Meet Dotfile, a new startup backed by eFounders that just raised a $2.7 million funding round (€2.5 million) to help companies verify users and other companies with a single application programming interface (API).

Serena is leading the funding round through its V13 Invest fund (backed by FDJ). Kima Ventures, Pareto Holdings, Super Capital, Upscalers, Polymatter Ventures as well as several business angels are also participating in the round.

If you’ve talked with fintech startup founders, they probably have told you there are dozens of small and big companies working on identity verification processes. The reason why there are so many players in this industry is that identity verification is an important process to comply with anti-money laundering (AML) and “know your customer” (KYC) regulation.

As a consumer, you may have encountered these verification systems when trying to send money on a peer-to-peer payment app, sell an expensive item on a marketplace or rent a car. These services ask you to scan your ID, take a selfie video, connect to your bank account, send documents, etc.

Dotfile’s founders. Image Credits: Dotfile

Instead of building yet another identity, risk and fraud management API with limited geographical and industry coverage, Dotfile wants to aggregate dozens of KYC and KYB services so that companies can mix and match APIs and data sources depending on their needs and the profiles of their clients.

This way, fintech startups that are just getting started don’t have to benchmark multiple products, negotiate contracts with each provider and manually build integrations with each API. Dotfile also tries to unify these services and provides an embeddable verification interface. Alternatively, developers can use Dotfile’s API directly.

Similarly, Dotfile helps you centralize your verification data in a single backend. If a user emails you because they received an error when trying to verify their identity, the person in charge of compliance can easily see where the process failed.

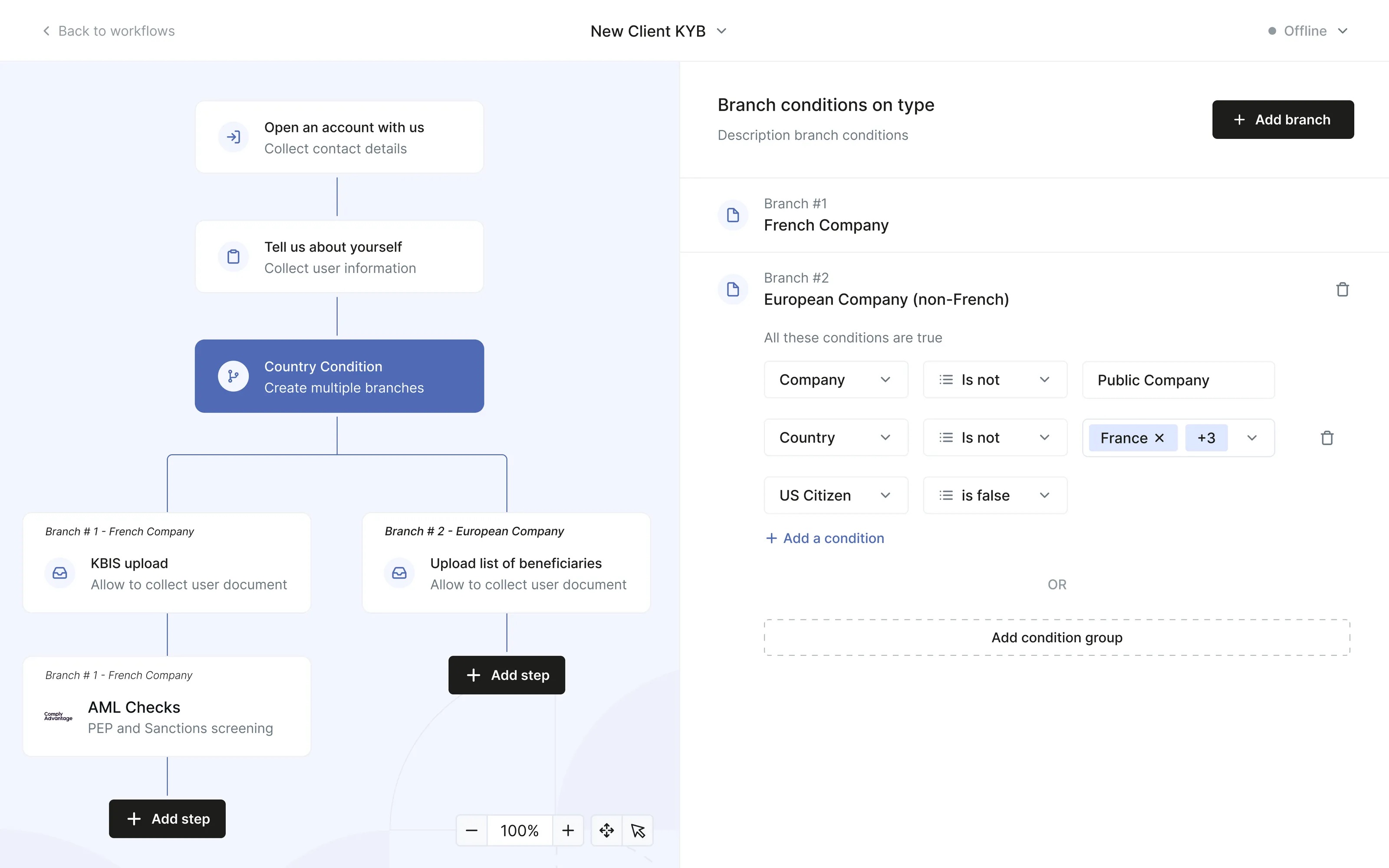

Dotfile also provides a workflow builder, which lets you create if-then-else rules to cover all sorts of scenarios. For instance, if a customer is trying to verify their business, there could be different processes if it’s a French company, a European company or a non-European company.

The startup is still relatively new as it was created in 2021. But it could be particularly interesting for new fintech startups as Dotfile helps you ship a fintech product more quickly. In a way, it acts an abstraction layer so that entrepreneurs can focus on different things.

Image Credits: Dotfile