Longevity-focused startups have been proliferating in recent years as we become more focused on our health. However, it’s not just about apps to get you in the gym. Longevity startups can range from biotech-oriented disease prevention to organ regeneration. The Aging Analytics Agency estimates that global investments in longevity-focused startups hit more than $40 billion in 2021, and the market could grow to $600 billion by 2025, according to Bank of America.

Now investors like Apollo Health are raising large sums — such as their $180 million fund in November, while Maximon, Swiss longevity company builder, raised a €96 million fund, to name just two in Europe.

Now a new fund is coming out of the U.S. to join the fray.

New York-based Life Extension Ventures is a new $100 million fund saying it will focus on “longevity for people and planet”. In practice that will mean backing founders who are accelerating the science around longevity.

That includes areas such as people, animals, agriculture, food, energy and transportation, as well as AI, direct-to-consumer, web3, infrastructure-as-a-service, platforms and marketplaces.

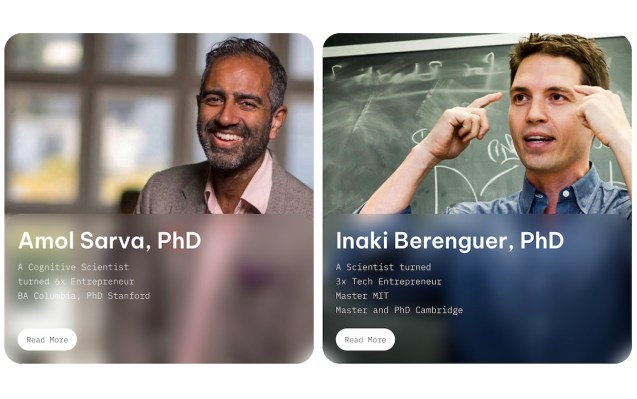

Luckily, the fund’s founders will know what they are talking about as the team has multiple science PhDs, successful startups and angel investing under their belts.

Life Extension’s LPs include founders and investors from other VCs, unicorn founders and large institutions.

The team includes Dr. Inaki Berenguer, the co-founder of Life Extension, who studied at MIT and Columbia, before founding Pixable (acquired by Singtel) and CoverWallet (acquired by Aon in 2020).

Co-founder Dr. Amol Sarva studied cognitive science at Stanford and Columbia, and taught entrepreneurship at Columbia. He is also gave WeWork a run for its money with flexible office unicorn Knotel, and also started Peek (acquired by SoftBank).

The pair have previously made angel investments in startups such as Galatea Bio, a DNA databank for genomic discovery; DeepCell the computer vision company that uses AI to create a database of cell morphology, which has raised $100 million; and Particle Health, which raised $40 million.

Over a call Sarva told me: “There was a clean tech 1.0, a clean tech 2.0, and something similar is happening in the biotech universe now. Software has now come to intersect with science in a new and different way and it makes the opportunity more like tech.”

Berenguer added: “We are going to focus on the software and data-driven companies in this category. Most of the entrepreneurs that we are going to back are not the typical biologist in a lab doing experiments. They are going to simulate experiments, they are going to analyze that data. They’re going to, for instance, commercialize using API’s within marketplaces. So it’s very similar to what happened with the internet 20 years ago.”

Sarva went on: “The future of humanity depends certainly on what we do for people, but also for the planet we live on. It’s the same. It’s the same technologies and science. That’s having an impact. It’s biology and chemistry. It’s having an impact on people on agriculture, food, even energy production. This cutting edge science is really the key to it all. And so we decided, let’s go find where science and software intersect. That’s going to have a huge impact.”

Headquartered in New York, the fund will also have team members in Madrid, London and San Francisco.