Lyst, the U.K. fashion e-commerce site that last year raised funding at a $700 million valuation, is the latest tech startup to rein in spending by cutting staff. TechCrunch has learned that the company is in the process of laying off 25% of its employees, working out to about 50 people, as part of a larger restructuring to conserve cash flow and move to profitability.

The details were first leaked to us by way of an internal memo from the CEO, Emma McFerran, who took over the role of CEO from founder Chris Morton in July of this year. The company then confirmed the details to us. It’s not clear which departments will be most impacted, but the memo notes that some 85 people are being contacted who will be “impacted by this exercise.”

We understand from sources that the company had plans for an IPO next year but that these are now being pushed back, and that it might be looking for another round of funding to shore up its finances.

Lyst last raised money in May 2021, when the picture for e-commerce was rosily tinted, one of the ironic bright business spots in the largely otherwise devastating COVID-19 pandemic: fashion retailers in particular were seeing record-breaking revenues and business growth online as consumers turned away from shopping in person and used disposable income that they were no longer spending on going out. That made for buoyant sales, as well as very bullish prognostications: consumer shoppers, observers said, were unlikely to “go back” to physical shopping in the same numbers even after the pandemic subsided.

Lyst was a product of that: When it announced its $85 million raise, it planned for that to be its last fundraise ahead of an IPO, which it was planning potentially for London or New York as soon as this year.

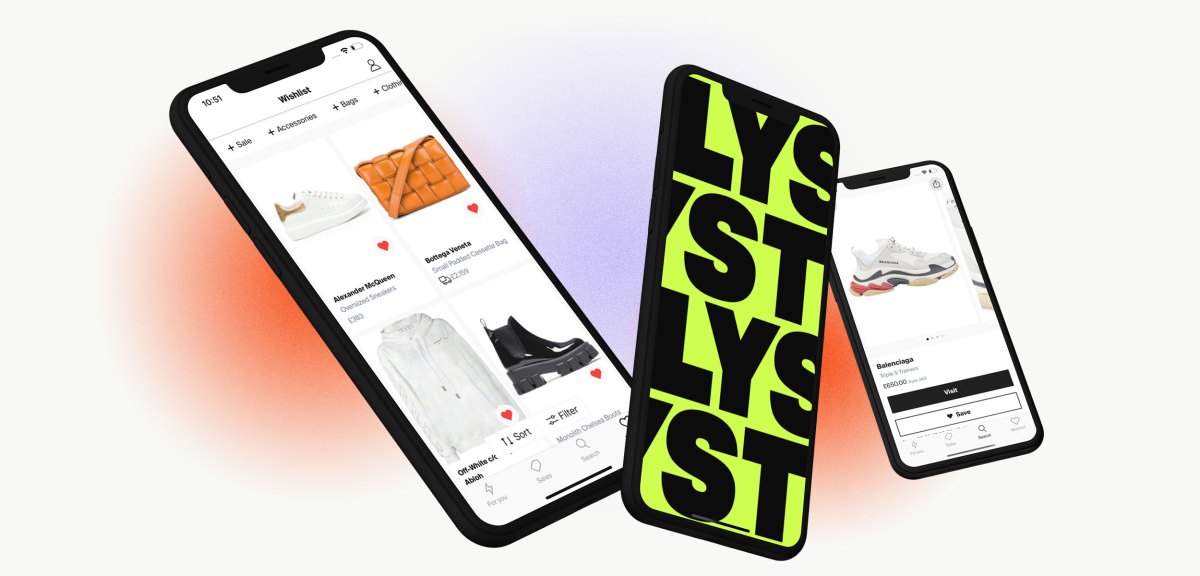

At the time it said it had 150 million users and a catalog of 8 million products from 17,000 brands and retailers. That list of brands includes a number of high-end labels such as Balenciaga, Balmain, Bottega Veneta, Burberry, Fendi, Gucci, Moncler, Off-White, Prada, Saint Laurent and Valentino, and that combined with an active audience of shoppers led the company to strong growth. In 2020, gross merchandise value on Lyst was over $500 million. Between then and 2021, new user numbers grew 1,100%, and by the time the round was announced, GMV was at more than $2 billion.

Fast-forward to today and the most optimistic and bullish prognostications in e-commerce have failed to play out: online sales have not continued with torrid growth, and people generally haven’t been spending as much online with the return to in-store shopping.

That has led to some business contractions across the board. Amazon, the biggest of all e-commerce operations (which has been working to build out a strong line in fashion) may lay off as much as 10,000 staff and are cutting a lot of product lines. A more direct rival of Lyst’s, the high-end fashion e-commerce poster child Farfetch, currently has a market cap of just $2.9 billion, a giant drop compared to the $14 billion it commanded in May 2021.

Many look to the holiday season as a critical indicator of how well e-commerce companies are doing in the current economy, and this year, so far, the figures are actually not as bad as many thought they would be: Adobe’s tracking of sales have shown big days like Black Friday and Cyber Monday both breaking sales records (respectively over $9 billion and over $11 billion).

Lyst itself has been seeing strong sales to kick off holiday shopping, posting its most profitable Black Friday weekend ever, with average order value up 15% — albeit with more discounting across the brands and stores that sell on the site to gin up activity.

But the bigger picture and the longer-term view are the factors driving today’s news. In addition to a focus on getting profitable, our source tells us that Lyst’s IPO was more recently targeted for 2023, but those plans have now been pushed back, and that it’s looking to do a new round of funding partly because it’s low on cash flow. (To be clear, the company would not comment on these facts.)

We’ll update this post as we learn more.

If you want to contact us with a story tip, you can do so securely here.