Four months after a seed round, Ascend is back with its first big boost to enable the company to expand its “buy now, pay later” commercial insurance tool that combines financing, collections and payables.

Today, the company announced $30 million in Series A funding along with $250 million in lending to finance insurance premium loans by Hudson Structured Capital Management (HSCM Bermuda).

The equity portion was led by Index Ventures and included new investors like Distributed Ventures and its anchor limited partner NFP, HSCM Bermuda, XYZ Ventures and a group of strategic angel investors. Existing investors First Round Capital, Susa Ventures and FirstMark Capital also participated.

The new financing follows a $5.5 million seed round announced last September to give the company $39 million in total equity funding raised to date.

When we first reported on Ascend, we learned that the company, founded by Andrew Wynn and Praveen Chekuri, had just launched its service and was already live in 20 states. Its technology revolves around payments APIs that automate end-to-end insurance payments. The company offers a buy now, pay later financing option for distribution of commissions and carrier payables.

Wynn said raising again so soon after the seed round was planned, but the company was aiming to attract more capital from a debt standpoint. The new equity will be deployed into growing the team, expanding into different markets within the insurtech vertical and building its go-to-market and product engineering.

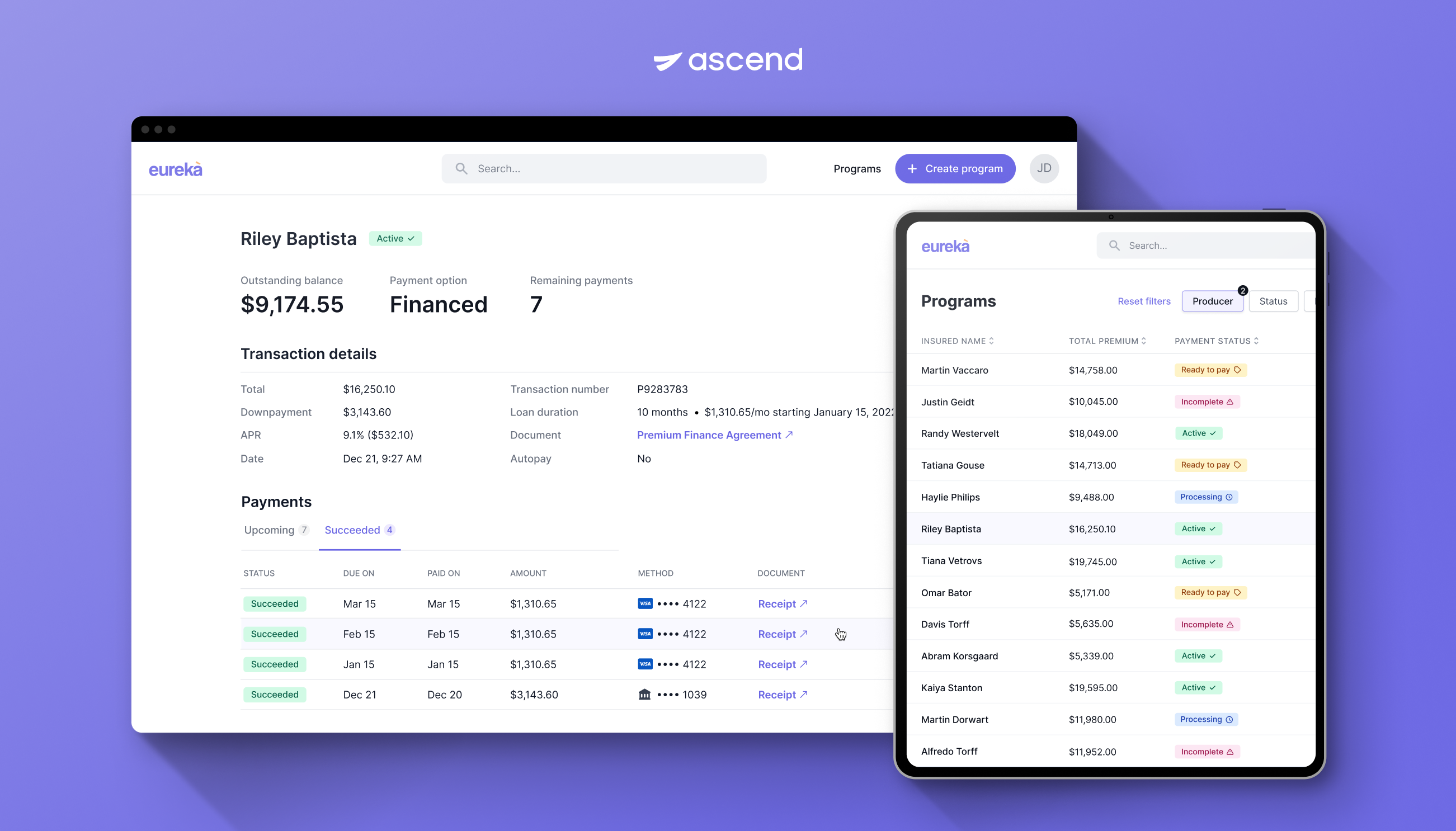

Ascend dashboard. Image Credits: Ascend

“The market responded so well to our product, so we wanted to secure financing for buy now, pay later to lend,” he added. “That prompted some conversations about debt, but also about equity.”

Much of the customer interest has come from traditional insurance agents and small independent insurance agents, which was actually a segment they were intentionally not going after, but ended up coming to them. Chekuri explained that independent agents noticed that Ascend was providing more of an experience and marketing tools to convert on policies.

The company signed its first customer last July, and Ascend is now in all 50 states and working with customers like Vouch, Cowbell, Newfront, Boost Insurance, NFP, LuckyTruck, Rogue Risk, Portal Insurance and Riskwell. Customers represent upwards of $50 billion in total premiums, Wynn said.

In addition, offering monthly flexible payments at the point of sale has resulted in customers seeing an increase in policy purchase conversion. For some that has meant customer adoption of financing went from less than 40%, before using Ascend, to 80% after.

“One-third of checkouts created by brokers and sent to customers convert to sale,” Wynn added. “And of those, 30% convert to a sale on the same day, so we are reducing the friction around buying and paying for it.”