About 10% of startups will fail in their first year. Between years two through five, approximately 70% of companies will go under.

But those figures don’t matter when you’re pitching: Investors expect to see a business plan that describes how you plan to reach profitability within 3-5 years.

“While it may feel unfamiliar, as a founder there are a few key things to keep in mind that will ensure that your financial model is both a powerful tool for you and is also investor-ready,” writes legal/business advisor Anthony Millin.

Full TechCrunch+ articles are only available to members

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription

In this detailed primer, he shares a framework for creating a 60-month bottom-up financial plan that accounts for early fixed expenses like R&D and marketing, which drive high burn rates during the first 12-18 months of operation.

“Remember, the goal here is to demonstrate a thorough understanding of your market and how your business scales, which is then reflected through the various assumptions you use to build the model,” writes Millin.

Thanks very much for reading,

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

If you’ve raised venture capital, you have to pay yourself

Image Credits: Liia Galimzianova (opens in a new window) / Getty Images

What’s a suitable salary for an early-stage startup founder? Should they even get paid at all?

Haje Jan Kamps says some investors are urging entrepreneurs to forego paychecks, but “not being able to afford your mortgage, rent [or] car payment” will have a material impact on a company’s chances of success.

“As an investor in these startups, it’s your duty to help the startup get to that point in the shortest possible amount of time,” he writes.

“Telling founders not to take a salary is wonderfully counterproductive on so many levels.”

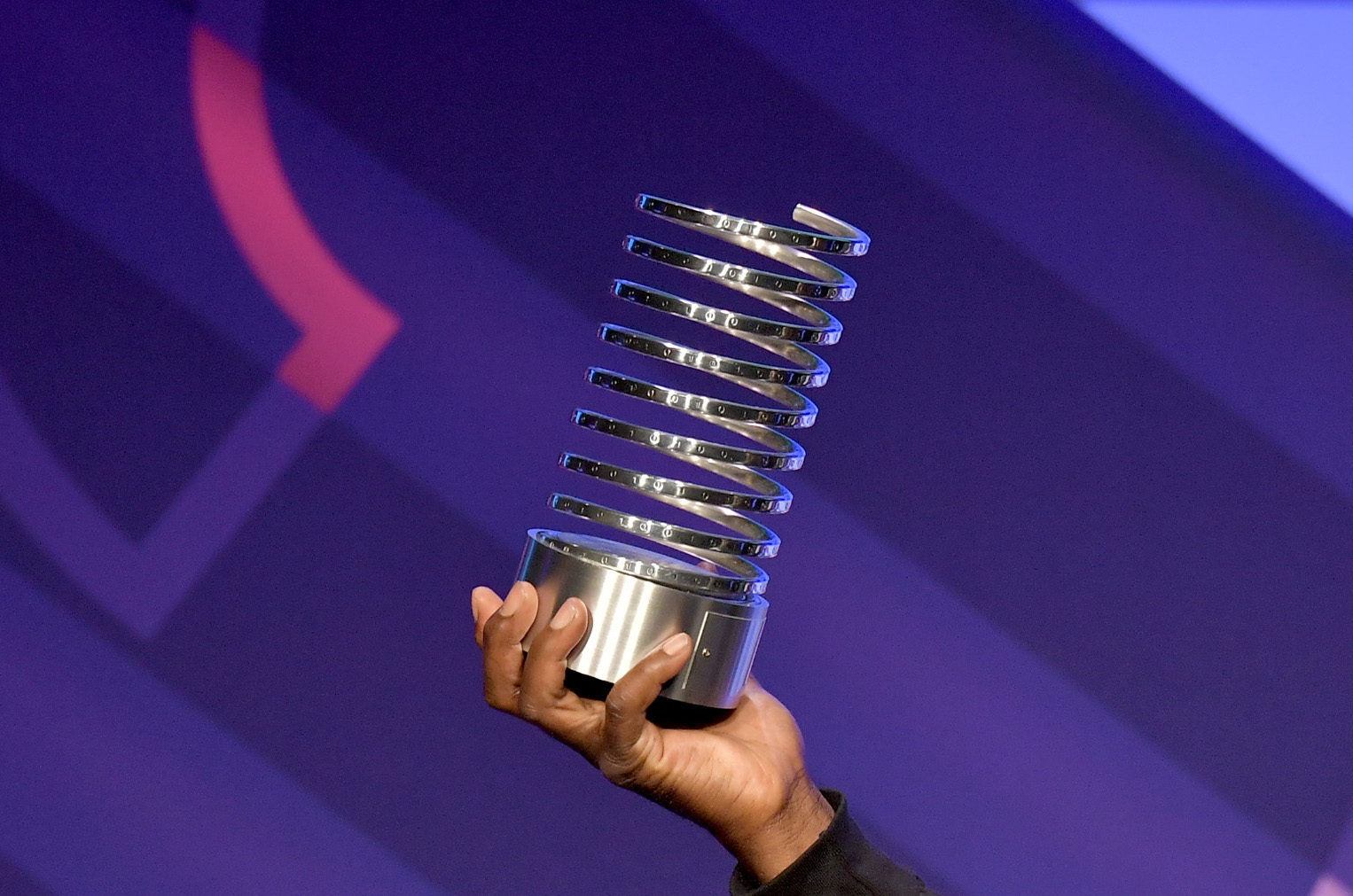

Vote for TechCrunch in the Webby Awards!

Image Credits: Michael Loccisano (opens in a new window) / Getty Images (Image has been modified)

Two TechCrunch podcasts, Chain Reaction and Found, have each been nominated for Webby Awards in the Best Technology Podcast category.

Cast your vote before Thursday, April 20!

In the new normal for VC, builders will win

Image Credits: LEREXIS (opens in a new window) / Getty Images

Large VC firms ensure deal access using a complex mix of strategy, research and relationship building, but “looking deep to the vision and initiative of each founder is the only way forward,” says Will Robbins, a general partner at Contrary Capital.

Because so much capital is readily available, “we are never going back to the days where venture capital firms can win by being the only term sheet on the table,” writes Robbins, who shares his perspective on collecting deal flow, building a tech stack, and productization “for LPs thinking about the decade to come.”

As crypto startup valuations come back to Earth, big investors are bargain hunting

Image Credits: Bryce Durbin / TechCrunch

Several large crypto funds that launched in the last two years are still actively deploying capital and hunting for additional opportunities, reports Jacquelyn Melinek.

To get a sense of what they’re looking for and the trends they’re anticipating in 2023, she spoke to:

- Lydia Chiu, VP of business development, Ava Labs

- Tushar Jain, managing partner, Multicoin Capital

- Peter Knez, chairman, Venom Foundation

- Arianna Simpson, general partner, Andreessen Horowitz

RevOps unleashed: 4 tips that help teams filter out the noise and focus on the big picture

Image Credits: MirageC (opens in a new window) / Getty Images

No single person could manage a B2B SaaS sales operation today, which is probably why Head of Revenue Operations is #1 on LinkedIn’s 2023 Jobs on the Rise list.

To claw back time from mundane tasks so RevOps teams can tackle “larger, meatier projects,” Rattle COO Apoorva Verma shares recommended tactics for training sales reps, finding places to automate, and ideas for codifying “every single one of your business-critical processes.”

When your startup fails

Image Credits: Bohdan Skrypnyk / Getty Images

When a fighter has no reasonable chance of winning the match, throwing in the towel is the smart move.

The same holds true for startups that are failing to thrive: After a certain point, an entrepreneur can do themselves more harm than good by doggedly pursuing their goal.

To learn more about what happens when a founder shuts down her own company, Ron Miller interviewed Lillian Cartwright, co-founder of ShelfLife, a B2B marketplace for wholesale ingredients.

Cartwright raised a $3 million seed round in 2021, but after approaching 90 VCs in the summer of 2022, “we couldn’t raise anything,” she said.

“So the first week of February, I notified the investors in my normal regular update that I was winding down the company and returning the capital.”