If you ask three different people whether we’re in a recession, you could easily get three different answers.

As often as the “R” word is bandied about in tech, a survey of 450 early-stage founders found that only 12% plan to hire fewer workers and 6% have laid people off.

“The data is proving that early-stage founders are seeing a more gradual approach to the downturn,” said January Ventures founding partner Jen Neundorfer.

Full TechCrunch+ articles are only available to members.

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription.

“It’s in contrast to some of the memos you see from the Sequoias of the world that say, ‘cut immediately and cut deep.’”

Eighty percent of the seed-stage and pre-seed founders who responded to January’s survey have less than a year of runway left. Only half of the respondents said they planned to cut costs, “compared to 2020, when 81% of companies reported doing so,” writes Rebecca Szkutak.

Thanks very much for reading,

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

December 8 Twitter Space: Immigration law for startups

Image Credits: Bryce Durbin/TechCrunch

On Thursday, December 8 at 9 a.m. PT/noon ET, I’m hosting a Twitter Space with Sophie Alcorn, an immigration attorney based in Silicon Valley and the author of Dear Sophie, a column that appears on TechCrunch+ each Wednesday.

If you’re a visa worker who’s been laid off, or if you just have questions about working and living legally inside the United States, please join the conversation.

This Space is open to everyone: click through to set a reminder and submit your immigration-related questions so we can raise them during the Q&A.

Use customer health data to grow and forecast future NRR

Image Credits: Osaka Wayne Studios (opens in a new window) / Getty Images

When investors are more interested in organic growth than in writing follow-on checks, desperate founders may launch a quest for One Metric to Rule Them All, like one of the rings of power in Middle Earth.

Net revenue retention is a powerful yardstick for startups seeking to reduce churn rates, which is why Kellie Capote, chief customer officer at Gainsight, recommends using the DEAR framework:

- Deployment

- Engagement

- Adoption

- ROI

“The DEAR customer outcomes score enables you to connect workflows to leading indicators and lagging outcomes,” writes Capote.

“If you’re looking for a data-driven way to build confidence in your modeling with your executive team and board, this is it.”

