Even though consumer gaming constitutes a small fraction of its overall business, Microsoft’s announcement yesterday of its all-cash $69 billion deal to buy Activision Blizzard proves that the technology corporation takes the sector plenty seriously.

It is easy to think that Microsoft should have invested the money into other, perhaps more lucrative businesses in its portfolio. But with a market cap just over $2 trillion (a number so large it’s hard to wrap your head around), Microsoft has vast resources to invest in the most logical parts of its business.

Even if this $70 billion bet doesn’t pay out, Microsoft will come out on the other side fairly unscathed. That kind of financial power gives a company myriad options, even if it involves making one of the largest acquisitions in tech history.

Let’s not forget that this deal comes on the heels of Microsoft’s acquisition of speech-to-text company Nuance last spring for $20 billion. That deal that is stuck in regulatory limbo in the U.K., which begs the question: Given it size and scope, could regulators end up taking a close look at the Activision Blizzard deal, what could be perceived as a gaming market land grab?

Even if this $70 billion bet doesn’t pay out, Microsoft will come out on the other side fairly unscathed.

With that in mind, we’re examining this deal’s financial viability to see whether Microsoft might have been better off putting those resources into the enterprise/business side of the house, or if its resources are simply so vast that the company doesn’t have to consider the sort of tradeoffs most companies must make when it comes to an M&A of this magnitude.

Digging into the portfolio

Although Microsoft is reporting earnings next week, we can still see the breakdown of how the company makes the majority of its money from its most recent report, disclosed October 26, 2021. In that earnings digest, the Redmond, Washington-based software giant reported over $45 billion in revenue, with its Intelligent Cloud division accounting for $17 billion of the total, and its Productivity and Business Processes group good for $15 billion more.

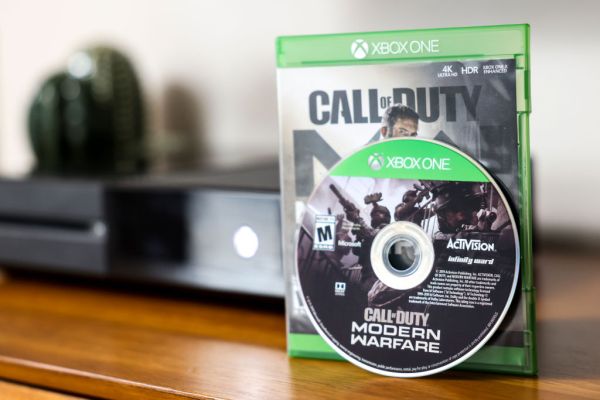

The consumer side of the house produced more than $13 billion in top line, but gaming was just a portion of that division’s results that includes certain Windows and Surface incomes, along with search and advertising.

In spite of the differential in scale between the company’s entertainment work and its enterprise income, Microsoft CEO Satya Nadella called out gaming in its earnings report call with analysts, praising its growth:

And in gaming, revenue increased 16% at 14% in constant currency, ahead of expectations. Better-than-expected console supply, and continued strong demand resulted in Xbox hardware revenue growth of 166% and 162% in constant currency. Xbox content and services revenue increased 2% and was relatively unchanged in constant currency against a strong prior-year comparable. Segment gross margin dollars increased 10% and 8% in constant currency. Gross margin percentage decreased roughly one point year over year, driven by sales mix shift to gaming hardware.

Clearly, the company sees gaming as an important growth driver. How does that fit into the recent deal announcement? Not merely in terms of the company stacking accretive gaming revenues, with Constellation Research analyst Holger Mueller viewing the transaction as a way to grow related incomes via Windows and Azure cloud services.