Forecasting, also known as demand variability, has long been a hurdle for businesses reliant on the global supply chain. In a survey conducted long before the pandemic began (in 2015), large companies — those with revenues in the range of $500 to more than $1 billion — pegged variability as the top challenge that they faced. Predicting supply chain volatility has only grown more difficult as pandemic-related shocks, including elevated e-commerce volume, impact shipping and raw materials availability.

Vic Patil thinks the solution lies in a “mesh” — specifically what he calls a “supply mesh,” inspired by the way wireless mesh networks function. That’s the product Backbone, the startup Patil helped to co-found, is selling: a platform designed to enable companies to respond to supply chain disruptions by surfacing replacement options, including vendors.

Backbone today announced that it raised $14 million in seed funding from Nautilus Ventures, 12/12 Ventures, and individual investors to prove out its technology. The capital raised will be used to onboard new customers, expand into new markets and develop the company’s supply mesh technology as it accelerates growth globally, Patil told TechCrunch via email.

“[We’re] looking to expand Backbone’s … group of certified vendors who can work together to ensure businesses always have reliable vendors,” Patil added. “As evidenced by the last two years of the pandemic, legacy systems aren’t very good at predicting or modeling volatility and are even worse at reacting to volatility — they overcorrect and lead to the jams we see in logistics, manufacturing and more … Backbone is a fully configurable supply chain platform that lets operators spot and address breakdowns in real time, using a mesh network approach that helps companies weather volatility and scale.”

Building a supply chain backbone

Patil co-founded Backbone, which is based in San Francisco, alongside Rajesh Chandran in 2017. Chandran is an Oracle and NetSuite veteran who’s launched several AI startups, while Patil spent time as a software engineer at Intuit before moving to Heighten, a sales tech company. Patil stayed on at Heighten after it was acquired by LinkedIn in 2017.

Patil and Chandran became investors in several supply chain-dependent brands prior to starting Backbone, which is when they realized even small hiccups, like shipping delays, could be expensive to recover from. The motivation behind Backbone was to provide greater visibility into their personal investments, but it dawned on Patil and Chandran that the product might be scalable to other industries.

“Backbone … spans the fundamentally decentralized supply chain and creates a “virtualized” representation of it end to end … [to allow] better resilience to volatility by reducing reaction times to unexpected disruptions,” Patil said. “[U]sing its mesh model approach, [Backbone] helps companies embed resilience into their supply chain so that they’re better prepared to manage periods of volatility versus predict them. For instance, if a company received a bulk order that they don’t have enough supplies or ingredients necessary to fulfill, Backbone will quickly connect them with the appropriate suppliers so that they don’t lose out on the sale.”

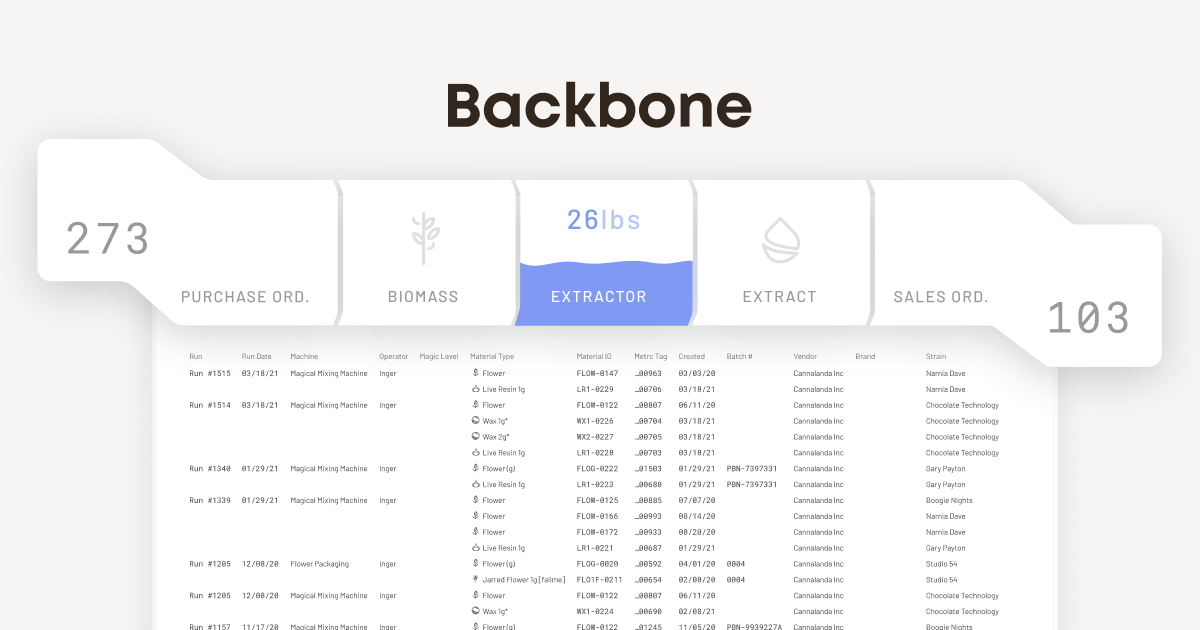

Backbone, which initially engaged with cannabis and hemp suppliers, tracks production compliance, yields and audit reporting data in one place. The platform translates the components of a company’s supply chain to a browser-based, visual dashboard, where it tries to calculate the costs associated with items to predict how profitable they’ll be, accounting for supply chain variability.

Image Credits: Backbone

Patil emphasizes that Backbone can recommend possible solutions to route around supply chain issues, like material shortages and truck stoppages, as they’re happening. He sees this as the platform’s key differentiator, along with Backbone’s ability to customize for regulated industries like pharma and agriculture.

“The tech allows the data decision-maker to act on potential supply chain breakdowns with confidence … That’s the big idea behind Backbone — a supply mesh, unlike a ‘chain,’ casts a much wider net for solutions,” Patil said. “Where traditionally if a single link in a chain breaks, the whole operation is stalled until that one link is repaired … with Backbone, there is no need to wait for this repair as companies can ‘route’ around breakdown confidently … It’s essentially helping growing companies keep up with unforeseen demand so that they don’t have to scramble and miss out on significant growth opportunities that their current infrastructure might not yet support.”

Potential customers

While they might not boast about “mesh chain” technology, a number of companies compete with Backbone in the growing supply chain management software space. For example, there’s 7Bridges, which offers tools to digitize and optimize supply chains. Project44 is a behemoth rival, having recently raised $202 million in a recent funding round led by Goldman Sachs and others.

Backbone is looking to establish a foothold with agriculture, hemp, cosmetics and pharmaceuticals customers to begin with — it’s planning to facilitate cannabis transactions between the U.S. and U.K. — before expanding out from there. Patil claims that the 65-person company has over 100 customers and is on track to triple revenue for the second time in two years.

“The pandemic underlined the importance of the Backbone technology and highlights the expected continued growth as supply chain issues continue due to [health crises], unexpected war, climate change and more,” Patil said. “The supply chain software industry is full of legacy products that rely on traditional technology. Backbone is changing the game with new tech that includes solutions to new problems and puts companies back in control of their supply chains.”