There’s no better way to show you have high conviction in yourself as an investor than being the biggest LP in your $101 million fund, right?

Especially if you name your firm Conviction, as Sarah Guo did after leaving Greylock following a decade of investing for the well-known venture group. Last week, she announced that she raised $101 million for her new fund to back companies that are building artificial intelligence and what she describes as software 3.0.

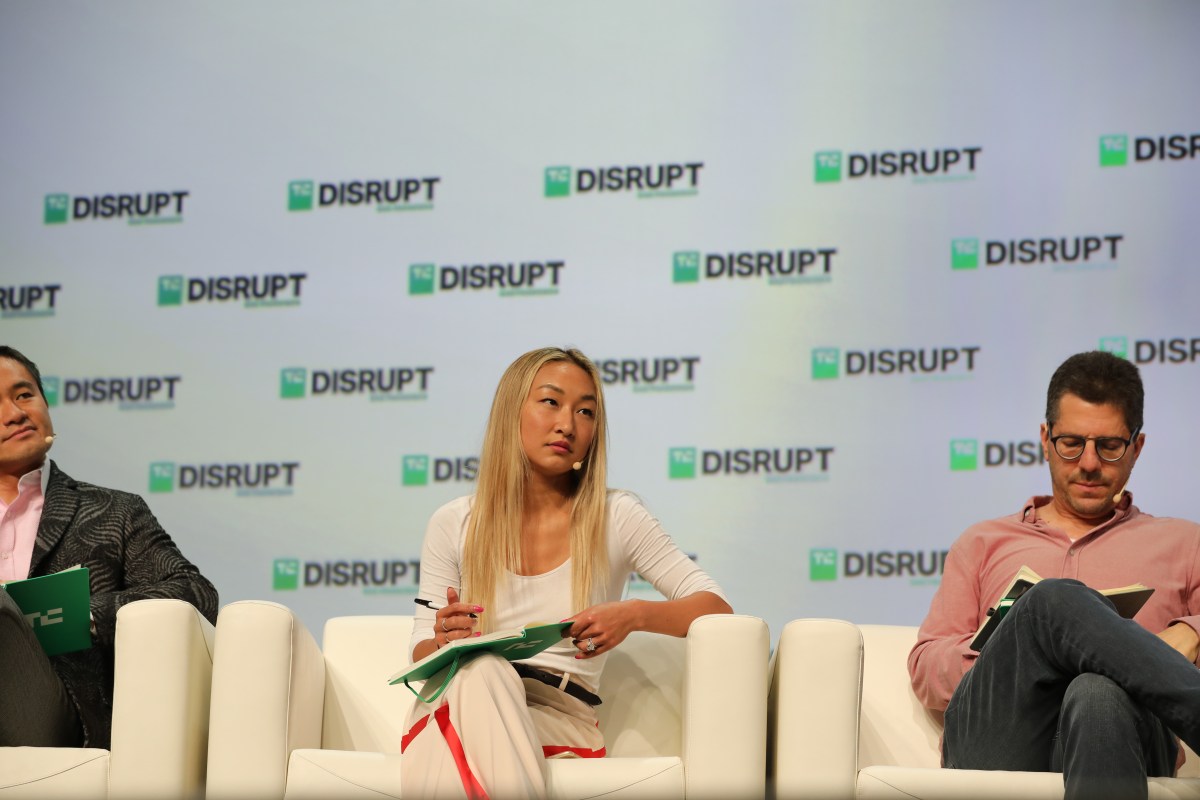

Guo spoke to TechCrunch’s Equity podcast, co-hosted by Natasha Mascarenhas and Alex Wilhelm, about her inaugural fund and the broader market that she is investing in today. The entire conversation is live now wherever you find podcasts, so take a listen if you haven’t yet. Below we extracted four key excerpts from the interview to discuss further. Guo’s comments were edited lightly for clarity.

Think of venture in innings

Part of the allure of startups is that when things don’t go wrong, which they often do, you might just find yourself as an early employee of a rocket ship. That counts in VC, too, of course, if you were the first person to back a company like Airtable or see the power of connected fitness.

But what happens when you want to disrupt a category that has been around the block a few times? Guo shared her framework around venture innings, and how that plays a role in her new focus areas at Conviction: