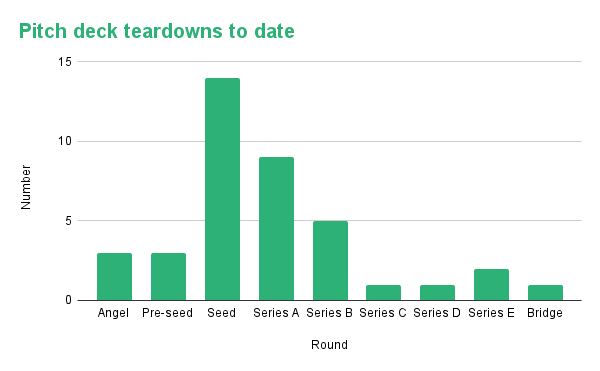

Welcome to our 40th Pitch Deck Teardown! Goodness, time flies.

Of those 40, just three were angel rounds, so today, we’ll take apart the angel deck of MiO Marketplace, a platform for media publishers and buyers. The company raised $550,000 at a $3.6 million pre-money valuation.

Breakdown of the pitch deck teardowns to date. Image Credits: TechCrunch / Haje Kamps

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

MiO Marketplace comes out of the gate hard and just keeps going. The deck didn’t include all the important bits, however, and I wish the company had done a few things differently, but we’ll get to that. For now, here are the 16 slides that make up its angel deck:

- Cover slide

- History slide (“Evolution of online marketplaces”)

- Vision and mission slide

- Problem slide

- Solution slide

- Opportunity slide

- Market-size slide

- Competition slide (“B2B SaaS for Media Buyers/Sellers”)

- Value proposition slide 1 (“Features for buyers”)

- Value proposition slide 2 (“Intelligence for sellers”)

- Business model slide (labeled as “Go-to-market”)

- Traction slide

- Financial slide (labeled as “Projections”)

- Team slide (“Founder”)

- Board of directors slide

- Contact slide

Three things to love

MiO nails its pitch in a few really important parts, which is ever so delightful. Its team slide focuses on all the right things, it does a good job explaining its value prop and including the company’s mission helps solidify how it views the landscape.

Really promising team slide

[Slide 14] That’s how you show founder-market fit. Image Credits: MiO Marketplace

At the earliest stages of a new business, investors don’t have a lot to go on: There’s not much of a product yet, there isn’t much traction — there’s really not much of anything. So, how do you evaluate an early-stage company? You look at things like whether there’s a big enough market, problem and opportunity for return, but most importantly, you have to consider whether this is the right team to bring this product to market. On paper, CEO and founder Sean Halter is a good bet. He claims to have decades of experience and appears to have deep market understanding. Those are all useful. So what does a VC do next? A bit of light due diligence to see if what’s on the slide matches up.