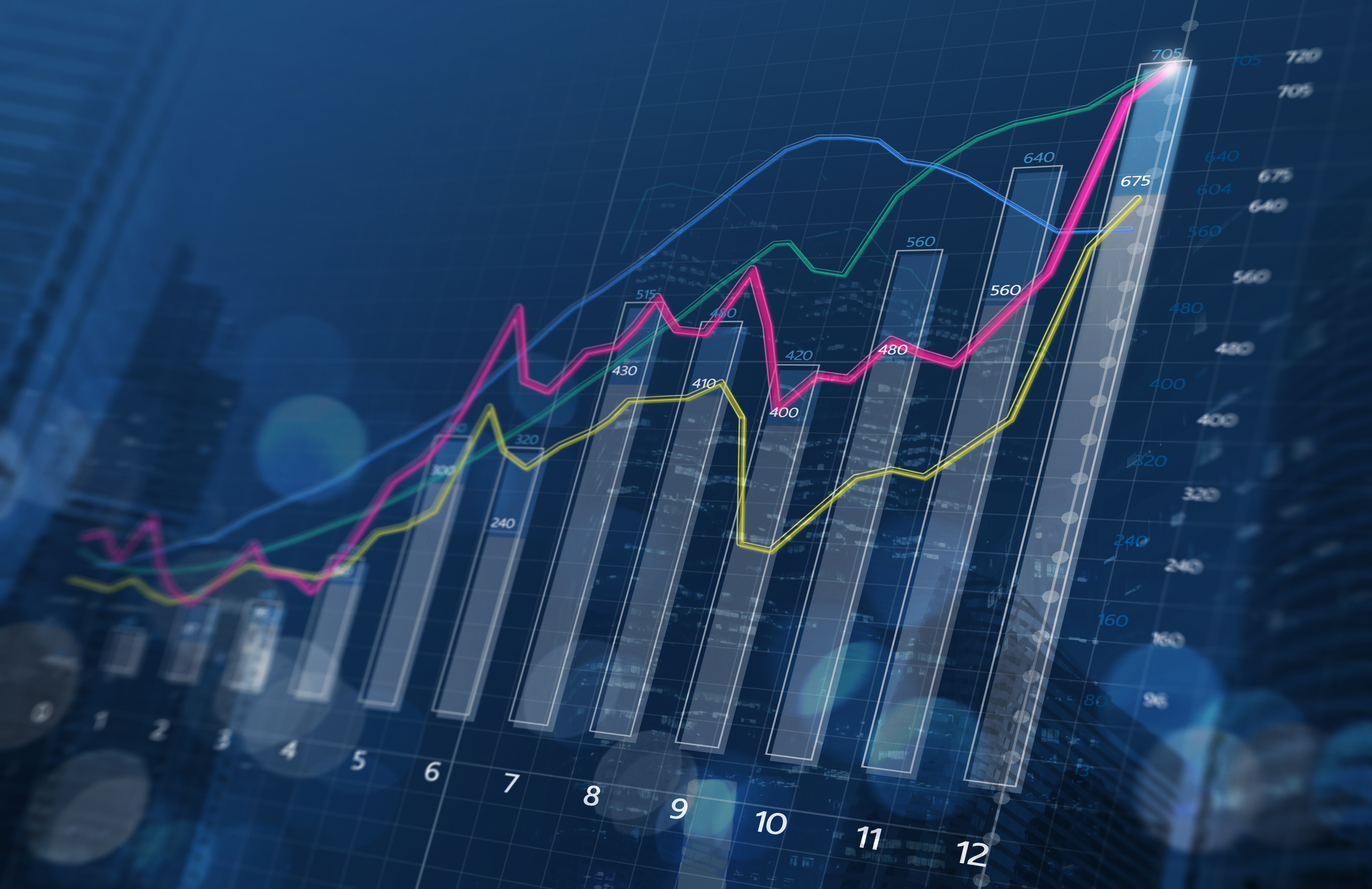

Which way is up? The end of free money and the importance of keeping cash on hand

Image Credits: PM Images (opens in a new window) / Getty Images

In simpler times, founders could often satisfy investors just by showing how quickly their company was meeting growth expectations.

“Well, investors today care about the less-distant future,” according to Max Schireson, an operating partner at Battery Ventures.

“They care about how much money they need to put into your company to get to that future and when it will arrive.”

In a guest post for TC+, he shares frank advice and multiple scenarios that can help founders meet investor exceptions during tough times.

“They say time is the one thing you can’t buy, but in fact, time is the easiest thing to buy at a startup.”

If you’re a bootstrapped startup, turn to user-centered design to thrive during adversity

Image Credits: Tony C French (opens in a new window) / Getty Images

I began paying more attention to a CEO who’s using surveys to ask platform users about which features are most important to them.

So far, it’s not going very well.

With true user-centered design, product managers gather as much information as they can to make sure they’re building for an audience — not themselves.

“Now that investors are more demanding and writing smaller checks, UCD can be the difference between your business launching or never making it off the drawing board,” says Adam Sandman, founder and CEO of Inflectra.

How companies can slash ballooning SaaS costs

Image Credits: Ong-ad Nuseewor (opens in a new window) / Getty Images

A study conducted by purchasing management platform Vertice found that one of every eight dollars spent by enterprises go to SaaS products.

“It’s not surprising when you consider the average organization now uses around 110 SaaS solutions,” reports Kyle Wiggers. As a result, customers are spending 53% more on software licensing today than in 2017.

“Most organizations have grown their portfolio of software vendors dramatically over the past 10 years,” said Stephen White, senior director-analyst, Gartner. “It’s not uncommon to have more than doubled that vendor portfolio.”