Space startup SpinLaunch is fundraising again, though a source tells TechCrunch that it was exploring raising a significantly more ambitious sum earlier this year.

The company has closed an $11.5 million round out of a planned $25 million, according to a filing with the U.S. Securities and Exchange Commission. SpinLaunch confirmed funding to TechCrunch, but did not comment on the amount raised. It last raised a $71 million Series B in 2022.

But a person familiar with the company’s plans told TechCrunch that the startup had talked to investors around nine months ago, hoping they would pile into a $350 million round at a $2 billion valuation. In response to a question about this fundraising target, SpinLaunch CEO David Wrenn said the figures were “highly inaccurate and misleading” and that he was “pleased with our recently closed financing.”

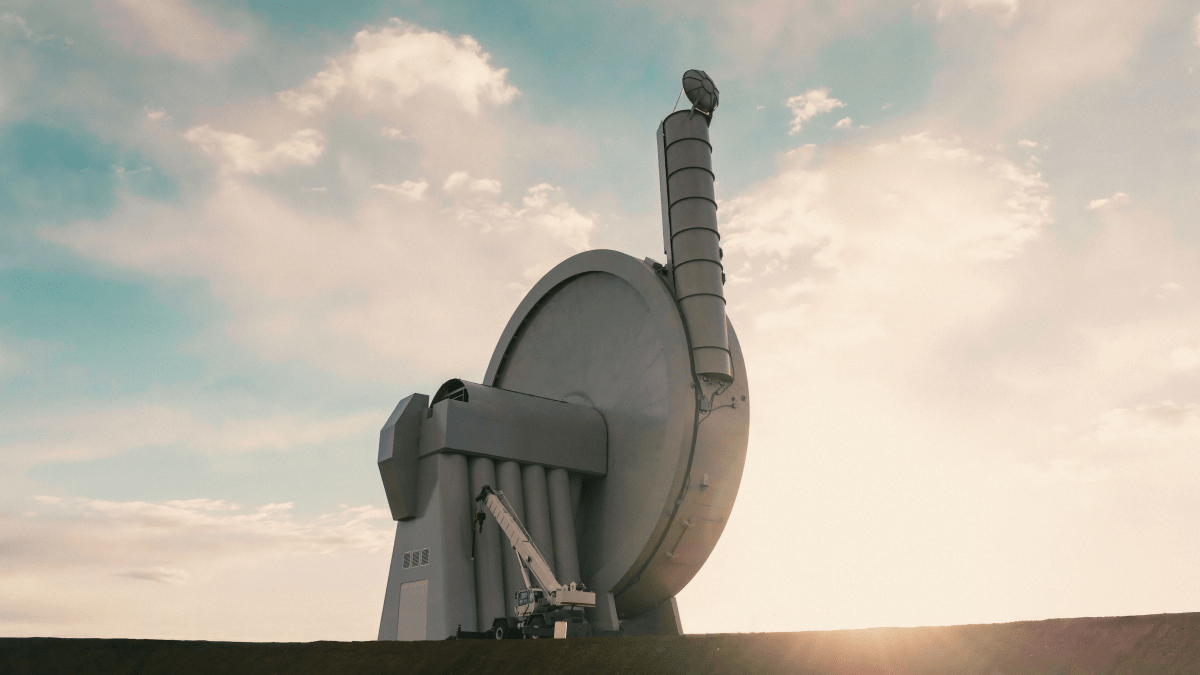

SpinLaunch made a splash back in 2018 with ambitious plans to build a kinetic launch system as a low-cost, high-cadence alternative to rockets. Instead of vertically launching a satellite on top of a rocket, SpinLaunch’s proposal is to spin up those payloads to high Gs inside a vacuum chamber before flinging them up into orbit.

The company has made some compelling claims about its system: that it will be able to put an up-to-200 kilogram satellite into orbit for just $250,000, and that it will be able to launch up to five-10 times per day. It was making progress: SpinLaunch has conducted 10 suborbital tests using a smaller version of the accelerator at New Mexico’s Spaceport America, where it maintains a long-term lease.

The company was considering raising such a massive sum to essentially compete with Starlink, the person familiar with its plans says. This plan first came to light in 2021 when SpinLaunch filed an application with the FCC to operate a 1,190 satellite constellation to provide global broadband service from space. The company, under the name of its subsidiary SN Space Systems, initially filed an application in November 2021 with the U.S. Federal Communications Commission for the constellation. The company met with FCC personnel last September to discuss the application, according to one document filed with the regulator from SpinLaunch’s former senior regulatory counsel Michelle McClure, but how close the company may be to getting its application approved is unclear.

There have been signs that the 10-year-old startup is going through a period of flux as it looks to enter into its commercialization phase. Last October, SpinLaunch brought on two new board members, including aerospace executive Dómhnal Slattery as chairman (a new role). Then, this March, those board members appointed Wrenn, the company’s former COO, to the chief executive position, which had been held by SpinLaunch founder Jonathan Yaney.

Amidst the leadership shake-up, the company had been quietly pursuing a very small Alaskan island as the site for its first orbital accelerator. SpinLaunch signed an MOU to convey its intent to site its accelerator in Adak, Alaska, around 18 months ago. The Adak city council later sent a letter of support for the plans to The Aleut Corporation, the Alaska Native Regional Corporation that SpinLaunch has been working with. Adak city manager Layton Lockett confirmed to TechCrunch that the letter of support, which was sent April 17, is the “last substantive update” on the city’s involvement with either SpinLaunch or Aleut, however.

In his response to TechCrunch, Wrenn did not directly address the status of the satellite constellation application or plans to build an orbital accelerator in Adak. However, he added that the company has met its investment and revenue objectives this year, and that the new financing “will help accelerate the commercialization of our disruptive space technologies and advance SpinLaunch’s integrated suite of low-cost, sustainable space solutions.”

SpinLaunch has grand ambitions: building a massive satellite constellation and a kinetic launch system. But as is so often the case in space, funding and execution are another case entirely.