No-code continues to permeate the many layers of enterprise IT, where traditionally non-technical workers have had to rely on technical experts to get things done, and startups building these tools are raising a lot of money as they see a surge of business.

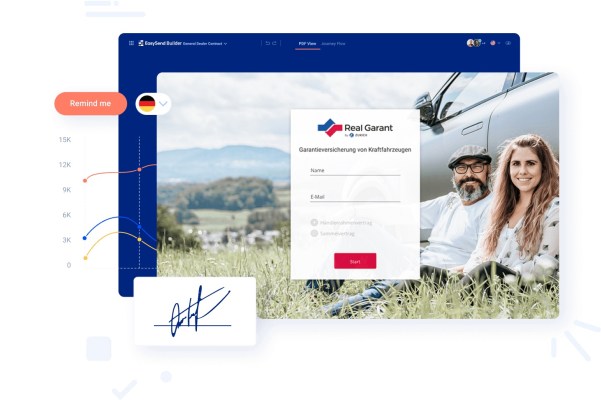

In the latest development, EasySend — a Tel Aviv startup that has built a platform for people to build customer interactions using drag-and-drop interfaces that do not require knowing any coding languages — has raised $55.5 million, a Series B that it will be using to continue building out more templates for its platform, hire more talent, and for business development.

Oak HC/FT is leading the round, with previous backers Vertex IL, Intel Capital, and Hanaco Venture also participating. EasySend said it separately also secured $5 million in venture debt from Silicon Valley Bank. Tal Daskal — the company’s CEO who co-founded the startup with COO Omer Shirazi, and CTO Eran Shirazi — would not disclose EasySend’s valuation but said it was five times bigger than its previous valuation.

For some context on that earlier number, PitchBook estimated that the startup was valued at $31.4 million in its last round, which would make this current valuation about $157 million, if that figure is accurate. In any case, the company has seen a big boost of business specifically out of the U.S., where revenues grew 10-fold.

EasySend has some 100 enterprise customers today, spanning areas like education, government, financial services and insurance. The latter two are particularly strong verticals for EasySend, with Cincinnati Insurance, NJM Insurance Group, PSCU, Sompo, and Petplan among its customers.

The startup has raised $71.5 million to date.

The opportunity in the market that EasySend has been targeting is that typically a lot of businesses produce and use paper-based forms to gather information about customers, and the people who often formulate those materials are not technical.

But as companies started to make a bigger and bigger shift towards virtual environments for customer service, they needed to move away from all of those paper-based processes. Daskal and the team saw an opportunity, he said, to “help them business digital customer journeys from scratch.” The company started out first in traditional banking, but quickly saw the same problem and potential solution in a lot of adjacent markets.

That development, meanwhile, has been also caught up in the currents of Covid-19: as more companies push for so-called “digital transformation” they have sped up the move away from paper-based and offline activity. That has also driven more business to EasySend, as one way for companies to help more of their staff engage with and use digital tools to get their work done.

And, as is often the case, the digital tools replacing the analogue ones are giving their users more functionality: one area where EasySend has built out tech and will be doing more is in the area of analytics, where users can track engagement around the interactions that they have built. That will soon become augmented with AI insights to provide more trending and forecasting data, Daskal told TechCrunch.

The plan is to continue investing not just in addressing more “customer journey” use cases, but to bring in more technology like RPA to make the process even more integrated with the rest of the business. Adding in newer services like ID verification, e-signatures, and other technology from third parties will potentially open the door to handling a more complex and wider array of interactions.

“Today, more than ever, companies need to create exceptional customer experiences to have a competitive edge. EasySend has transformed the way businesses deliver a digital experience to their customers in a quick and efficient way,” said Dan Petrozzo, Partner at Oak HC/FT, in a statemetn. “Our investment is a reflection of our belief that EasySend is in a unique position to lead enterprises into the digital era, and we see significant growth opportunities ahead.”