Recent headlines have been dominated by announcements of large headcount reductions across the tech industry and especially at giants like Meta, Amazon and Twitter. But it’s not just the big names pulling back on headcount — private SaaS companies have similarly been implementing hiring freezes and headcount reductions for almost half a year now.

This isn’t surprising, as VCs started pushing for more focus on capital efficiency and the “Rule of 40” earlier this summer as it became clear that the “growth at all costs” mentality was going out of favor and the goal was to extend runway to weather the storm.

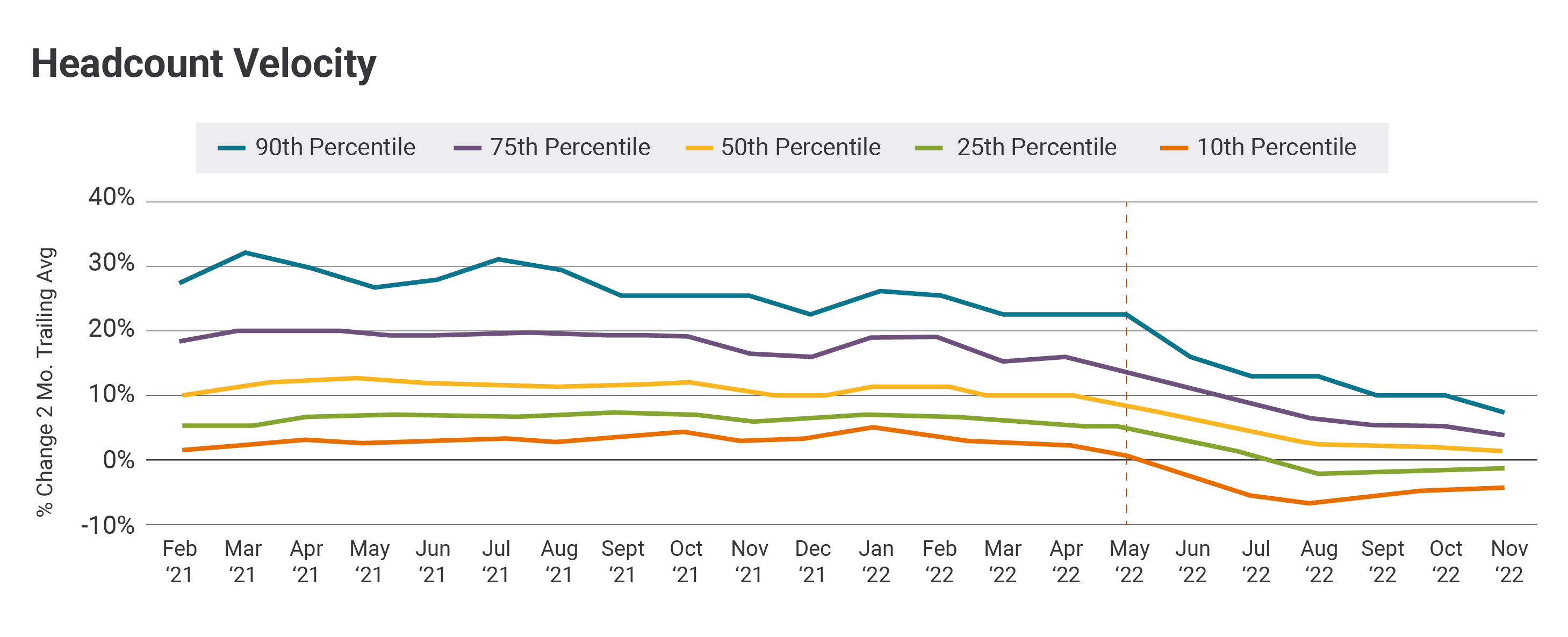

To get a better understanding of headcount fluctuations within the private market, we programmatically tracked the headcount of 150 private Series A to Series C B2B Enterprise SaaS startups across various industries over 24 months.

Here are the highlights of our study:

Companies are reducing headcount growth to extend runway

Headcounts rose every month across the last four months at a median rate of around 2% compared to the 10% we saw previously. Additionally, the 25th percentile of startups showed reductions in headcounts, indicating that many companies are taking drastic measures to extend their runway.

For companies with a strong balance sheet, strong backers and low burn/product-market fit, now is the best time to make critical hires.

This is a gloomy indicator as startups brace for additional macro headwinds and repricing events.

Another round of cuts are likely early next year

If the macro environment doesn’t improve, we would expect another wave of job cuts after companies’ fourth-quarter board meetings (usually in January or February).

Many companies will discuss their CY ’23 forecasts, and headcount is always a lever to extend runway since it can account for up to 80% of a startup’s expenses. Given that many companies have maintained their headcounts, we may see them having to lay people off to reduce burn.

Tighter hiring started as early as May 2022

Private companies began tapping the brakes right around May 2022, and more firms started acting in unison, as seen from the tighter headcount velocity interquartile range, which was compressed heavily but has now stabilized.

Companies serving HR and procurement saw the steepest drop

As these services have shrunk across the industry, companies providing tech aimed at HR and procurement professionals saw the steepest drop in headcount growth. However, all the tracked customer profiles have trended toward reducing hiring efforts.

There’s lots of available talent

On a positive note, this is an excellent time for companies with product-market fit (and supportive investors) to hire the right talent, as big tech is reducing headcount and the market is flooded with exceptional talent.

From aggressive headcount growth to holding flat

Until April, most companies were hiring aggressively, with headcount rising month over month at over 10%, and the 75th percentile was close to about 20%.

In contrast, the current median is +1% and the 75th percentile is +4%.

This downward trend kicked off in May and continues today. The interquartile range continues to compress, with the median ultimately heading toward flat headcount (i.e., replacing natural attrition but not hiring beyond that). The 25th percentile fell into layoff territory around August, but both the 10th percentile and 25th percentile have since pulled back.

Image Credits: Eddie Ackerman

Now that we have set the stage: