system.”

Managing Editor Eric Eldon interviewed Libin and Wendy Nice Barnes, chief people officer at Gitlab, to learn more about how to foster company culture, manage individuals and hire efficiently in a distributed workplace.

“It’s much easier now versus getting in my car, commuting to an office, having to check in and go through security — and then go sit in a room and be there for five or six hours,” said Barnes.

“Now, you have the flexibility and you’re intrigued and you’re going to learn faster through the interview process remotely.”

Expensify CEO David Barrett discusses going public and why expense management is a $1T opportunity

Image Credits: Expensify (opens in a new window)

Fintech reporter Ryan Lawler interviewed Expensify CEO David Barrett this week about the timing of the company’s IPO, and why they chose a traditional direct listing over a more trendy SPAC.

“We’re aiming to be the most pro-employee IPO ever. So even though it’s a traditional IPO, with the exception of a collection of insiders, all of our employees can trade up to 15% of their shares starting today. Normally, you can only get that kind of ‘day one’ liquidity if you did a direct listing.”

Barrett said getting liquidity for early shareholders was also a major consideration, as the company is already profitable.

“It really came down to — there’s no future where we don’t end up going public at some point. So then it’s no longer if we should go public, it’s really about when.”

Crypto volatility continues to flummox Wall Street

Image Credits: Nigel Sussman (opens in a new window)

The fact that Q3 earnings for Robinhood and Coinbase were both below expectation has Alex Wilhelm wondering whether Wall Street is underestimating just how volatile the crypto market is.

“The speed of the crypto economy as a whole may be simply too quick for public-market investors to fully grok,” he writes.

“And the exchanges aren’t even the swingiest of crypto-themed investments.”

Whether to sell your company is always going to be a huge decision for founders

Image Credits: temmuzcan / Getty Images

To better understand what goes through a founder’s mind when considering a sale, Ron Miller hosted a panel at TC Sessions: SaaS with:

- Jyoti Bansal, who sold his previous startup AppDynamics to Cisco for $3.7 billion.

- Monica Sarbu, who sold her startup Packetbeat to Elastic.

- Nick Mehta, who sold his email archiving startup LiveOffice to Symantec.

“It was four days of long board meetings and discussions and debates and fights and getting to the decision. So it wasn’t an easy decision,” said Bansal.

“Even though, at $3.7 billion, everyone thought it should probably be a no-brainer; it wasn’t.”